2012 Half Year Results Media Presentation - Origin Energy

2012 Half Year Results Media Presentation - Origin Energy

2012 Half Year Results Media Presentation - Origin Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

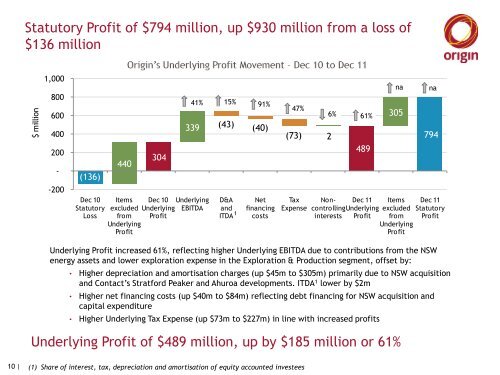

$ million<br />

Statutory Profit of $794 million, up $930 million from a loss of<br />

$136 million<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

-<br />

-200<br />

(136)<br />

Dec 10<br />

Statutory<br />

Loss<br />

440<br />

Items<br />

excluded<br />

from<br />

Underlying<br />

Profit<br />

<strong>Origin</strong> Underlying Profit Movement - Dec 10 to Dec 2011<br />

304<br />

Dec 10<br />

Underlying<br />

Profit<br />

41% 15% 91%<br />

339<br />

Underlying<br />

EBITDA<br />

(43)<br />

D&A<br />

and<br />

1<br />

ITDA<br />

(40)<br />

Net<br />

financing<br />

costs<br />

47%<br />

(73)<br />

Tax<br />

Expense<br />

6%<br />

2<br />

Noncontrolling<br />

interests<br />

61%<br />

489<br />

Dec 11<br />

Underlying<br />

Profit<br />

na<br />

305<br />

Items<br />

excluded<br />

from<br />

Underlying<br />

Profit<br />

na<br />

794<br />

Dec 11<br />

Statutory<br />

Profit<br />

Underlying Profit increased 61%, reflecting higher Underlying EBITDA due to contributions from the NSW<br />

energy assets and lower exploration expense in the Exploration & Production segment, offset by:<br />

• Higher depreciation and amortisation charges (up $45m to $305m) primarily due to NSW acquisition<br />

and Contact‟s Stratford Peaker and Ahuroa developments. ITDA 1 lower by $2m<br />

• Higher net financing costs (up $40m to $84m) reflecting debt financing for NSW acquisition and<br />

capital expenditure<br />

• Higher Underlying Tax Expense (up $73m to $227m) in line with increased profits<br />

Underlying Profit of $489 million, up by $185 million or 61%<br />

10 |<br />

(1) Share of interest, tax, depreciation and amortisation of equity accounted investees