2012 Half Year Results Media Presentation - Origin Energy

2012 Half Year Results Media Presentation - Origin Energy

2012 Half Year Results Media Presentation - Origin Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

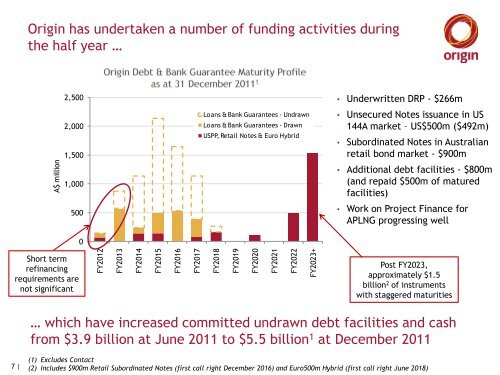

A$ million<br />

FY<strong>2012</strong><br />

FY2013<br />

FY2014<br />

FY2015<br />

FY2016<br />

FY2017<br />

FY2018<br />

FY2019<br />

FY2020<br />

FY2021<br />

FY2022<br />

FY2023+<br />

<strong>Origin</strong> has undertaken a number of funding activities during<br />

the half year …<br />

<strong>Origin</strong> Debt & Bank Guarantee Maturity Profile as at 31 December 2011<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

Loans & Bank Guarantees - Undrawn<br />

Loans & Bank Guarantees - Drawn<br />

USPP, Retail Notes & Euro Hybrid<br />

• Underwritten DRP - $266m<br />

• Unsecured Notes issuance in US<br />

144A market – US$500m ($492m)<br />

• Subordinated Notes in Australian<br />

retail bond market - $900m<br />

• Additional debt facilities - $800m<br />

(and repaid $500m of matured<br />

facilities)<br />

• Work on Project Finance for<br />

APLNG progressing well<br />

Short term<br />

refinancing<br />

requirements are<br />

not significant<br />

Post FY2023,<br />

approximately $1.5<br />

billion 2 of instruments<br />

with staggered maturities<br />

… which have increased committed undrawn debt facilities and cash<br />

from $3.9 billion at June 2011 to $5.5 billion 1 at December 2011<br />

7 |<br />

(1) Excludes Contact<br />

(2) Includes $900m Retail Subordinated Notes (first call right December 2016) and Euro500m Hybrid (first call right June 2018)