2012 Half Year Results Media Presentation - Origin Energy

2012 Half Year Results Media Presentation - Origin Energy

2012 Half Year Results Media Presentation - Origin Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

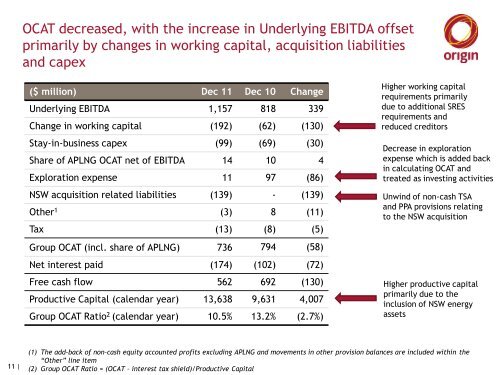

OCAT decreased, with the increase in Underlying EBITDA offset<br />

primarily by changes in working capital, acquisition liabilities<br />

and capex<br />

($ million) Dec 11 Dec 10 Change<br />

Underlying EBITDA 1,157 818 339<br />

Change in working capital (192) (62) (130)<br />

Stay-in-business capex (99) (69) (30)<br />

Share of APLNG OCAT net of EBITDA 14 10 4<br />

Exploration expense 11 97 (86)<br />

NSW acquisition related liabilities (139) - (139)<br />

Other 1 (3) 8 (11)<br />

Tax (13) (8) (5)<br />

Group OCAT (incl. share of APLNG) 736 794 (58)<br />

Net interest paid (174) (102) (72)<br />

Free cash flow 562 692 (130)<br />

Productive Capital (calendar year) 13,638 9,631 4,007<br />

Group OCAT Ratio 2 (calendar year) 10.5% 13.2% (2.7%)<br />

Higher working capital<br />

requirements primarily<br />

due to additional SRES<br />

requirements and<br />

reduced creditors<br />

Decrease in exploration<br />

expense which is added back<br />

in calculating OCAT and<br />

treated as investing activities<br />

Unwind of non-cash TSA<br />

and PPA provisions relating<br />

to the NSW acquisition<br />

Higher productive capital<br />

primarily due to the<br />

inclusion of NSW energy<br />

assets<br />

11 |<br />

(1) The add-back of non–cash equity accounted profits excluding APLNG and movements in other provision balances are included within the<br />

“Other” line item<br />

(2) Group OCAT Ratio = (OCAT – interest tax shield)/Productive Capital