Annual Report 2008-09 - Legal Services Commissioner

Annual Report 2008-09 - Legal Services Commissioner

Annual Report 2008-09 - Legal Services Commissioner

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

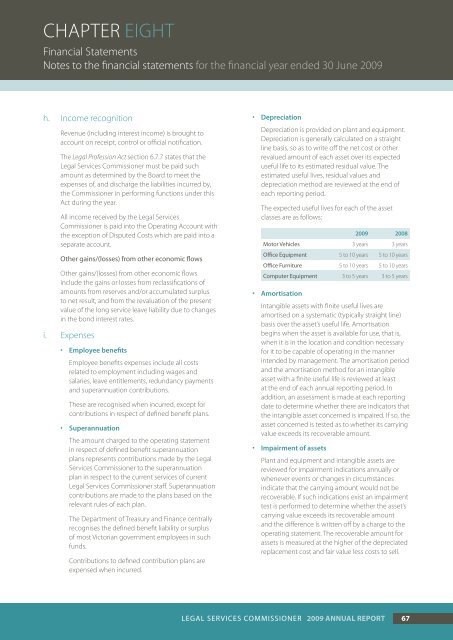

Chapter EIGHT<br />

Financial Statements<br />

Notes to the financial statements for the financial year ended 30 June 20<strong>09</strong><br />

h. Income recognition<br />

Revenue (including interest income) is brought to<br />

account on receipt, control or official notification.<br />

The <strong>Legal</strong> Profession Act section 6.7.7 states that the<br />

<strong>Legal</strong> <strong>Services</strong> <strong>Commissioner</strong> must be paid such<br />

amount as determined by the Board to meet the<br />

expenses of, and discharge the liabilities incurred by,<br />

the <strong>Commissioner</strong> in performing functions under this<br />

Act during the year.<br />

All income received by the <strong>Legal</strong> <strong>Services</strong><br />

<strong>Commissioner</strong> is paid into the Operating Account with<br />

the exception of Disputed Costs which are paid into a<br />

separate account.<br />

Other gains/(losses) from other economic flows<br />

Other gains/(losses) from other economic flows<br />

include the gains or losses from reclassifications of<br />

amounts from reserves and/or accumulated surplus<br />

to net result, and from the revaluation of the present<br />

value of the long service leave liability due to changes<br />

in the bond interest rates.<br />

i. Expenses<br />

• Employee benefits<br />

Employee benefits expenses include all costs<br />

related to employment including wages and<br />

salaries, leave entitlements, redundancy payments<br />

and superannuation contributions.<br />

These are recognised when incurred, except for<br />

contributions in respect of defined benefit plans.<br />

• Superannuation<br />

The amount charged to the operating statement<br />

in respect of defined benefit superannuation<br />

plans represents contributions made by the <strong>Legal</strong><br />

<strong>Services</strong> <strong>Commissioner</strong> to the superannuation<br />

plan in respect to the current services of current<br />

<strong>Legal</strong> <strong>Services</strong> <strong>Commissioner</strong> staff. Superannuation<br />

contributions are made to the plans based on the<br />

relevant rules of each plan.<br />

The Department of Treasury and Finance centrally<br />

recognises the defined benefit liability or surplus<br />

of most Victorian government employees in such<br />

funds.<br />

Contributions to defined contribution plans are<br />

expensed when incurred.<br />

• Depreciation<br />

Depreciation is provided on plant and equipment.<br />

Depreciation is generally calculated on a straight<br />

line basis, so as to write off the net cost or other<br />

revalued amount of each asset over its expected<br />

useful life to its estimated residual value. The<br />

estimated useful lives, residual values and<br />

depreciation method are reviewed at the end of<br />

each reporting period.<br />

The expected useful lives for each of the asset<br />

classes are as follows:<br />

20<strong>09</strong> <strong>2008</strong><br />

Motor Vehicles 3 years 3 years<br />

Office Equipment 5 to 10 years 5 to 10 years<br />

Office Furniture 5 to 10 years 5 to 10 years<br />

Computer Equipment 3 to 5 years 3 to 5 years<br />

• Amortisation<br />

Intangible assets with finite useful lives are<br />

amortised on a systematic (typically straight line)<br />

basis over the asset’s useful life. Amortisation<br />

begins when the asset is available for use, that is,<br />

when it is in the location and condition necessary<br />

for it to be capable of operating in the manner<br />

intended by management. The amortisation period<br />

and the amortisation method for an intangible<br />

asset with a finite useful life is reviewed at least<br />

at the end of each annual reporting period. In<br />

addition, an assessment is made at each reporting<br />

date to determine whether there are indicators that<br />

the intangible asset concerned is impaired. If so, the<br />

asset concerned is tested as to whether its carrying<br />

value exceeds its recoverable amount.<br />

• Impairment of assets<br />

Plant and equipment and intangible assets are<br />

reviewed for impairment indications annually or<br />

whenever events or changes in circumstances<br />

indicate that the carrying amount would not be<br />

recoverable. If such indications exist an impairment<br />

test is performed to determine whether the asset’s<br />

carrying value exceeds its recoverable amount<br />

and the difference is written off by a charge to the<br />

operating statement. The recoverable amount for<br />

assets is measured at the higher of the depreciated<br />

replacement cost and fair value less costs to sell.<br />

<strong>Legal</strong> <strong>Services</strong> COMMISSIONER 20<strong>09</strong> <strong>Annual</strong> <strong>Report</strong> 67