Annual Report 2008-09 - Legal Services Commissioner

Annual Report 2008-09 - Legal Services Commissioner

Annual Report 2008-09 - Legal Services Commissioner

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

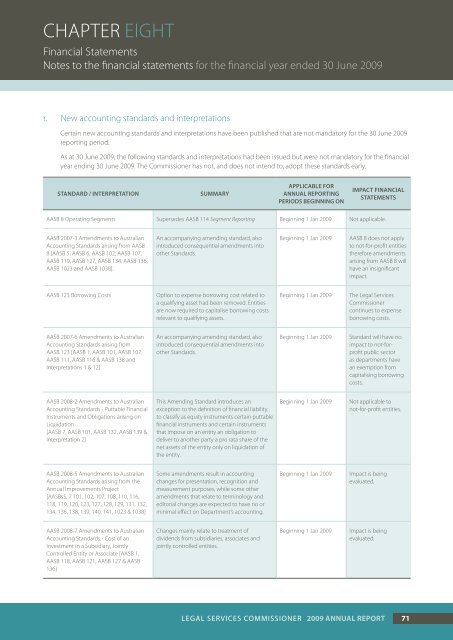

Chapter EIGHT<br />

Financial Statements<br />

Notes to the financial statements for the financial year ended 30 June 20<strong>09</strong><br />

r. New accounting standards and interpretations<br />

Certain new accounting standards and interpretations have been published that are not mandatory for the 30 June 20<strong>09</strong><br />

reporting period.<br />

As at 30 June 20<strong>09</strong>, the following standards and interpretations had been issued but were not mandatory for the financial<br />

year ending 30 June 20<strong>09</strong>. The <strong>Commissioner</strong> has not, and does not intend to, adopt these standards early.<br />

Standard / Interpretation<br />

Summary<br />

Applicable for<br />

annual reporting<br />

periods beginning on<br />

Impact financial<br />

statements<br />

AASB 8 Operating Segments Supersedes AASB 114 Segment <strong>Report</strong>ing Beginning 1 Jan 20<strong>09</strong> Not applicable.<br />

AASB 2007‐3 Amendments to Australian<br />

Accounting Standards arising from AASB<br />

8 [AASB 5, AASB 6, AASB 102, AASB 107,<br />

AASB 119, AASB 127, AASB 134, AASB 136,<br />

AASB 1023 and AASB 1038].<br />

An accompanying amending standard, also<br />

introduced consequential amendments into<br />

other Standards.<br />

Beginning 1 Jan 20<strong>09</strong><br />

AASB 8 does not apply<br />

to not-for-profit entities<br />

therefore amendments<br />

arising from AASB 8 will<br />

have an insignificant<br />

impact.<br />

AASB 123 Borrowing Costs<br />

Option to expense borrowing cost related to<br />

a qualifying asset had been removed. Entities<br />

are now required to capitalise borrowing costs<br />

relevant to qualifying assets.<br />

Beginning 1 Jan 20<strong>09</strong><br />

The <strong>Legal</strong> <strong>Services</strong><br />

<strong>Commissioner</strong><br />

continues to expense<br />

borrowing costs.<br />

AASB 2007‐6 Amendments to Australian<br />

Accounting Standards arising from<br />

AASB 123 [AASB 1, AASB 101, AASB 107,<br />

AASB 111, AASB 116 & AASB 138 and<br />

Interpretations 1 & 12]<br />

An accompanying amending standard, also<br />

introduced consequential amendments into<br />

other Standards.<br />

Beginning 1 Jan 20<strong>09</strong><br />

Standard will have no<br />

impact to not-forprofit<br />

public sector<br />

as departments have<br />

an exemption from<br />

capitalising borrowing<br />

costs.<br />

AASB <strong>2008</strong>‐2 Amendments to Australian<br />

Accounting Standards ‐ Puttable Financial<br />

Instruments and Obligations arising on<br />

Liquidation<br />

[AASB 7, AASB 101, AASB 132, AASB 139 &<br />

Interpretation 2]<br />

This Amending Standard introduces an<br />

exception to the definition of financial liability,<br />

to classify as equity instruments certain puttable<br />

financial instruments and certain instruments<br />

that impose on an entity an obligation to<br />

deliver to another party a pro rata share of the<br />

net assets of the entity only on liquidation of<br />

the entity.<br />

Beginning 1 Jan 20<strong>09</strong><br />

Not applicable to<br />

not‐for‐profit entities.<br />

AASB <strong>2008</strong>‐5 Amendments to Australian<br />

Accounting Standards arising from the<br />

<strong>Annual</strong> Improvements Project<br />

[AASBs5, 7 101, 102, 107, 108, 110, 116,<br />

118, 119, 120, 123, 127, 128, 129, 131, 132,<br />

134, 136, 138, 139, 140, 141, 1023 & 1038]<br />

Some amendments result in accounting<br />

changes for presentation, recognition and<br />

measurement purposes, while some other<br />

amendments that relate to terminology and<br />

editorial changes are expected to have no or<br />

minimal effect on Department’s accounting.<br />

Beginning 1 Jan 20<strong>09</strong><br />

Impact is being<br />

evaluated.<br />

AASB <strong>2008</strong>‐7 Amendments to Australian<br />

Accounting Standards ‐ Cost of an<br />

Investment in a Subsidiary, Jointly<br />

Controlled Entity or Associate [AASB 1,<br />

AASB 118, AASB 121, AASB 127 & AASB<br />

136]<br />

Changes mainly relate to treatment of<br />

dividends from subsidiaries, associates and<br />

jointly controlled entities.<br />

Beginning 1 Jan 20<strong>09</strong><br />

Impact is being<br />

evaluated.<br />

<strong>Legal</strong> <strong>Services</strong> COMMISSIONER 20<strong>09</strong> <strong>Annual</strong> <strong>Report</strong> 71