RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

Khazanah US$850 million <strong>Sukuk</strong> (<strong>continued</strong>...)<br />

to protect the certifi cate holders from any potential<br />

reduction of the dividend yield, a signifi cant buffer has<br />

been included in the structure between the 2% periodic<br />

payment and the current 4% PLUS dividend yield.<br />

World Leaders in Shariah-compliant<br />

Banking & <strong>Finance</strong> Training<br />

The excess will be retained in a “sinking fund” for future<br />

payments if required.<br />

The certifi cates were priced to achieve a yield to<br />

scheduled dissolution of 4.58% and an exchange premium<br />

of 23% over RM3.21 (US$1), being the volume weighted<br />

average price of PLUS shares on the 27 th June 2007.<br />

On the exercise of the exchange rights under the<br />

certifi cates, the holders will be entitled to receive an<br />

aggregate of approximately 751 million ordinary shares of<br />

PLUS, which represent approximately 15% of PLUS’ current<br />

share capital.<br />

AGGRESSIVE PRICING<br />

Compared to Khazanah’s fi rst deal, the issuance achieved<br />

signifi cantly more aggressive pricing, with terms fi xed at<br />

the tight end of all the marketing ranges. The yield was<br />

LIBOR-90 bps as compared to LIBOR+4 bps in the fi rst deal.<br />

The premium, which marketed at a range of 19% to 23%,<br />

achieved 23% as compared to 19% in the fi rst deal.<br />

The order book was covered over 13 times with sizeable<br />

demand of US$$7.8 billion coming from over 200<br />

international investors with no pricing sensitivity.<br />

This is especially impressive, given that the bookrunners<br />

capped each investor’s initial order to 10% of the base<br />

deal, i.e. US$60 million.<br />

Although marketed as a Shariah compliant structure, this<br />

did not deter conventional investors who were drawn to the<br />

rarity of the value of the Khazanah credit and also the value<br />

of the equity linkage to a major Malaysian company.<br />

Compared to the fi rst deal in 2006 — which had a 70%:30%<br />

allocation between conventional: Middle East/<strong>Islamic</strong><br />

accounts — the Khazanah into PLUS exchangeable <strong>Sukuk</strong><br />

allocated over 50% to Middle East/<strong>Islamic</strong> accounts.<br />

In summary, the transaction was labeled a “blowout<br />

success” (<strong>Finance</strong>Asia) and surpassed the award-winning<br />

maiden exchangeable <strong>Sukuk</strong> in being multiple times<br />

oversubscribed, achieving signifi cantly more aggressive<br />

pricing and breaking the trend in placing over 50% of the<br />

overall allocation with Middle East/<strong>Islamic</strong> accounts.<br />

This case study was written by Atia Riaz, an <strong>Islamic</strong><br />

fi nance structurer at JPMorgan Securities in London<br />

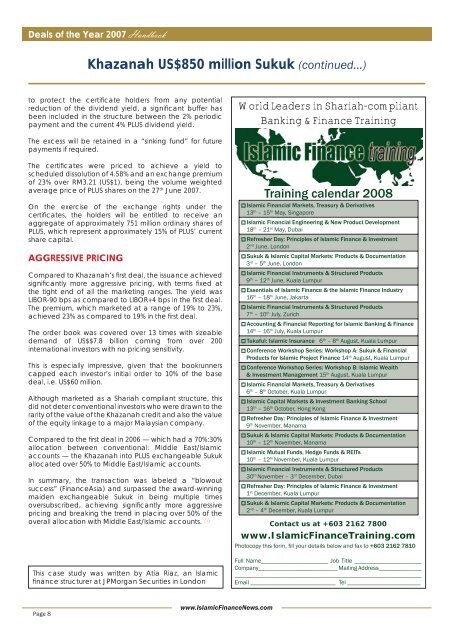

Training calendar 2008<br />

<strong>Islamic</strong> Financial Markets, Treasury & Derivatives<br />

13 th – 15 th May, Singapore<br />

<strong>Islamic</strong> Financial Engineering & New Product Development<br />

18 th – 21 st May, Dubai<br />

Refresher Day: Principles of <strong>Islamic</strong> <strong>Finance</strong> & Investment<br />

2 nd June, London<br />

<strong>Sukuk</strong> & <strong>Islamic</strong> Capital Markets: Products & Documentation<br />

3 rd – 5 th June, London<br />

<strong>Islamic</strong> Financial Instruments & Structured Products<br />

9 th – 12 th June, Kuala Lumpur<br />

Essentials of <strong>Islamic</strong> <strong>Finance</strong> & the <strong>Islamic</strong> <strong>Finance</strong> Industry<br />

16 th – 18 th June, Jakarta<br />

<strong>Islamic</strong> Financial Instruments & Structured Products<br />

7 th – 10 th July, Zurich<br />

Accounting & Financial Reporting for <strong>Islamic</strong> Banking & <strong>Finance</strong><br />

14 th – 16 th July, Kuala Lumpur<br />

Takaful: <strong>Islamic</strong> Insurance 6 th – 8 th August, Kuala Lumpur<br />

Conference Workshop Series: Workshop A: <strong>Sukuk</strong> & Financial<br />

Products for <strong>Islamic</strong> Project <strong>Finance</strong> 14 th August, Kuala Lumpur<br />

Conference Workshop Series: Workshop B: <strong>Islamic</strong> Wealth<br />

& Investment Management 15 th August, Kuala Lumpur<br />

<strong>Islamic</strong> Financial Markets, Treasury & Derivatives<br />

6 th – 8 th October, Kuala Lumpur<br />

<strong>Islamic</strong> Capital Markets & Investment Banking School<br />

13 th – 16 th October, Hong Kong<br />

Refresher Day: Principles of <strong>Islamic</strong> <strong>Finance</strong> & Investment<br />

9 th November, Manama<br />

<strong>Sukuk</strong> & <strong>Islamic</strong> Capital Markets: Products & Documentation<br />

10 th – 12 th November, Manama<br />

<strong>Islamic</strong> Mutual Funds, Hedge Funds & REITs<br />

10 th – 12 th November, Kuala Lumpur<br />

<strong>Islamic</strong> Financial Instruments & Structured Products<br />

30 th November – 3 rd December, Dubai<br />

Refresher Day: Principles of <strong>Islamic</strong> <strong>Finance</strong> & Investment<br />

1 st December, Kuala Lumpur<br />

<strong>Sukuk</strong> & <strong>Islamic</strong> Capital Markets: Products & Documentation<br />

2 nd – 4 th December, Kuala Lumpur<br />

Contact us at +603 2162 7800<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

Photocopy this form, fi ll your details below and fax to +603 2162 7810<br />

Full Name______________________ Job Title ______________________<br />

Company__________________________ Mailing Address______________<br />

_____________________________________________________________<br />

Email ____________________________ Tel ________________________<br />

Page 8<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com