RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

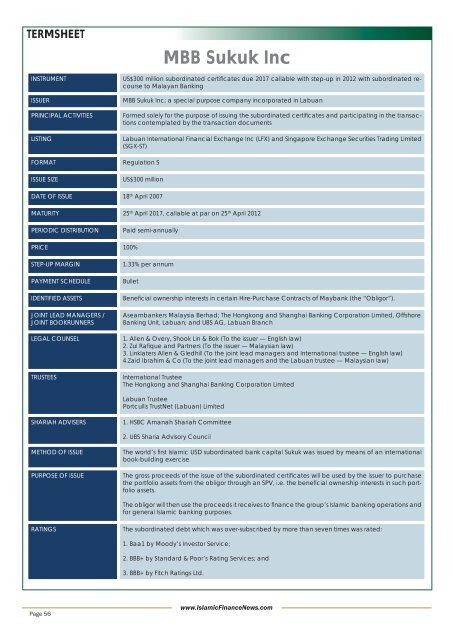

TERMSHEET<br />

INSTRUMENT<br />

ISSUER<br />

PRINCIPAL ACTIVITIES<br />

LISTING<br />

FORMAT<br />

ISSUE SIZE<br />

MBB <strong>Sukuk</strong> Inc<br />

US$300 million subordinated certifi cates due 2017 callable with step-up in 2012 with subordinated recourse<br />

to Malayan Banking<br />

MBB <strong>Sukuk</strong> Inc; a special purpose company incorporated in Labuan<br />

Formed solely for the purpose of issuing the subordinated certifi cates and participating in the transactions<br />

contemplated by the transaction documents<br />

Labuan International Financial Exchange Inc (LFX) and Singapore Exchange Securities Trading Limited<br />

(SGX-ST)<br />

Regulation S<br />

US$300 million<br />

DATE OF ISSUE 18 th April 2007<br />

MATURITY 25 th April 2017, callable at par on 25 th April 2012<br />

PERIODIC DISTRIBUTION<br />

Paid semi-annually<br />

PRICE 100%<br />

STEP-UP MARGIN<br />

PAYMENT SCHEDULE<br />

IDENTIFIED ASSETS<br />

JOINT LEAD MANAGERS /<br />

JOINT BOOKRUNNERS<br />

LEGAL COUNSEL<br />

TRUSTEES<br />

1.33% per annum<br />

Bullet<br />

Benefi cial ownership interests in certain Hire-Purchase Contracts of Maybank (the “Obligor”).<br />

Aseambankers Malaysia Berhad; The Hongkong and Shanghai Banking Corporation Limited, Offshore<br />

Banking Unit, Labuan; and UBS AG, Labuan Branch<br />

1. Allen & Overy, Shook Lin & Bok (To the issuer — English law)<br />

2. Zul Rafi que and Partners (To the issuer — Malaysian law)<br />

3. Linklaters Allen & Gledhill (To the joint lead managers and International trustee — English law)<br />

4.Zaid Ibrahim & Co (To the joint lead managers and the Labuan trustee — Malaysian law)<br />

International Trustee<br />

The Hongkong and Shanghai Banking Corporation Limited<br />

Labuan Trustee<br />

Portcullis TrustNet (Labuan) Limited<br />

SHARIAH ADVISERS<br />

1. HSBC Amanah Shariah Committee<br />

2. UBS Sharia Advisory Council<br />

METHOD OF ISSUE<br />

PURPOSE OF ISSUE<br />

The world’s fi rst <strong>Islamic</strong> USD subordinated bank capital <strong>Sukuk</strong> was issued by means of an international<br />

book-building exercise<br />

The gross proceeds of the issue of the subordinated certifi cates will be used by the issuer to purchase<br />

the portfolio assets from the obligor through an SPV, i.e. the benefi cial ownership interests in such portfolio<br />

assets.<br />

The obligor will then use the proceeds it receives to fi nance the group’s <strong>Islamic</strong> banking operations and<br />

for general <strong>Islamic</strong> banking purposes.<br />

RATINGS<br />

The subordinated debt which was over-subscribed by more than seven times was rated:<br />

1. Baa1 by Moody’s Investor Service;<br />

2. BBB+ by Standard & Poor’s Rating Services; and<br />

3. BBB+ by Fitch Ratings Ltd.<br />

Page 56<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com