RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

Kuala Lumpur Sentral US$225 million<br />

<strong>Sukuk</strong> Musharakah<br />

HSBC Bank Malaysia and Kuwait <strong>Finance</strong> House (Malaysia)<br />

(KFHM) acted as joint lead managers and joint lead arrangers<br />

for Kuala Lumpur Sentral (KLS)’s RM720 million (US$225.4<br />

million) <strong>Sukuk</strong> Musharakah. In addition, KFHM was the Shariah<br />

adviser and credit enhancement provider, whereby it<br />

undertook to buy certain project lands under a put option<br />

contract (POC) for the transaction. The <strong>Sukuk</strong> were issued<br />

on the 6 th April 2007.<br />

BACKGROUND OF THE ISSUER<br />

KLS was incorporated on the 7 th November 1994 as a joint<br />

venture company to carry out the design and construction<br />

works in respect of the Kuala Lumpur Sentral Station Complex<br />

(KL Sentral). The joint venture partners are Malaysian<br />

Resources Corporation, Keretapi Tanah Melayu and Pembinaan<br />

Redzai.<br />

The concession agreement was signed on the 18 th August<br />

1997, pursuant to which KLS was required to build an integrated<br />

railway station and hand it over to the government<br />

of Malaysia. The construction of KL Sentral Station<br />

has been completed.<br />

In return for constructing the KL Sentral Station, KLS was<br />

granted the development rights over the remaining site for<br />

commercial property development, which makes up approximately<br />

62 acres surrounding the KL Sentral Station.<br />

Pursuant to a supplementary agreement signed by KLS, the<br />

government of Malaysia and Syarikat Tanah dan Harta on the<br />

10 th March 1999, the government of Malaysia was to transfer<br />

such lands to KLS based on the progress of construction works.<br />

To date, all such lands have been transferred to KLS.<br />

RATING<br />

Rating Agency Malaysia (RAM) has assigned a rating of<br />

AA2(s) to KLS, which indicated high safety for timely payment<br />

of profi t and principal. The rating is a much improved<br />

rating from the former Al-Bai Bithaman Ajil <strong>Islamic</strong> Debt Securities<br />

(BaIDS), which was accorded a rating of A+ID(s).<br />

UTILIZATION OF PROCEEDS<br />

KLS was to utilize the proceeds to repurchase and cancel<br />

its outstanding BaIDS. The transaction also involved negotiation<br />

with the existing BaIDS holders for the early redemption<br />

of the BaIDS at a price acceptable to the BaIDS holders<br />

as well as KLS.<br />

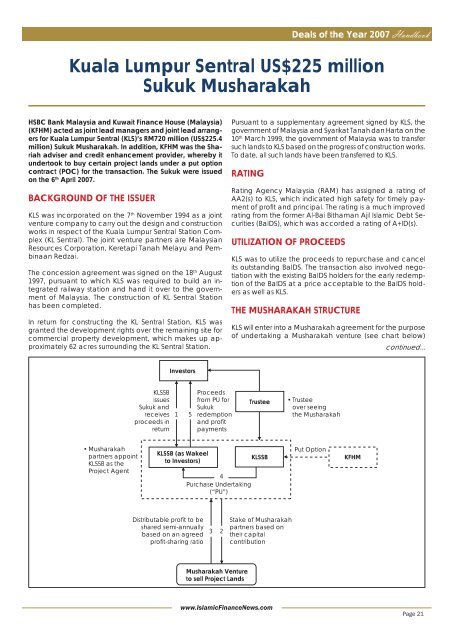

THE MUSHARAKAH STRUCTURE<br />

KLS will enter into a Musharakah agreement for the purpose<br />

of undertaking a Musharakah venture (see chart below)<br />

<strong>continued</strong>...<br />

Investors<br />

KLSSB<br />

issues<br />

<strong>Sukuk</strong> and<br />

receives<br />

proceeds in<br />

return<br />

1 5<br />

Proceeds<br />

from PU for<br />

<strong>Sukuk</strong><br />

redemption<br />

and profit<br />

payments<br />

Trustee<br />

• Trustee<br />

over seeing<br />

the Musharakah<br />

• Musharakah<br />

partners appoint<br />

KLSSB as the<br />

Project Agent<br />

KLSSB (as Wakeel<br />

to Investors)<br />

4<br />

Purchase Undertaking<br />

(“PU”)<br />

KLSSB<br />

Put Option<br />

KFHM<br />

Distributable profit to be<br />

shared semi-annually<br />

based on an agreed<br />

profit-sharing ratio<br />

3 2<br />

Stake of Musharakah<br />

partners based on<br />

their capital<br />

contribution<br />

Musharakah Venture<br />

to sell Project Lands<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 21