RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Deals of the Year 2007 Handbook<br />

Maybank Subordinated Capital <strong>Sukuk</strong> (<strong>continued</strong>...)<br />

these payments to <strong>Sukuk</strong> holders<br />

as periodic payments (profi ts). Any<br />

surplus income would be retained by<br />

Maybank as their fees. Any mismatch<br />

in the periodic payment would be<br />

fi nanced by Maybank via a Shariah<br />

compliant liquidity facility pursuant<br />

to the management agreement.<br />

(c) At maturity<br />

On maturity date, under the terms of<br />

the deed of purchase undertaking,<br />

Maybank would undertake to<br />

acquire the <strong>Sukuk</strong> assets at their<br />

principal value, either at maturity<br />

date or upon an event of dissolution.<br />

MBB <strong>Sukuk</strong> would then utilize the<br />

proceeds from the sale of the <strong>Sukuk</strong><br />

assets to repay the principal of the<br />

<strong>Sukuk</strong> to the <strong>Sukuk</strong> holders.<br />

ACHIEVEMENTS<br />

The objectives and achievements for<br />

the issuances of the US$ subordinated<br />

<strong>Sukuk</strong>:<br />

• An internationally Shariah<br />

compliant structure guaranteed<br />

access to a wider investors’<br />

base. Hence, funds were raised<br />

at competitive rates which in<br />

turn translated into lower overall<br />

fi nancing costs for Maybank;<br />

• The internationally Shariah compliant structure also<br />

enhanced Maybank’s profi ling among international<br />

investors;<br />

• Fully supported the government of Malaysia’s<br />

objective to make the country an international<br />

fi nancial center through issuing an internationally<br />

accepted debt instrument.<br />

This case study<br />

was written by<br />

Aseambankers Debt Capital Markets Team.<br />

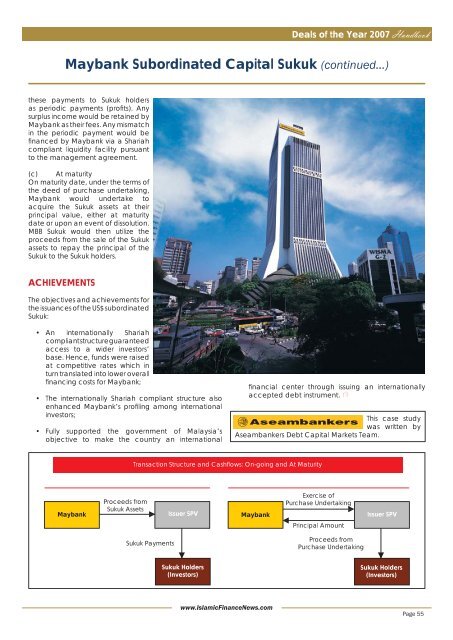

Transaction Structure and Cashflows: On-going and At Maturity<br />

Maybank<br />

Proceeds from<br />

<strong>Sukuk</strong> Assets<br />

Issuer SPV<br />

Maybank<br />

Exercise of<br />

Purchase Undertaking<br />

Issuer SPV<br />

Principal Amount<br />

<strong>Sukuk</strong> Payments<br />

Proceeds from<br />

Purchase Undertaking<br />

<strong>Sukuk</strong> Holders<br />

(Investors)<br />

<strong>Sukuk</strong> Holders<br />

(Investors)<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 55