RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Deals of the Year 2007 Handbook<br />

Al-Hadharah Boustead REIT (<strong>continued</strong>...)<br />

valued at RM472 million (US$148 million) — were purchased<br />

from Boustead Properties, Boustead Plantations and<br />

Boustead Heah Joo Seang (collectively, the vendors).<br />

Oil palm, being a favored product as a feedstock in<br />

biodiesel production, and with the strong demand for oil<br />

palm in the market which will sustain CPO prices, is seen as<br />

a more attractive alternative investment to savvy investors<br />

monitoring the sky-rocketing oil prices. The Al-Hadharah<br />

Boustead REIT provides stable earnings and income<br />

growth. Risk is minimized with the support of the value of<br />

the plantation assets as well as the yields offered, providing<br />

the investor with some degree of capital protection.<br />

To fund the purchase consideration for the plantation<br />

assets, the Al-Hadharah Boustead REIT issued units to the<br />

vendors as part of the purchase consideration and the<br />

balance of the purchase consideration was satisfi ed in<br />

cash, based on the proceeds raised from the initial public<br />

offering (IPO).<br />

THE DEAL<br />

The units issued by the Al-Hadharah Boustead REIT, together<br />

with the proceeds from the IPO and <strong>Islamic</strong> fi nancing<br />

facility, were utilized by the Al-Hadharah Boustead REIT<br />

to fi nance the purchase of the plantation assets and to<br />

fi nance the listing expenses and working capital of the Al-<br />

Hadharah Boustead REIT.<br />

AI-Hadharah Boustead REIT’s purchase of the plantation<br />

assets is primarily to facilitate the REIT exercise involving the<br />

arrangement to lease those assets back to the vendors<br />

pursuant to several Ijarah agreements.<br />

The income of the Al-Hadharah Boustead REIT is derived,<br />

among others, from a stable distribution of returns of<br />

fi xed fee rentals and a variable fee which introduced<br />

performance-based profi t sharing, which is accustomed<br />

to providing a yield dependent on the growth of the<br />

plantation assets acquired and the palm oil industry.<br />

The Al-Hadharah Boustead REIT offered a profi t sharing of<br />

at least 98% of its distributable earnings to be paid to its unit<br />

holders in the fi rst three fi nancial years.<br />

INSTRUMENTAL DOCUMENTS<br />

The Al-Hadharah Boustead REIT is governed by the REIT<br />

Guidelines issued by the Securities Commission of Malaysia<br />

(SC). The transaction was complex as it involved the transfer<br />

of ownership of land which had various restrictions in interest.<br />

Hence, the transaction documents for the acquisition and<br />

<strong>continued</strong>...<br />

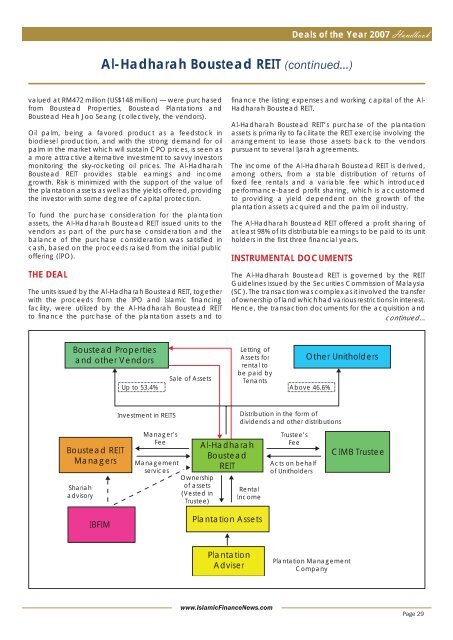

Boustead Properties<br />

and other Vendors<br />

Letting of<br />

Assets for<br />

rental to<br />

be paid by<br />

Sale of Assets Tenants<br />

Up to 53.4% Above 46.6%<br />

Other Unitholders<br />

Boustead REIT<br />

Managers<br />

Shariah<br />

advisory<br />

Investment in REITS<br />

Manager’s<br />

Fee<br />

Management<br />

services<br />

Ownership<br />

of assets<br />

(Vested in<br />

Trustee)<br />

Al-Hadharah<br />

Boustead<br />

REIT<br />

Distribution in the form of<br />

dividends and other distributions<br />

Rental<br />

Income<br />

Trustee’s<br />

Fee<br />

Acts on behalf<br />

of Unitholders<br />

CIMB Trustee<br />

IBFIM<br />

Plantation Assets<br />

Plantation<br />

Adviser<br />

Plantation Management<br />

Company<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 29