RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

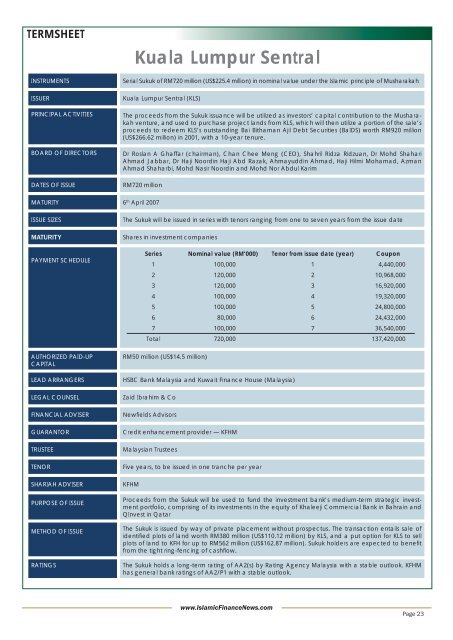

TERMSHEET<br />

INSTRUMENTS<br />

ISSUER<br />

PRINCIPAL ACTIVITIES<br />

BOARD OF DIRECTORS<br />

DATES OF ISSUE<br />

Kuala Lumpur Sentral<br />

Serial <strong>Sukuk</strong> of RM720 million (US$225.4 million) in nominal value under the <strong>Islamic</strong> principle of Musharakah<br />

Kuala Lumpur Sentral (KLS)<br />

The proceeds from the <strong>Sukuk</strong> issuance will be utilized as investors’ capital contribution to the Musharakah<br />

venture, and used to purchase project lands from KLS, which will then utilize a portion of the sale’s<br />

proceeds to redeem KLS’s outstanding Bai Bithaman Ajil Debt Securities (BaIDS) worth RM920 million<br />

(US$266.62 million) in 2001, with a 10-year tenure.<br />

Dr Roslan A Ghaffar (chairman), Chan Chee Meng (CEO), Shahril Ridza Ridzuan, Dr Mohd Shahari<br />

Ahmad Jabbar, Dr Haji Noordin Haji Abd Razak, Ahmayuddin Ahmad, Haji Hilmi Mohamad, Azman<br />

Ahmad Shaharbi, Mohd Nasir Noordin and Mohd Nor Abdul Karim<br />

RM720 million<br />

MATURITY 6 th April 2007<br />

ISSUE SIZES<br />

MATURITY<br />

PAYMENT SCHEDULE<br />

AUTHORIZED PAID-UP<br />

CAPITAL<br />

LEAD ARRANGERS<br />

LEGAL COUNSEL<br />

FINANCIAL ADVISER<br />

GUARANTOR<br />

TRUSTEE<br />

TENOR<br />

SHARIAH ADVISER<br />

PURPOSE OF ISSUE<br />

METHOD OF ISSUE<br />

RATINGS<br />

The <strong>Sukuk</strong> will be issued in series with tenors ranging from one to seven years from the issue date<br />

Shares in investment companies<br />

RM50 million (US$14.5 million)<br />

HSBC Bank Malaysia and Kuwait <strong>Finance</strong> House (Malaysia)<br />

Zaid Ibrahim & Co<br />

Newfi elds Advisors<br />

Credit enhancement provider — KFHM<br />

Malaysian Trustees<br />

Five years, to be issued in one tranche per year<br />

KFHM<br />

Series Nominal value (RM’000) Tenor from issue date (year) Coupon<br />

1 100,000 1 4,440,000<br />

2 120,000 2 10,968,000<br />

3 120,000 3 16,920,000<br />

4 100,000 4 19,320,000<br />

5 100,000 5 24,800,000<br />

6 80,000 6 24,432,000<br />

7 100,000 7 36,540,000<br />

Total 720,000 137,420,000<br />

Proceeds from the <strong>Sukuk</strong> will be used to fund the investment bank’s medium-term strategic investment<br />

portfolio, comprising of its investments in the equity of Khaleeji Commercial Bank in Bahrain and<br />

QInvest in Qatar<br />

The <strong>Sukuk</strong> is issued by way of private placement without prospectus. The transaction entails sale of<br />

identifi ed plots of land worth RM380 million (US$110.12 million) by KLS, and a put option for KLS to sell<br />

plots of land to KFH for up to RM562 million (US$162.87 million). <strong>Sukuk</strong> holders are expected to benefi t<br />

from the tight ring-fencing of cashfl ow.<br />

The <strong>Sukuk</strong> holds a long-term rating of AA2(s) by Rating Agency Malaysia with a stable outlook. KFHM<br />

has general bank ratings of AA2/P1 with a stable outlook.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 23