RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

Aldar Properties US$2.53 billion<br />

Exchangeable <strong>Sukuk</strong><br />

ISSUER<br />

Aldar Properties is one of the largest listed UAE property<br />

development companies by market value (US$6.4<br />

billion as at December 2007). Its substantial shareholders<br />

are predominantly drawn from Abu Dhabi institutions,<br />

founder-shareholders and individual investors — including<br />

Mubadala Development Company, The National Investor,<br />

Abu Dhabi Investment Company, Abu Dhabi National<br />

Hotels Company, and the National Corporation for Tourism<br />

and Hotels.<br />

Aldar was incorporated as a private joint stock company<br />

in October 2004, and subsequently listed on the<br />

Abu Dhabi Securities Market (ADSM) on the 4 th April 2005.<br />

It is a leading real estate developer in Abu Dhabi by virtue<br />

of the size of its land bank (it owns over 30 million<br />

sq m of land valued at US$10.4 billion) at strategic locations<br />

across the city of Abu Dhabi.<br />

Its planned developments, worth approximately US$60 billion,<br />

include the construction and management of offi ces,<br />

residential properties, retail sites, hotels, tourist attractions,<br />

leisure facilities, luxury resorts and schools.<br />

OBJECTIVES FOR THE ISSUER<br />

The objectives of Aldar’s maiden <strong>Sukuk</strong> issuance were to:<br />

• Raise funds via the <strong>Islamic</strong> capital markets at a competitive<br />

rate<br />

• Achieve flexibility in the management of the proceeds<br />

• Tap a wider investor base<br />

• Increase the profi le of the company regionally and<br />

internationally.<br />

TRANSACTION HIGHLIGHTS<br />

National Bank of Abu Dhabi (NBAD), Barclays Capital and<br />

Credit Suisse were mandated by Aldar in November 2006<br />

to arrange its maiden <strong>Sukuk</strong> issuance. On the 20 th February<br />

2007, via its global roadshow, Aldar announced the fi nal<br />

terms for its 4.75-year, US$2.53 billion exchangeable <strong>Sukuk</strong><br />

(including a 15% increase option) from a special purpose<br />

vehicle, or SPV, into its ordinary shares.<br />

The profi t rate used to calculate the periodic distribution<br />

amount is 5.76% per annum on a quarterly basis, equivalent<br />

to a margin of 0.65% above the fi ve-year US dollar midswap<br />

rate at the time of pricing. The exchange price was<br />

set at US$1.55, refl ecting an initial exchange premium of<br />

37% above the arithmetic average of the volume weighted<br />

average price (VWAP) of Aldar’s ordinary shares on each<br />

trading day from the 4 th February 2007 to the pricing date,<br />

the 20 th February 2007.<br />

The <strong>Sukuk</strong> issuance entrusted Aldar to act as Mudarib<br />

(<strong>Islamic</strong> investment manager) for investors in the Abu Dhabi<br />

property sector. The exchangeable <strong>Sukuk</strong> issuance was<br />

well received by regional and international investors, and<br />

was about 10 times oversubscribed at the initial transaction<br />

size of US$1.3 billion. The order book exceeded US$13<br />

billion. Favorable response and strong demand resulted<br />

in improved terms for Aldar’s exchangeable <strong>Sukuk</strong>, where<br />

periodic profi t distribution was set 10 basis points (bps) below<br />

the initial price guidance of 75 to 85 bps, and premium set<br />

at the top end of the range at 37%.<br />

The proceeds from the transaction were utilized to invest<br />

with the Mudarib, which formed the Mudarabah capital in<br />

<strong>continued</strong>...<br />

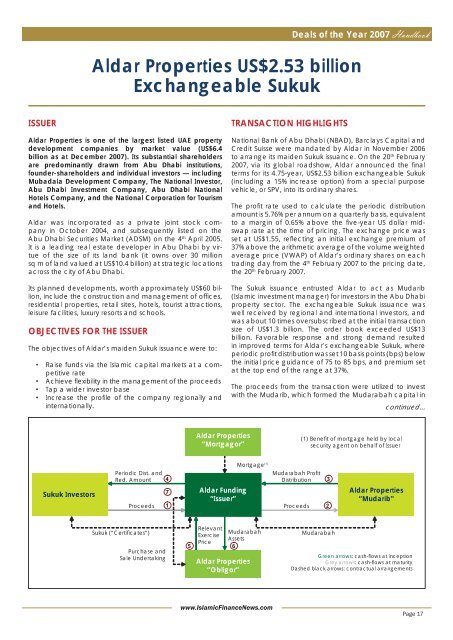

Aldar Properties<br />

“Mortgagor”<br />

(1) Benefit of mortgage held by local<br />

security agent on behalf of Issuer<br />

<strong>Sukuk</strong> Investors<br />

Periodic Dist. and<br />

Red. Amount<br />

Proceeds<br />

4<br />

7<br />

1<br />

Aldar Funding<br />

“Issuer”<br />

Mortgage (1)<br />

Mudarabah Profit<br />

Distribution<br />

Proceeds<br />

3<br />

2<br />

Aldar Properties<br />

“Mudarib”<br />

<strong>Sukuk</strong> (“Certificates”)<br />

Purchase and<br />

Sale Undertaking<br />

Relevant<br />

Mudarabah<br />

Exercise<br />

Assets<br />

Price<br />

5 6<br />

Aldar Properties<br />

“Obligor”<br />

Mudarabah<br />

Green arrows: cash-flows at inception<br />

Grey arrows: cash-flows at maturity<br />

Dashed black arrows: contractual arrangements<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 17