RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

Mada Leletisalat <strong>Islamic</strong> financing facility (<strong>continued</strong>...)<br />

The guarantee facility was made available in one drawdown<br />

to meet the initial funding commitment of 80% of the<br />

license fee in accordance with the licensing schedule and<br />

procedures set out in the CITC documents.<br />

The subject guarantee was secured by cash collateral of<br />

US$2.15 billion by the sponsors and shareholder loan of<br />

US$288.5 million, deposited into an escrow account in favor<br />

of the security agent acting on behalf of the fi nanciers.<br />

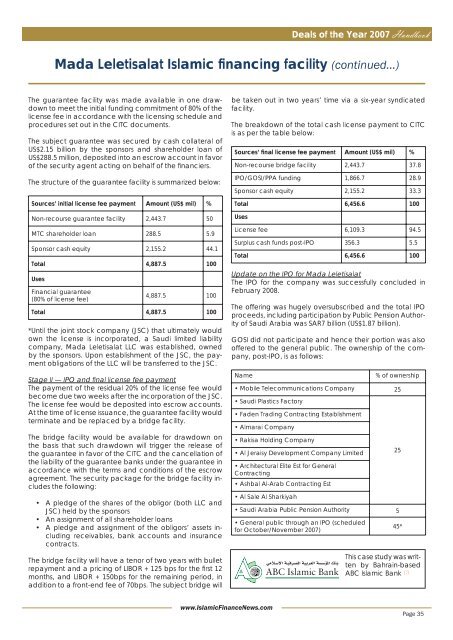

The structure of the guarantee facility is summarized below:<br />

Sources’ initial license fee payment Amount (US$ mil) %<br />

Non-recourse guarantee facility 2,443.7 50<br />

MTC shareholder loan 288.5 5.9<br />

Sponsor cash equity 2,155.2 44.1<br />

Total 4,887.5 100<br />

Uses<br />

Financial guarantee<br />

(80% of license fee)<br />

4,887.5 100<br />

Total 4,887.5 100<br />

*Until the joint stock company (JSC) that ultimately would<br />

own the license is incorporated, a Saudi limited liability<br />

company, Mada Leletisalat LLC was established, owned<br />

by the sponsors. Upon establishment of the JSC, the payment<br />

obligations of the LLC will be transferred to the JSC.<br />

Stage II — IPO and fi nal license fee payment<br />

The payment of the residual 20% of the license fee would<br />

become due two weeks after the incorporation of the JSC.<br />

The license fee would be deposited into escrow accounts.<br />

At the time of license issuance, the guarantee facility would<br />

terminate and be replaced by a bridge facility.<br />

The bridge facility would be available for drawdown on<br />

the basis that such drawdown will trigger the release of<br />

the guarantee in favor of the CITC and the cancellation of<br />

the liability of the guarantee banks under the guarantee in<br />

accordance with the terms and conditions of the escrow<br />

agreement. The security package for the bridge facility includes<br />

the following:<br />

• A pledge of the shares of the obligor (both LLC and<br />

JSC) held by the sponsors<br />

• An assignment of all shareholder loans<br />

• A pledge and assignment of the obligors’ assets including<br />

receivables, bank accounts and insurance<br />

contracts.<br />

The bridge facility will have a tenor of two years with bullet<br />

repayment and a pricing of LIBOR + 125 bps for the fi rst 12<br />

months, and LIBOR + 150bps for the remaining period, in<br />

addition to a front-end fee of 70bps. The subject bridge will<br />

be taken out in two years’ time via a six-year syndicated<br />

facility.<br />

The breakdown of the total cash license payment to CITC<br />

is as per the table below:<br />

Sources’ final license fee payment Amount (US$ mil) %<br />

Non-recourse bridge facility 2,443.7 37.8<br />

IPO/GOSI/PPA funding 1,866.7 28.9<br />

Sponsor cash equity 2,155.2 33.3<br />

Total 6,456.6 100<br />

Uses<br />

License fee 6,109.3 94.5<br />

Surplus cash funds post-IPO 356.3 5.5<br />

Total 6,456.6 100<br />

Update on the IPO for Mada Leletisalat<br />

The IPO for the company was successfully concluded in<br />

February 2008.<br />

The offering was hugely oversubscribed and the total IPO<br />

proceeds, including participation by Public Pension Authority<br />

of Saudi Arabia was SAR7 billion (US$1.87 billion).<br />

GOSI did not participate and hence their portion was also<br />

offered to the general public. The ownership of the company,<br />

post-IPO, is as follows:<br />

Name<br />

% of ownership<br />

• Mobile Telecommunications Company 25<br />

• Saudi Plastics Factory<br />

• Faden Trading Contracting Establishment<br />

• Almarai Company<br />

• Rakisa Holding Company<br />

• Al Jeraisy Development Company Limited<br />

• Architectural Elite Est for General<br />

Contracting<br />

• Ashbal Al-Arab Contracting Est<br />

• Al Sale Al Sharkiyah<br />

• Saudi Arabia Public Pension Authority 5<br />

• General public through an IPO (scheduled<br />

for October/November 2007)<br />

25<br />

45*<br />

This case study was written<br />

by Bahrain-based<br />

ABC <strong>Islamic</strong> Bank<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 35