RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Adhi Karya US$13.6 million<br />

<strong>Sukuk</strong> Mudarabah<br />

Deals of the Year 2007 Handbook<br />

TRANSACTION DESCRIPTION<br />

In June 2007, Mandiri Sekuritas acted as sole lead<br />

underwriter for the <strong>Sukuk</strong> Mudarabah bond issue of Adhi<br />

Karya, an Indonesian-owned construction company.<br />

The <strong>Sukuk</strong>, which were oversubscribed, raised IDR125<br />

billion (US$13.6 million) and were issued with a maturity of<br />

fi ve years. The money raised was used for working capital<br />

needs and ongoing and future projects fi nancing.<br />

The deal is considered one of the few attractive <strong>Sukuk</strong><br />

Ijarah issues deals in 2007 amid several other corporate<br />

bonds issued within the same period as PLN Bonds and the<br />

downtrend of the interest rates.<br />

The success of Mandiri Sekuritas’ lead in <strong>Islamic</strong><br />

financing is an example of innovation in a rapidly<br />

growing market.<br />

“The deal is considered one<br />

of the few attractive <strong>Sukuk</strong><br />

Ijarah issues deals in 2007<br />

amid several other corporate<br />

bonds issued within the same<br />

period as PLN Bonds and the<br />

downtrend of the interest rates”<br />

TRANSACTION OVERVIEW<br />

The Adhi Karya <strong>Sukuk</strong> Mudarabah transaction is a landmark<br />

transaction in many respects:<br />

• The fi rst <strong>Sukuk</strong> Mudarabah by one of the leading<br />

construction companies that’s government-owned<br />

• The <strong>Sukuk</strong> Mudarabah of Adhi Karya were specially<br />

structured to effect a profi t-sharing principle in<br />

order to do away with the interest-bearing coupons<br />

that are prohibited by <strong>Islamic</strong> law. The successful<br />

execution of this <strong>Sukuk</strong> has set a platform for future<br />

<strong>Islamic</strong> construction company fi nancings in the<br />

country.<br />

• The <strong>Sukuk</strong> Mudarabah of Adhi Karya was not only<br />

one of the attractive <strong>Islamic</strong> fi nancings in the country<br />

during 2007, the issue was structured and executed<br />

with intensive interactions with local regulators and<br />

Shariah boards.<br />

• The transactions introduced Adhi Karya to the <strong>Islamic</strong><br />

investor base, and enabled the company to diversify<br />

its funding to a new investor base, which was a key<br />

objective of Adhi Karya’s management.<br />

• The offering was competitively priced in comparison<br />

with others at that time, and has set a new benchmark<br />

for the company’s subsequent fi nancings.<br />

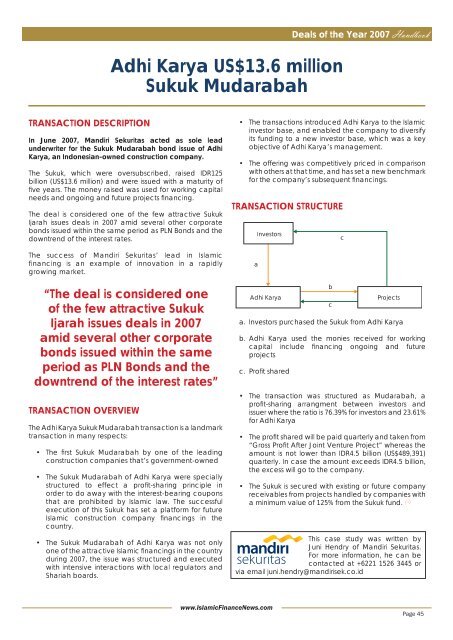

TRANSACTION STRUCTURE<br />

a<br />

Investors<br />

Adhi Karya<br />

a. Investors purchased the <strong>Sukuk</strong> from Adhi Karya<br />

b. Adhi Karya used the monies received for working<br />

capital include fi nancing ongoing and future<br />

projects<br />

c. Profi t shared<br />

b<br />

c<br />

• The transaction was structured as Mudarabah, a<br />

profi t-sharing arrangment between investors and<br />

issuer where the ratio is 76.39% for investors and 23.61%<br />

for Adhi Karya<br />

• The profi t shared will be paid quarterly and taken from<br />

“Gross Profi t After Joint Venture Project” whereas the<br />

amount is not lower than IDR4.5 billion (US$489,391)<br />

quarterly. In case the amount exceeds IDR4.5 billion,<br />

the excess will go to the company.<br />

• The <strong>Sukuk</strong> is secured with existing or future company<br />

receivables from projects handled by companies with<br />

a minimum value of 125% from the <strong>Sukuk</strong> fund.<br />

c<br />

Projects<br />

This case study was written by<br />

Juni Hendry of Mandiri Sekuritas.<br />

For more information, he can be<br />

contacted at +6221 1526 3445 or<br />

via email juni.hendry@mandirisek.co.id<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 45