RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

Maybank Subordinated Capital <strong>Sukuk</strong> (<strong>continued</strong>...)<br />

Globally, the US$ subordinated <strong>Sukuk</strong> achieved the tightest<br />

pricing ever for a US$ <strong>Sukuk</strong> (excluding supranational<br />

issuers).<br />

FINANCING PLAN AND STRUCTURE<br />

(a) At Inception<br />

The US$ subordinated <strong>Sukuk</strong> fi nancing structure entailed<br />

establishment of two special purpose vehicle (SPV)<br />

companies incorporated in Labuan solely for the purpose<br />

of facilitating and ensuring the proposed <strong>Islamic</strong> fi nancing<br />

structure is in compliance with the Shariah standards set<br />

by the Shariah scholars in the Gulf Cooperation Council<br />

(GCC) countries.<br />

The GCC’s Shariah board also required that both the SPVs<br />

were orphan companies, i.e. not owned by Maybank.<br />

Under the transaction, Maybank transferred benefi cial<br />

ownership interests in a portfolio of assets (<strong>Sukuk</strong> assets<br />

which comprised <strong>Islamic</strong> fi nancial assets such as Ijarah<br />

<strong>Islamic</strong> assets or other acceptable Shariah compliant<br />

assets).<br />

MBB <strong>Sukuk</strong> would then issue the US$ subordinated <strong>Sukuk</strong> to<br />

investors, and proceeds from the issuance would be utilized<br />

to fi nance the purchase of the <strong>Sukuk</strong> assets. As the seller of<br />

the <strong>Sukuk</strong> assets, Maybank would then utilize these <strong>Sukuk</strong><br />

proceeds to fund its <strong>Islamic</strong> fi nance operations or business<br />

activities.<br />

The benefi cial interest in the <strong>Sukuk</strong> assets shall be ultimately<br />

transferred in favor of MBB <strong>Sukuk</strong>, while the legal ownership<br />

should remain at Maybank. In essence, the sale and<br />

purchase of the <strong>Sukuk</strong> assets only refl ected the transfer<br />

of the benefi cial ownership and there would not be any<br />

physical movement of these <strong>Sukuk</strong> assets.<br />

This effectively meant the MBB <strong>Sukuk</strong> held the <strong>Sukuk</strong> assets<br />

on trust for the benefi t of the <strong>Sukuk</strong> holders who should<br />

also be the benefi cial owners of the undivided fractional<br />

ownership of the <strong>Sukuk</strong> assets.<br />

MBB <strong>Sukuk</strong>, under a management agreement, would<br />

appoint Maybank as a manager/wakeel to manage the<br />

<strong>Sukuk</strong> assets and payment agent for all collections related<br />

to the <strong>Sukuk</strong> assets and would then use these periodic<br />

payments as periodic <strong>Sukuk</strong> payments.<br />

The US$ subordinated <strong>Sukuk</strong> incorporated a deed of<br />

purchase undertaking and deed of sale undertaking.<br />

Pursuant to the purchase undertaking issued in favor of<br />

MBB <strong>Sukuk</strong>, Maybank was required to purchase the US$<br />

subordinated <strong>Sukuk</strong> upon maturity of dissolution for a price<br />

equivalent to outstanding principal, plus profi ts accrued<br />

and unpaid.<br />

Conversely, MBB <strong>Sukuk</strong> would issue a sale undertaking in<br />

favor of Maybank granting Maybank the rights to purchase<br />

the US$ subordinated <strong>Sukuk</strong> at a prescribed price based on<br />

the agreed redemption date.<br />

(b) Ongoing<br />

Maybank, in its capacity as manager, would collect any<br />

payments from the <strong>Sukuk</strong> assets. MBB <strong>Sukuk</strong> would forward<br />

<strong>continued</strong>...<br />

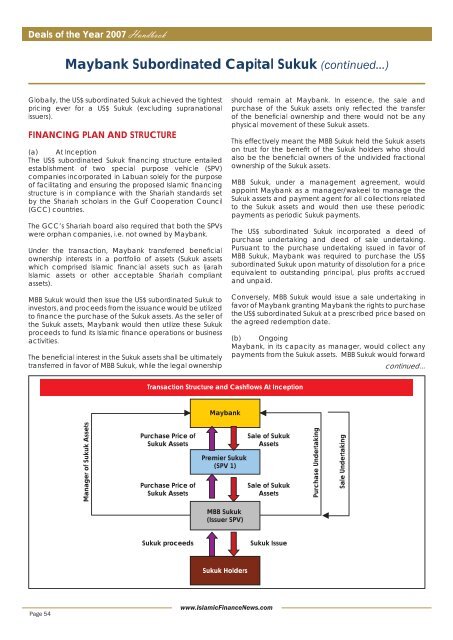

Transaction Structure and Cashflows At Inception<br />

Maybank<br />

Manager of <strong>Sukuk</strong> Assets<br />

Purchase Price of<br />

<strong>Sukuk</strong> Assets<br />

Purchase Price of<br />

<strong>Sukuk</strong> Assets<br />

Premier <strong>Sukuk</strong><br />

(SPV 1)<br />

Sale of <strong>Sukuk</strong><br />

Assets<br />

Sale of <strong>Sukuk</strong><br />

Assets<br />

Purchase Undertaking<br />

Sale Undertaking<br />

MBB <strong>Sukuk</strong><br />

(Issuer SPV)<br />

<strong>Sukuk</strong> proceeds<br />

<strong>Sukuk</strong> Issue<br />

<strong>Sukuk</strong> Holders<br />

Page 54<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com