RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

RAKIA Sukuk (continued...) - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deals of the Year 2007 Handbook<br />

Engro Chemical Pakistan US$150 million<br />

Project <strong>Finance</strong> Facility<br />

THE COMPANY AND ITS BUSINESSES<br />

Engro Chemical Pakistan is a public limited company listed<br />

on the stock exchanges of Karachi, Lahore and Islamabad.<br />

It was incorporated in 1965 as Exxon Chemical Pakistan.<br />

In 1991, when Exxon decided to divest its fertilizer business<br />

on a global basis, its employees, in partnership with leading<br />

international and local fi nancial institutions, bought out<br />

Exxon’s equity. The company was renamed Engro Chemical<br />

Pakistan.<br />

While Engro’s primary business line continues to be fertilizer,<br />

it has diversifi ed into other businesses, including dairy<br />

products, seeds, energy, storage of bulk liquid chemicals,<br />

and manufacture of polyvinyl chloride (PVC).<br />

THE PROJECT<br />

On the 11 th December 2006, Engro Chemicals was<br />

allocated 100 MMCFD (million cubic feet per day) gas<br />

from the Qadirpur gas fi eld, to be delivered via a pipeline<br />

constructed by Sui Northern Gas Pipeline Company. Engro<br />

was to construct a modern urea plant (the project) on the<br />

land adjacent to its existing plant location in Dharki. The<br />

project cost is US$950 million — the largest private sector<br />

project in Pakistan’s history. With a capacity of 1.3 tpa, the<br />

new plant will be the single largest urea plant in the world<br />

when it comes online in 2010, thereby making Engro the<br />

largest fertilizer producer in Pakistan.<br />

The project will allow Engro to leverage on its expertise<br />

and utilize its well-established distribution network, with the<br />

result of increasing market share which will afford it greater<br />

pricing power.<br />

TRANSACTION STRUCTURE AND DOCUMENTS<br />

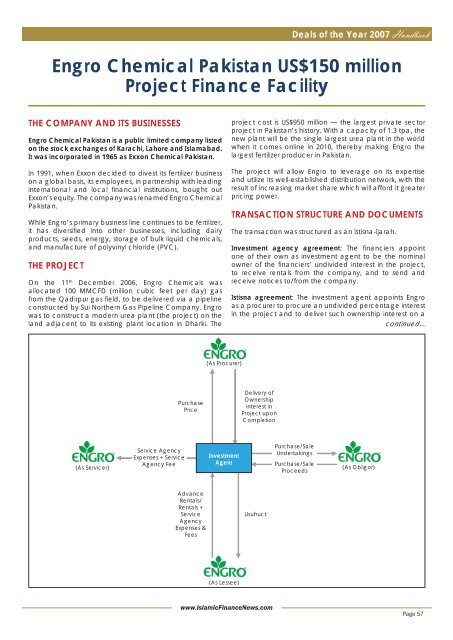

The transaction was structured as an Istisna-Ijarah.<br />

Investment agency agreement: The fi nanciers appoint<br />

one of their own as investment agent to be the nominal<br />

owner of the fi nanciers’ undivided interest in the project,<br />

to receive rentals from the company, and to send and<br />

receive notices to/from the company.<br />

Istisna agreement: The investment agent appoints Engro<br />

as a procurer to procure an undivided percentage interest<br />

in the project and to deliver such ownership interest on a<br />

<strong>continued</strong>...<br />

(As Procurer)<br />

Purchase<br />

Price<br />

Delivery of<br />

Ownership<br />

interest in<br />

Project upon<br />

Completion<br />

(As Servicer)<br />

Service Agency<br />

Expenses + Service<br />

Agency Fee<br />

Investment<br />

Agent<br />

Purchase/Sale<br />

Undertakings<br />

Purchase/Sale<br />

Proceeds<br />

(As Obligor)<br />

Advance<br />

Rentals/<br />

Rentals +<br />

Service<br />

Agency<br />

Expenses &<br />

Fees<br />

Usufruct<br />

(As Lessee)<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

Page 57