Quarterly Bulletin Q3 2013

Quarterly Bulletin Q3 2013

Quarterly Bulletin Q3 2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

The Domestic Economy<br />

<strong>Quarterly</strong> <strong>Bulletin</strong> 03 / July 13<br />

Demand<br />

Consumer spending<br />

Annual National Accounts for 2012 point to a<br />

marginal decline in personal consumption of<br />

0.3 per cent last year, continuing a generally<br />

persistent downward trend in consumer<br />

spending over the last five years. The main<br />

determining factor underlying the weakness of<br />

consumer demand over this period has been<br />

the erosion of disposable incomes primarily<br />

due to declining employment and added to<br />

by an increase in taxes and lower transfer<br />

payments. In addition, the personal savings<br />

rate, following a sharp increase at the onset of<br />

the current crisis, has remained elevated in the<br />

face of continuing economic uncertainty and<br />

the need to reduce debt levels and to adjust to<br />

a significant decline in personal sector wealth.<br />

These headwinds, while becoming gradually<br />

less acute, will continue to restrain consumer<br />

demand over the next year and at this stage a<br />

further decline in consumer spending seems<br />

likely in <strong>2013</strong> with the prospect of only modest<br />

positive growth in 2014.<br />

The pattern of consumer demand during<br />

2012 was one of significant weakness in the<br />

early months of the year, followed by recovery<br />

by mid-year, but with renewed weakness<br />

in the final quarter. This weakness became<br />

more pronounced in the first quarter of this<br />

year, when consumer spending declined<br />

by 3 per cent in seasonally adjusted terms.<br />

While indicators such as retail sales, new car<br />

registrations and indirect tax receipts pointed<br />

to a decline in consumption in the first quarter,<br />

the rate of decline was greater than expected.<br />

While some recovery in consumer spending is<br />

expected for the remainder of this year against<br />

a background of a gradual improvement in<br />

labour market conditions and a marginal pickup<br />

in consumer sentiment, it seems likely<br />

at this stage that the volume of consumer<br />

spending will decline again in <strong>2013</strong>, by 0.5<br />

per cent. As regards 2014, a continuation of<br />

the positive trend in labour market conditions<br />

and a less significant fiscal adjustment point<br />

to some improvement in the prospects for<br />

personal disposable incomes which may<br />

support a modest increase in consumption of<br />

about 0.4 per cent.<br />

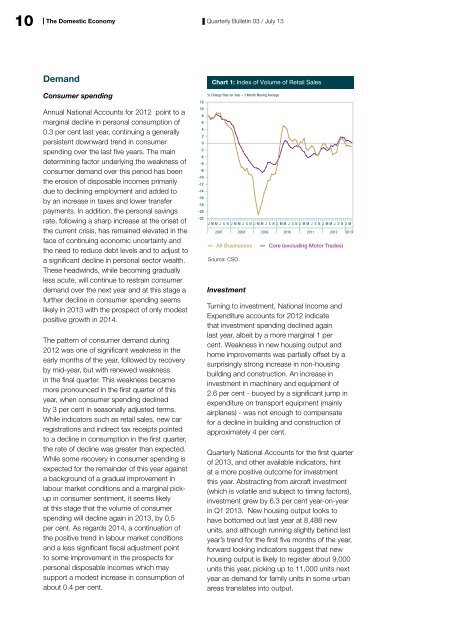

Chart 1: Index of Volume of Retail Sales<br />

% Change Year-on-Year – 3 Month Moving Average<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

-12<br />

-14<br />

-16<br />

-18<br />

-20<br />

-22<br />

JMMJ SNJMMJ SNJMMJ SNJMMJ SNJMMJ SN JMMJ SNJM<br />

2007 2008 2009 2010 2011 2012 <strong>2013</strong><br />

All Businesses<br />

Source: CSO.<br />

Investment<br />

Core (excluding Motor Trades)<br />

Turning to investment, National Income and<br />

Expenditure accounts for 2012 indicate<br />

that investment spending declined again<br />

last year, albeit by a more marginal 1 per<br />

cent. Weakness in new housing output and<br />

home improvements was partially offset by a<br />

surprisingly strong increase in non-housing<br />

building and construction. An increase in<br />

investment in machinery and equipment of<br />

2.6 per cent - buoyed by a significant jump in<br />

expenditure on transport equipment (mainly<br />

airplanes) - was not enough to compensate<br />

for a decline in building and construction of<br />

approximately 4 per cent.<br />

<strong>Quarterly</strong> National Accounts for the first quarter<br />

of <strong>2013</strong>, and other available indicators, hint<br />

at a more positive outcome for investment<br />

this year. Abstracting from aircraft investment<br />

(which is volatile and subject to timing factors),<br />

investment grew by 6.3 per cent year-on-year<br />

in Q1 <strong>2013</strong>. New housing output looks to<br />

have bottomed out last year at 8,488 new<br />

units, and although running slightly behind last<br />

year’s trend for the first five months of the year,<br />

forward looking indicators suggest that new<br />

housing output is likely to register about 9,000<br />

units this year, picking up to 11,000 units next<br />

year as demand for family units in some urban<br />

areas translates into output.