Quarterly Bulletin Q3 2013

Quarterly Bulletin Q3 2013

Quarterly Bulletin Q3 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

42<br />

Financing Developments<br />

<strong>Quarterly</strong> <strong>Bulletin</strong> 03 / July 13<br />

in the Irish Economy<br />

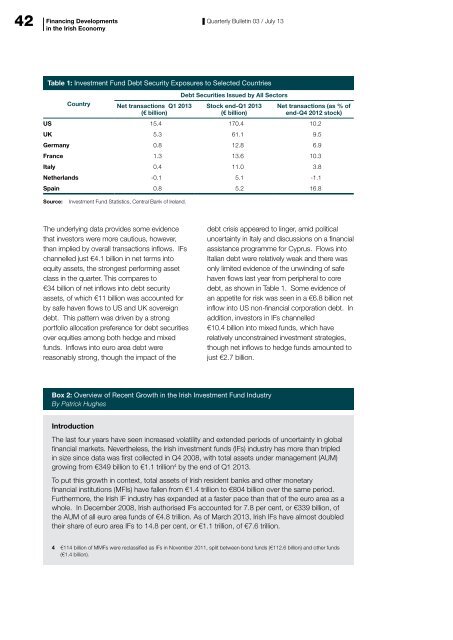

Table 1: Investment Fund Debt Security Exposures to Selected Countries<br />

Country<br />

Net transactions Q1 <strong>2013</strong><br />

(€ billion)<br />

Debt Securities Issued by All Sectors<br />

Stock end-Q1 <strong>2013</strong><br />

(€ billion)<br />

Net transactions (as % of<br />

end-Q4 2012 stock)<br />

US 15.4 170.4 10.2<br />

UK 5.3 61.1 9.5<br />

Germany 0.8 12.8 6.9<br />

France 1.3 13.6 10.3<br />

Italy 0.4 11.0 3.8<br />

Netherlands -0.1 5.1 -1.1<br />

Spain 0.8 5.2 16.8<br />

Source:<br />

Investment Fund Statistics, Central Bank of Ireland.<br />

The underlying data provides some evidence<br />

that investors were more cautious, however,<br />

than implied by overall transactions inflows. IFs<br />

channelled just €4.1 billion in net terms into<br />

equity assets, the strongest performing asset<br />

class in the quarter. This compares to<br />

€34 billion of net inflows into debt security<br />

assets, of which €11 billion was accounted for<br />

by safe haven flows to US and UK sovereign<br />

debt. This pattern was driven by a strong<br />

portfolio allocation preference for debt securities<br />

over equities among both hedge and mixed<br />

funds. Inflows into euro area debt were<br />

reasonably strong, though the impact of the<br />

debt crisis appeared to linger, amid political<br />

uncertainty in Italy and discussions on a financial<br />

assistance programme for Cyprus. Flows into<br />

Italian debt were relatively weak and there was<br />

only limited evidence of the unwinding of safe<br />

haven flows last year from peripheral to core<br />

debt, as shown in Table 1. Some evidence of<br />

an appetite for risk was seen in a €6.8 billion net<br />

inflow into US non-financial corporation debt. In<br />

addition, investors in IFs channelled<br />

€10.4 billion into mixed funds, which have<br />

relatively unconstrained investment strategies,<br />

though net inflows to hedge funds amounted to<br />

just €2.7 billion.<br />

Box 2: Overview of Recent Growth in the Irish Investment Fund Industry<br />

By Patrick Hughes<br />

Introduction<br />

The last four years have seen increased volatility and extended periods of uncertainty in global<br />

financial markets. Nevertheless, the Irish investment funds (IFs) industry has more than tripled<br />

in size since data was first collected in Q4 2008, with total assets under management (AUM)<br />

growing from €349 billion to €1.1 trillion 4 by the end of Q1 <strong>2013</strong>.<br />

To put this growth in context, total assets of Irish resident banks and other monetary<br />

financial institutions (MFIs) have fallen from €1.4 trillion to €804 billion over the same period.<br />

Furthermore, the Irish IF industry has expanded at a faster pace than that of the euro area as a<br />

whole. In December 2008, Irish authorised IFs accounted for 7.8 per cent, or €339 billion, of<br />

the AUM of all euro area funds of €4.8 trillion. As of March <strong>2013</strong>, Irish IFs have almost doubled<br />

their share of euro area IFs to 14.8 per cent, or €1.1 trillion, of €7.6 trillion.<br />

4 €114 billion of MMFs were reclassified as IFs in November 2011, split between bond funds (€112.6 billion) and other funds<br />

(€1.4 billion).