Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

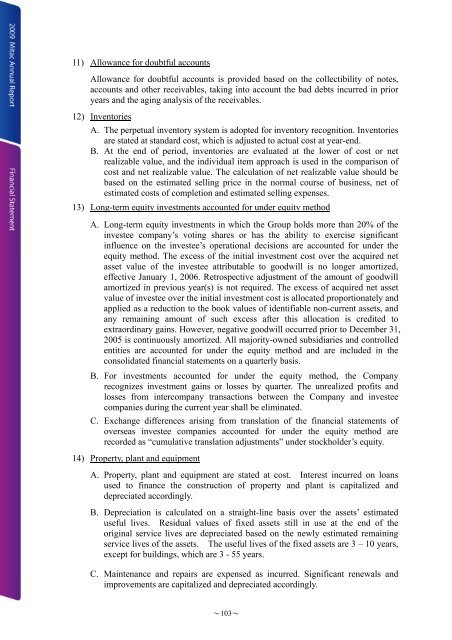

11) Allowance for doubtful accounts<br />

Allowance for doubtful accounts is provided based on the collectibility of notes,<br />

accounts and other receivables, taking into account the bad debts incurred in prior<br />

years and the aging analysis of the receivables.<br />

12) Inventories<br />

A. The perpetual inventory system is adopted for inventory recognition. Inventories<br />

are stated at standard cost, which is adjusted to actual cost at year-end.<br />

B. At the end of period, inventories are evaluated at the lower of cost or net<br />

realizable value, and the individual item approach is used in the comparison of<br />

cost and net realizable value. The calculation of net realizable value should be<br />

based on the estimated selling price in the normal course of business, net of<br />

estimated costs of completion and estimated selling expenses.<br />

13) Long-term equity investments accounted for under equity method<br />

A. Long-term equity investments in which the Group holds more than 20% of the<br />

investee company’s voting shares or has the ability to exercise significant<br />

influence on the investee’s operational decisions are accounted for under the<br />

equity method. The excess of the initial investment cost over the acquired net<br />

asset value of the investee attributable to goodwill is no longer amortized,<br />

effective January 1, 2006. Retrospective adjustment of the amount of goodwill<br />

amortized in previous year(s) is not required. The excess of acquired net asset<br />

value of investee over the initial investment cost is allocated proportionately and<br />

applied as a reduction to the book values of identifiable non-current assets, and<br />

any remaining amount of such excess after this allocation is credited to<br />

extraordinary gains. However, negative goodwill occurred prior to December 31,<br />

2005 is continuously amortized. All majority-owned subsidiaries and controlled<br />

entities are accounted for under the equity method and are included in the<br />

consolidated financial statements on a quarterly basis.<br />

B. For investments accounted for under the equity method, the Company<br />

recognizes investment gains or losses by quarter. The unrealized profits and<br />

losses from intercompany transactions between the Company and investee<br />

companies during the current year shall be eliminated.<br />

C. Exchange differences arising from translation of the financial statements of<br />

overseas investee companies accounted for under the equity method are<br />

recorded as “cumulative translation adjustments” under stockholder’s equity.<br />

14) Property, plant and equipment<br />

A. Property, plant and equipment are stated at cost. Interest incurred on loans<br />

used to finance the construction of property and plant is capitalized and<br />

depreciated accordingly.<br />

B. Depreciation is calculated on a straight-line basis over the assets’ estimated<br />

useful lives. Residual values of fixed assets still in use at the end of the<br />

original service lives are depreciated based on the newly estimated remaining<br />

service lives of the assets. The useful lives of the fixed assets are 3 – 10 years,<br />

except for buildings, which are 3 - 55 years.<br />

C. Maintenance and repairs are expensed as incurred. Significant renewals and<br />

improvements are capitalized and depreciated accordingly.<br />

~103~