Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

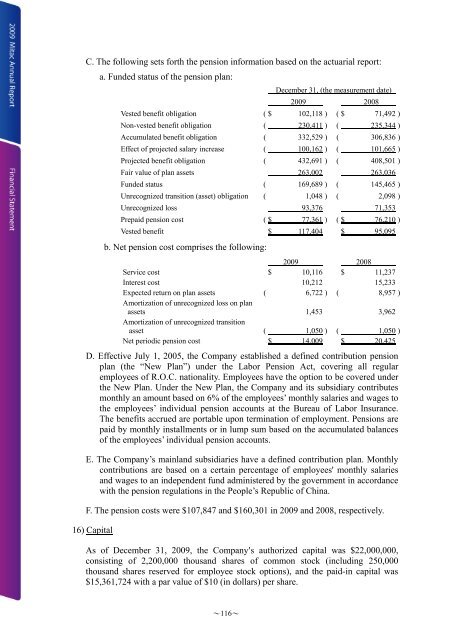

C. The following sets forth the pension information based on the actuarial report:<br />

a. Funded status of the pension plan:<br />

December 31, (the measurement date)<br />

2009 2008<br />

Vested benefit obligation ( $ 102,118 ) ( $ 71,492 )<br />

Non-vested benefit obligation ( 230,411 ) ( 235,344 )<br />

Accumulated benefit obligation ( 332,529 ) ( 306,836 )<br />

Effect of projected salary increase ( 100,162 ) ( 101,665 )<br />

Projected benefit obligation ( 432,691 ) ( 408,501 )<br />

Fair value of plan assets 263,002 263,036<br />

Funded status ( 169,689 ) ( 145,465 )<br />

Unrecognized transition (asset) obligation ( 1,048 ) ( 2,098 )<br />

Unrecognized loss 93,376 71,353<br />

Prepaid pension cost ( $ 77,361 ) ( $ 76,210 )<br />

Vested benefit $ 117,404 $ 95,095<br />

b. Net pension cost comprises the following:<br />

2009 2008<br />

Service cost $ 10,116 $ 11,237<br />

Interest cost 10,212 15,233<br />

Expected return on plan assets ( 6,722 ) ( 8,957 )<br />

Amortization of unrecognized loss on plan<br />

assets 1,453 3,962<br />

Amortization of unrecognized transition<br />

asset ( 1,050 ) ( 1,050 )<br />

Net periodic pension cost $ 14,009 $ 20,425<br />

D. Effective July 1, 2005, the Company established a defined contribution pension<br />

plan (the “New Plan”) under the Labor Pension Act, covering all regular<br />

employees of R.O.C. nationality. Employees have the option to be covered under<br />

the New Plan. Under the New Plan, the Company and its subsidiary contributes<br />

monthly an amount based on 6% of the employees’ monthly salaries and wages to<br />

the employees’ individual pension accounts at the Bureau of Labor Insurance.<br />

The benefits accrued are portable upon termination of employment. Pensions are<br />

paid by monthly installments or in lump sum based on the accumulated balances<br />

of the employees’ individual pension accounts.<br />

E. The Company’s mainland subsidiaries have a defined contribution plan. Monthly<br />

contributions are based on a certain percentage of employees' monthly salaries<br />

and wages to an independent fund administered by the government in accordance<br />

with the pension regulations in the People’s Republic of China.<br />

F. The pension costs were $107,847 and $160,301 in 2009 and 2008, respectively.<br />

16) Capital<br />

As of December 31, 2009, the Companys authorized capital was $22,000,000,<br />

consisting of 2,200,000 thousand shares of common stock (including 250,000<br />

thousand shares reserved for employee stock options), and the paid-in capital was<br />

$15,361,724 with a par value of $10 (in dollars) per share.<br />

~116~