Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

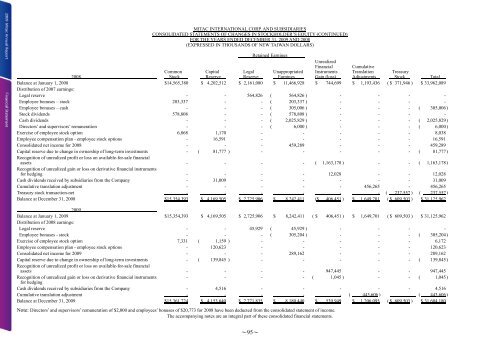

MITAC INTERNATIONAL CORP. AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDER’S EQUITY (CONTINUED)<br />

FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008<br />

(EXPRESSED IN THOUSANDS OF NEW TAIWAN DOLLARS)<br />

Retained Earnings<br />

Unrealized<br />

Financial<br />

Instruments<br />

Gain (loss)<br />

Cumulative<br />

Translation<br />

Adjustments<br />

Common Capital<br />

Legal Unappropriated<br />

Treasury<br />

2008<br />

Stock<br />

Reserve Reserve Earnings<br />

Stock <strong>To</strong>tal<br />

Balance at January 1, 2008 $14,565,380 $ 4,202,512 $ 2,161,080 $ 11,466,928 $ 744,699 $ 1,193,436 ( $ 371,946 ) $ 33,962,089<br />

Distribution of 2007 earnings:<br />

Legal reserve - - 564,826 ( 564,826 ) - - - -<br />

Employee bonuses – stock 203,337 - - ( 203,337 ) - - - -<br />

Employee bonuses – cash - - - ( 305,006 ) - - - ( 305,006 )<br />

Stock dividends 578,808 - - ( 578,808 ) - - - -<br />

Cash dividends - - - ( 2,025,829 ) - - - ( 2,025,829 )<br />

Directors’ and supervisors’ remuneration - - - ( 6,000 ) - - - ( 6,000 )<br />

Exercise of employee stock option 6,868 1,170 - - - - - 8,038<br />

Employee compensation plan - employee stock options - 16,591 - - - - - 16,591<br />

Consolidated net income for 2008 - - - 459,289 - - - 459,289<br />

Capital reserve due to change in ownership of long-term investments - ( 81,777 ) - - - - - ( 81,777 )<br />

Recognition of unrealized profit or loss on available-for-sale financial<br />

assets - - - - ( 1,163,178 ) - - ( 1,163,178 )<br />

Recognition of unrealized gain or loss on derivative financial instruments<br />

for hedging - - - - 12,028 - - 12,028<br />

Cash dividends received by subsidiaries from the Company - 31,009 - - - - - 31,009<br />

Cumulative translation adjustment - - - - - 456,265 - 456,265<br />

Treasury stock transaction-net - - - - - - ( 237,557 ) ( 237,557 )<br />

Balance at December 31, 2008 $15,354,393 $ 4,169,505 $ 2,725,906 $ 8,242,411 ($ 406,451 ) $ 1,649,701 ( $ 609,503 ) $ 31,125,962<br />

2009<br />

Balance at January 1, 2009 $15,354,393 $ 4,169,505 $ 2,725,906 $ 8,242,411 ( $ 406,451 ) $ 1,649,701 ( $ 609,503 ) $ 31,125,962<br />

Distribution of 2008 earnings:<br />

Legal reserve - - 45,929 ( 45,929 ) - - - -<br />

Employee bonuses - stock - - - ( 305,204 ) - - - ( 305,204 )<br />

Exercise of employee stock option 7,331 ( 1,159 ) - - - - - 6,172<br />

Employee compensation plan - employee stock options - 120,623 - - - - - 120,623<br />

Consolidated net income for 2009 - - - 289,162 - - - 289,162<br />

Capital reserve due to change in ownership of long-term investments - ( 139,845 ) - - - - - ( 139,845 )<br />

Recognition of unrealized profit or loss on available-for-sale financial<br />

assets - - - - 947,445 - - 947,445<br />

Recognition of unrealized gain or loss on derivative financial instruments<br />

- - - - ( 1,045 ) - - ( 1,045 )<br />

for hedging<br />

Cash dividends received by subsidiaries from the Company - 4,516 - - - - - 4,516<br />

Cumulative translation adjustment - - - - - ( 443,606 ) ( 443,606 )<br />

Balance at December 31, 2009 $15,361,724 $ 4,153,640 $ 2,771,835 $ 8,180,440 $ 539,949 $ 1,206,095 ( $ 609,503 ) $ 31,604,180<br />

Note: Directors’ and supervisors’ remuneration of $2,000 and employees’ bonuses of $20,773 for 2008 have been deducted from the consolidated statement of income.<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

~95~