Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ank transfer.<br />

11. Converting price and price adjustment<br />

(1) Converting price<br />

The price of the convertible bond is based on the cutoff date of July 28, 2005.The<br />

converting price (rounded up to the first decimal of New Taiwan Dollar) of the<br />

Company’s convertible bond is based on the average closing price of the Company’s<br />

common stock on the prior business day, prior three business days, or on the prior five<br />

business days by 112% converting premium rate. For any Ex-right and Ex-dividend<br />

enforced before the cutoff date, the sampled closing price for calculating the converting<br />

price must be translated to the Ex-right or Ex-dividend price. If there is any Ex-right or<br />

Ex-dividend enforced after determining the converting price and before the issuance<br />

date, the converting price is to be adjusted accordingly. The bond converting price is<br />

NT$48 per share.<br />

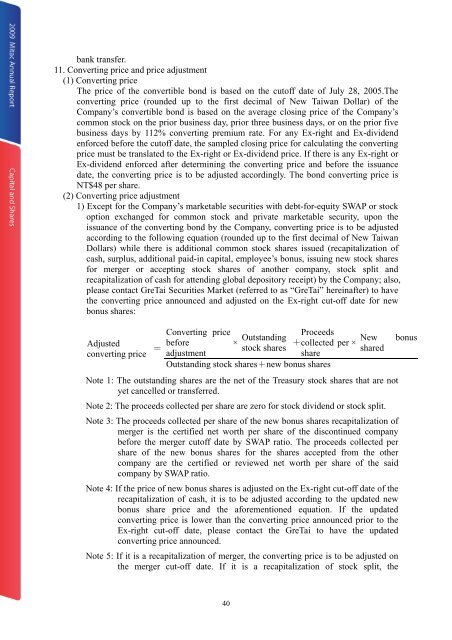

(2) Converting price adjustment<br />

1) Except for the Company’s marketable securities with debt-for-equity SWAP or stock<br />

option exchanged for common stock and private marketable security, upon the<br />

issuance of the converting bond by the Company, converting price is to be adjusted<br />

according to the following equation (rounded up to the first decimal of New Taiwan<br />

Dollars) while there is additional common stock shares issued (recapitalization of<br />

cash, surplus, additional paid-in capital, employee’s bonus, issuing new stock shares<br />

for merger or accepting stock shares of another company, stock split and<br />

recapitalization of cash for attending global depository receipt) by the Company; also,<br />

please contact GreTai Securities Market (referred to as “GreTai” hereinafter) to have<br />

the converting price announced and adjusted on the Ex-right cut-off date for new<br />

bonus shares:<br />

Converting price<br />

before × Outstanding Proceeds<br />

Adjusted<br />

stock shares + collected per<br />

converting price = adjustment<br />

share<br />

Outstanding stock shares+new bonus shares<br />

×<br />

New bonus<br />

shared<br />

Note 1: The outstanding shares are the net of the Treasury stock shares that are not<br />

yet cancelled or transferred.<br />

Note 2: The proceeds collected per share are zero for stock dividend or stock split.<br />

Note 3: The proceeds collected per share of the new bonus shares recapitalization of<br />

merger is the certified net worth per share of the discontinued company<br />

before the merger cutoff date by SWAP ratio. The proceeds collected per<br />

share of the new bonus shares for the shares accepted from the other<br />

company are the certified or reviewed net worth per share of the said<br />

company by SWAP ratio.<br />

Note 4: If the price of new bonus shares is adjusted on the Ex-right cut-off date of the<br />

recapitalization of cash, it is to be adjusted according to the updated new<br />

bonus share price and the aforementioned equation. If the updated<br />

converting price is lower than the converting price announced prior to the<br />

Ex-right cut-off date, please contact the GreTai to have the updated<br />

converting price announced.<br />

Note 5: If it is a recapitalization of merger, the converting price is to be adjusted on<br />

the merger cut-off date. If it is a recapitalization of stock split, the<br />

40