Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

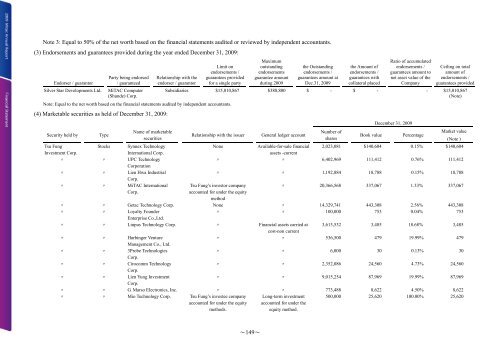

Note 3: Equal to 50% of the net worth based on the financial statements audited or reviewed by independent accountants.<br />

(3) Endorsements and guarantees provided during the year ended December 31, 2009:<br />

Endorser / guarantor<br />

Party being endorsed<br />

/ guaranteed<br />

Silver Star Developments Ltd. MiTAC Computer<br />

(Shunde) Corp.<br />

Relationship with the<br />

endorser / guarantor<br />

Limit on<br />

endorsements /<br />

guarantees provided<br />

for a single party<br />

Note: Equal to the net worth based on the financial statements audited by independent accountants.<br />

(4) Marketable securities as held of December 31, 2009:<br />

Security held by Type<br />

Name of marketable<br />

securities<br />

Tsu Fung<br />

Stocks Synnex Technology<br />

Investment Corp.<br />

International Corp.<br />

〃 〃 UPC Technology<br />

Corporation<br />

〃 〃 Lien Hwa Industrial<br />

Corp.<br />

〃 〃 MiTAC International<br />

Corp.<br />

Maximum<br />

outstanding<br />

endorsements<br />

guarantee amount<br />

during 2009<br />

the Outstanding<br />

endorsements /<br />

guarantees amount at<br />

Dec.31, 2009<br />

the Amount of<br />

endorsements /<br />

guarantees with<br />

collateral placed<br />

Ratio of accumulated<br />

endorsements /<br />

guarantees amount to<br />

net asset value of the<br />

Company<br />

Ceiling on total<br />

amount of<br />

endorsements /<br />

guarantees provided<br />

Subsidiaries $15,010,867 $388,800 $ - $ - - $15,010,867<br />

(Note)<br />

December 31, 2009<br />

Relationship with the issuer General ledger account<br />

Number of<br />

Market value<br />

Book value Percentage<br />

shares<br />

(Note )<br />

None<br />

Available-for-sale financial 2,023,081 $140,604 0.15% $140,604<br />

assets -current<br />

〃 〃 6,402,969 111,412 0.76% 111,412<br />

〃 〃 1,192,884 18,788 0.15% 18,788<br />

Tsu Fung’s investor company<br />

accounted for under the equity<br />

method<br />

〃 20,366,568 337,067 1.33% 337,067<br />

〃 〃 Getac Technology Corp. None 〃 14,329,741 443,308 2.56% 443,308<br />

〃 〃 Loyalty Founder<br />

〃 〃 100,000 753 0.04% 753<br />

Enterprise Co.,Ltd.<br />

〃 〃 Linpus Technology Corp. 〃 Financial assets carried at 3,613,532 3,485 18.68% 3,485<br />

cost-non current<br />

〃 〃 Harbinger Venture<br />

〃 〃 536,500 479 19.99% 479<br />

Management Co., Ltd.<br />

〃 〃 3Probe Technologies<br />

〃 〃 6,000 30 0.13% 30<br />

Corp.<br />

〃 〃 Cirocomm Technology<br />

〃 〃 2,352,086 24,560 4.73% 24,560<br />

Corp.<br />

〃 〃 Lien Yung Investment<br />

〃 〃 9,015,254 87,969 19.99% 87,969<br />

Corp.<br />

〃 〃 G. Marso Electronics, Inc. 〃 〃 773,488 8,622 4.50% 8,622<br />

〃 〃 Mio Technology Corp. Tsu Fung’s investee company<br />

accounted for under the equity<br />

methods.<br />

Long-term investment<br />

accounted for under the<br />

equity method.<br />

500,000 25,620 100.00% 25,620<br />

~149~