Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

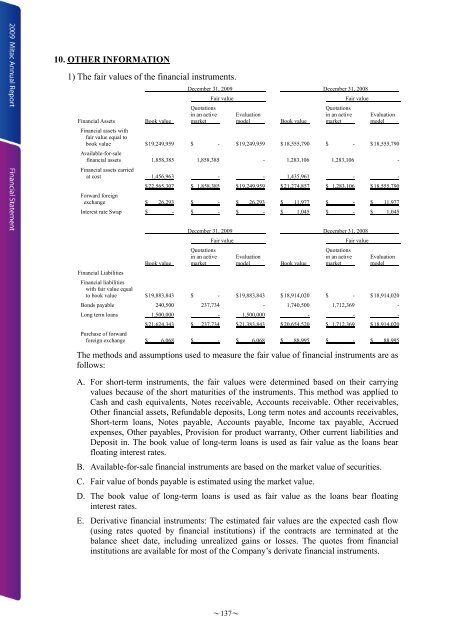

10. OTHER INFORMATION<br />

1) The fair values of the financial instruments.<br />

Financial Assets<br />

Book value<br />

December 31, 2009 December 31, 2008<br />

Quotations<br />

in an active<br />

market<br />

Fair value<br />

Evaluation<br />

model<br />

Book value<br />

Quotations<br />

in an active<br />

market<br />

Fair value<br />

Evaluation<br />

model<br />

Financial assets with<br />

fair value equal to<br />

book value $ 19,249,959 $ - $ 19,249,959 $ 18,555,790 $ - $ 18,555,790<br />

Available-for-sale<br />

financial assets 1,858,385 1,858,385 - 1,283,106 1,283,106 -<br />

Financial assets carried<br />

at cost 1,456,963 - - 1,435,961 - -<br />

$ 22,565,307 $ 1,858,385 $ 19,249,959 $ 21,274,857 $ 1,283,106 $ 18,555,790<br />

Forward foreign<br />

exchange $ 26,293 $ - $ 26,293 $ 11,977 $ - $ 11,977<br />

Interest rate Swap $ - $ - $ - $ 1,045 $ - $ 1,045<br />

December 31, 2009 December 31, 2008<br />

Fair value<br />

Fair value<br />

Quotations<br />

in an active<br />

market<br />

Evaluation<br />

model<br />

Quotations<br />

in an active<br />

market<br />

Evaluation<br />

model<br />

Book value<br />

Book value<br />

Financial Liabilities<br />

Financial liabilities<br />

with fair value equal<br />

to book value $ 19,883,843 $ - $ 19,883,843 $ 18,914,020 $ - $ 18,914,020<br />

Bonds payable 240,500 237,734 - 1,740,500 1,712,369 -<br />

Long term loans 1,500,000 - 1,500,000 - - -<br />

$ 21,624,343 $ 237,734 $ 21,383,843 $ 20,654,520 $ 1,712,369 $ 18,914,020<br />

Purchase of forward<br />

foreign exchange $ 6,068 $ - $ 6,068 $ 88,995 $ - $ 88,995<br />

The methods and assumptions used to measure the fair value of financial instruments are as<br />

follows:<br />

A. For short-term instruments, the fair values were determined based on their carrying<br />

values because of the short maturities of the instruments. This method was applied to<br />

Cash and cash equivalents, Notes receivable, Accounts receivable. Other receivables,<br />

Other financial assets, Refundable deposits, Long term notes and accounts receivables,<br />

Short-term loans, Notes payable, Accounts payable, Income tax payable, Accrued<br />

expenses, Other payables, Provision for product warranty, Other current liabilities and<br />

Deposit in. The book value of long-term loans is used as fair value as the loans bear<br />

floating interest rates.<br />

B. Available-for-sale financial instruments are based on the market value of securities.<br />

C. Fair value of bonds payable is estimated using the market value.<br />

D. The book value of long-term loans is used as fair value as the loans bear floating<br />

interest rates.<br />

E. Derivative financial instruments: The estimated fair values are the expected cash flow<br />

(using rates quoted by financial institutions) if the contracts are terminated at the<br />

balance sheet date, including unrealized gains or losses. The quotes from financial<br />

institutions are available for most of the Company’s derivate financial instruments.<br />

~137~