Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(d) Derivative financial instruments: The forward for trading was entered for hedging<br />

the foreign exchange risk. It results cash in and cash out, respectively, at maturity.<br />

Because the Group will receive and pay the cash on settlement dates and the<br />

future working capital is sufficient, therefore, the liquidity risk and cash flow risk<br />

is low.<br />

(e) Long-term liabilities of financial instruments: The Group has sufficient working<br />

capital to meet various funding needs and major capital expenditures. Thus, the<br />

Group expects to have no significant liquidity risk.<br />

D. Cash flow risk<br />

(a) The Group issues parts of secured bonds payable with fixed interest rate and parts<br />

of secured bonds payable with floating interest rate. The Group undertakes<br />

interest rate swaps to hedge cash flow risk arising from fluctuations in interest<br />

rates.<br />

The Group issues unsecured bonds payable with zero interest and there is no cash<br />

flow risk arising from fluctuations in interest rates.<br />

(b) Derivative financial instruments: These financial instruments are non-interest<br />

bearing financial instruments. Thus, there is no cash flow risk.<br />

(c) Short-term financial instruments: Maturities of these financial instruments are<br />

within one year, there is no material cash flow risk.<br />

(d) Long-term liabilities of financial instruments: The Group borrows loans, with<br />

floating interest rate. The effective interest rate of loans would be changed due to<br />

changes in market interest rates, which would cause the fluctuations in future<br />

cash flows. The Group also has established a risk management program and<br />

carries out procedures to monitor cash flow risk arising from fluctuations in<br />

interest rates. Thus, the Group expects to have no significant cash flow risk.<br />

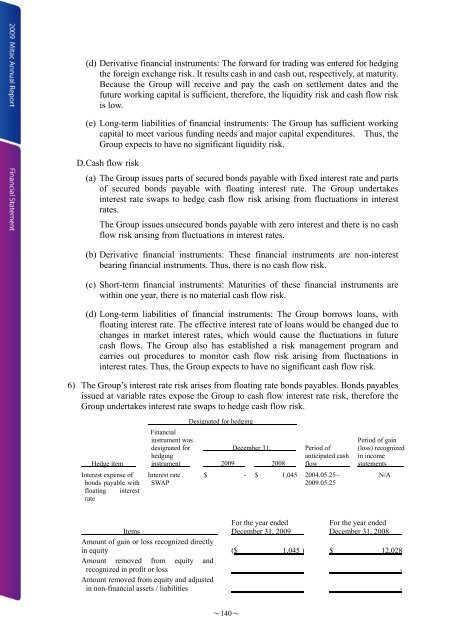

6) The Group’s interest rate risk arises from floating rate bonds payables. Bonds payables<br />

issued at variable rates expose the Group to cash flow interest rate risk, therefore the<br />

Group undertakes interest rate swaps to hedge cash flow risk.<br />

Hedge item<br />

Interest expense of<br />

bonds payable with<br />

floating interest<br />

rate<br />

Designated for hedging<br />

Financial<br />

instrument was<br />

designated for<br />

December 31,<br />

hedging<br />

instrument 2009 2008<br />

Interest rate<br />

SWAP<br />

Period of<br />

anticipated cash<br />

flow<br />

$ - $ 1,045 2004.05.25~<br />

2009.05.25<br />

Period of gain<br />

(loss) recognized<br />

in income<br />

statements<br />

N/A<br />

For the year ended<br />

December 31, 2009<br />

For the year ended<br />

December 31, 2008<br />

Items<br />

Amount of gain or loss recognized directly<br />

in equity ($ 1,045 ) $ 12,028<br />

Amount removed from equity and<br />

recognized in profit or loss -<br />

Amount removed from equity and adjusted<br />

in non-financial assets / liabilities -<br />

~140~