- Page 1 and 2:

Orange County Mayor Teresa Jacobs B

- Page 3 and 4:

Despite a sluggish economy, shows s

- Page 5:

ORANGE COUNTY, FLORIDA BOARD OF COU

- Page 8 and 9:

OFFICE OF MANAGEMENT AND BUDGET Ran

- Page 11: TABLE OF CONTENTS BUDGET IN BRIEF .

- Page 15 and 16: TABLE OF CONTENTS BUDGET IN BRIEF H

- Page 17 and 18: How to Use This Book Budget in Brie

- Page 19 and 20: HOW TO USE THIS BOOK Capital Improv

- Page 21 and 22: Orange County Organizational Chart

- Page 23 and 24: Electorate Constitutional Officers

- Page 25 and 26: General This section includes: Info

- Page 27 and 28: In November 2008, the following ame

- Page 29 and 30: 2. Investment Trust Funds account f

- Page 31 and 32: FY 2012-13 BUDGET ASSUMPTIONS The F

- Page 33 and 34: Charts and This section includes:

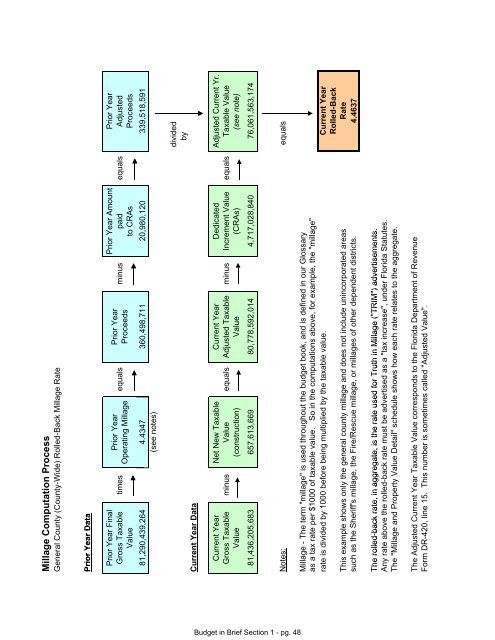

- Page 35 and 36: Millage and Property Value Detail M

- Page 37 and 38: ___________________________________

- Page 39 and 40: ___________________________________

- Page 41 and 42: Three-Year Comparison of Budgeted F

- Page 43 and 44: BUDGET SUMMARY ORANGE COUNTY BOARD

- Page 45 and 46: How the County Allocates Money Oran

- Page 47 and 48: Budget in Brief Section 1 - pg. 33

- Page 49 and 50: Uses of Funds Countywide FY 2011-12

- Page 51 and 52: General Fund Comparison FY 2010-11

- Page 53 and 54: Budget in Brief Section 1 - pg. 39

- Page 55 and 56: Uses of Funds General Fund (and Sub

- Page 57 and 58: INTERFUND TRANSFERS OUT FY 12-13 FY

- Page 59 and 60: Estimated Fund Balances FY 2010-11

- Page 61: Budget in Brief Section 1 - pg. 47

- Page 65 and 66: CHANGES IN AUTHORIZED POSITIONS Dep

- Page 67 and 68: CHANGES IN AUTHORIZED POSITIONS Dep

- Page 69 and 70: Total Positions by Function FY 2011

- Page 71 and 72: Guide to Other Useful References Bu

- Page 73 and 74: Orange County Code - A detailed lis

- Page 75 and 76: Glossary of Budget Terms Budget in

- Page 77 and 78: Budget Adjustment - A revision to t

- Page 79 and 80: Fund - A fiscal and accounting enti

- Page 81 and 82: Real Property - Land and the buildi

- Page 83 and 84: TABLE OF CONTENTS REVENUES AND EXPE

- Page 85 and 86: REVENUE CATEGORIES Revenues in this

- Page 87 and 88: EXPENDITURE CATEGORIES Personal Ser

- Page 89 and 90: Summary of Revenues and Expenditure

- Page 91 and 92: Summary of Revenues and Expenditure

- Page 93 and 94: Summary of Revenues and Expenditure

- Page 95 and 96: Summary of Revenues and Expenditure

- Page 97 and 98: Summary of Revenues and Expenditure

- Page 99 and 100: Summary of Revenues and Expenditure

- Page 101 and 102: Summary of Revenues and Expenditure

- Page 103 and 104: Summary of Revenues and Expenditure

- Page 105 and 106: Summary of Revenues and Expenditure

- Page 107 and 108: Summary of Revenues and Expenditure

- Page 109 and 110: Summary of Revenues and Expenditure

- Page 111 and 112: Summary of Revenues and Expenditure

- Page 113 and 114:

Summary of Revenues and Expenditure

- Page 115 and 116:

Summary of Revenues and Expenditure

- Page 117 and 118:

Summary of Revenues and Expenditure

- Page 119 and 120:

Summary of Revenues and Expenditure

- Page 121 and 122:

Summary of Revenues and Expenditure

- Page 123 and 124:

Summary of Revenues and Expenditure

- Page 125 and 126:

Summary of Revenues and Expenditure

- Page 127 and 128:

Summary of Revenues and Expenditure

- Page 129 and 130:

Summary of Revenues and Expenditure

- Page 131 and 132:

Summary of Revenues and Expenditure

- Page 133 and 134:

Summary of Revenues and Expenditure

- Page 135 and 136:

Summary of Revenues and Expenditure

- Page 137 and 138:

Summary of Revenues and Expenditure

- Page 139 and 140:

Summary of Revenues and Expenditure

- Page 141 and 142:

Summary of Revenues and Expenditure

- Page 143 and 144:

Summary of Revenues and Expenditure

- Page 145 and 146:

Summary of Revenues and Expenditure

- Page 147 and 148:

Summary of Revenues and Expenditure

- Page 149 and 150:

Summary of Revenues and Expenditure

- Page 151 and 152:

Summary of Revenues and Expenditure

- Page 153 and 154:

Summary of Revenues and Expenditure

- Page 155 and 156:

Summary of Revenues and Expenditure

- Page 157 and 158:

Summary of Revenues and Expenditure

- Page 159 and 160:

Summary of Revenues and Expenditure

- Page 161 and 162:

Summary of Revenues and Expenditure

- Page 163 and 164:

Summary of Revenues and Expenditure

- Page 165 and 166:

Summary of Revenues and Expenditure

- Page 167 and 168:

TABLE OF CONTENTS CONSTITUTIONAL OF

- Page 169 and 170:

CITIZENS Board of County Commission

- Page 171 and 172:

Constitutional Officers EXPENDITURE

- Page 173 and 174:

FUNDING SOURCE HIGHLIGHTS The major

- Page 175 and 176:

Office: County Mayor Expenditures b

- Page 177 and 178:

Office: Sheriff Expenditures by Cat

- Page 179 and 180:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 181 and 182:

TABLE OF CONTENTS ADMINISTRATIVE SE

- Page 183 and 184:

ADMINISTRATIVE SERVICES Facilities

- Page 185 and 186:

Administrative Services EXPENDITURE

- Page 187 and 188:

Division: Facilities Management Exp

- Page 189 and 190:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 191 and 192:

TABLE OF CONTENTS COMMUNITY, ENVIRO

- Page 193 and 194:

COMMUNITY, ENVIRONMENTAL AND DEVELO

- Page 195 and 196:

Community, Environmental and Develo

- Page 197 and 198:

Division: Building Safety Expenditu

- Page 199 and 200:

Division: Fiscal & Operational Supp

- Page 201 and 202:

Division: Transportation Planning E

- Page 203 and 204:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 205 and 206:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 207 and 208:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 209 and 210:

TABLE OF CONTENTS CONVENTION CENTER

- Page 211 and 212:

CONVENTION CENTER Executive Office

- Page 213 and 214:

Convention Center EXPENDITURE HIGHL

- Page 215 and 216:

Division: Convention Center Capital

- Page 217 and 218:

Division: Convention Center Non-Ope

- Page 219 and 220:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 221 and 222:

TABLE OF CONTENTS CORRECTIONS DEPAR

- Page 223 and 224:

CORRECTIONS Administration Command

- Page 225 and 226:

Corrections EXPENDITURE HIGHLIGHTS

- Page 227 and 228:

Division: Community Corrections Exp

- Page 229 and 230:

Division: Fiscal & Operational Supp

- Page 231 and 232:

TABLE OF CONTENTS FAMILY SERVICES D

- Page 233 and 234:

FAMILY SERVICES Department Office A

- Page 235 and 236:

Family Services EXPENDITURE HIGHLIG

- Page 237 and 238:

Human Services Associates, Inc.: Ad

- Page 239 and 240:

Division: Citizens' Commission for

- Page 241 and 242:

Division: Family Svc Dept Office Ex

- Page 243 and 244:

Division: Regional History Center E

- Page 245 and 246:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 247 and 248:

TABLE OF CONTENTS FIRE RESCUE DEPAR

- Page 249 and 250:

FIRE RESCUE DEPARTM ENT Department

- Page 251 and 252:

Fire Rescue EXPENDITURE HIGHLIGHTS

- Page 253 and 254:

Division: Fire Communication Expend

- Page 255 and 256:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 257 and 258:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 259 and 260:

TABLE OF CONTENTS HEALTH SERVICES D

- Page 261 and 262:

Health Services Section 10 - pg. 3

- Page 263 and 264:

Health Services EXPENDITURE HIGHLIG

- Page 265 and 266:

Division: Medical Clinic Expenditur

- Page 267 and 268:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 269 and 270:

TABLE OF CONTENTS OFFICE OF ACCOUNT

- Page 271 and 272:

COUNTY MAYOR BOARD OF COUNTY COMMIS

- Page 273 and 274:

Office of Accountability EXPENDITUR

- Page 275 and 276:

Division: 911 Fees Expenditures by

- Page 277 and 278:

Division: Management and Budget Exp

- Page 279 and 280:

Division: Risk Management Program E

- Page 281 and 282:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 283 and 284:

TABLE OF CONTENTS PUBLIC WORKS DEPA

- Page 285 and 286:

PUBLIC WORKS Public Works Engineeri

- Page 287 and 288:

Public Works EXPENDITURE HIGHLIGHTS

- Page 289 and 290:

Division: Highway Construction Expe

- Page 291 and 292:

Division: Roads & Drainage (MSBU) E

- Page 293 and 294:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 295 and 296:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 297 and 298:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 299 and 300:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 301 and 302:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 303 and 304:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 305 and 306:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 307 and 308:

TABLE OF CONTENTS UTILITIES DEPARTM

- Page 309 and 310:

UTILITIES DEPARTMENT Customer Servi

- Page 311 and 312:

Utilities EXPENDITURE HIGHLIGHTS Pe

- Page 313 and 314:

Division: Fiscal & Operational Supp

- Page 315 and 316:

Division: Utilities Field Services

- Page 317 and 318:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 319 and 320:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 321 and 322:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 323 and 324:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 325 and 326:

TABLE OF CONTENTS OTHER OFFICES ORG

- Page 327 and 328:

COUNTY MAYOR BOARD OF COUNTY COMMIS

- Page 329 and 330:

Other Offices EXPENDITURE HIGHLIGHT

- Page 331 and 332:

Division: Agenda Development Expend

- Page 333 and 334:

Division: Economic Trade & Tourism

- Page 335 and 336:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 337 and 338:

TABLE OF CONTENTS OTHER APPROPRIATI

- Page 339 and 340:

Other Appropriations EXPENDITURE HI

- Page 341 and 342:

Non-Departmental FY 2010-11 FY 2011

- Page 343 and 344:

Division: East Central Florida Regi

- Page 345 and 346:

Other Appropriations Section 15 - p

- Page 347 and 348:

Other Court Funds EXPENDITURE HIGHL

- Page 349 and 350:

Division: Court Facilities Expendit

- Page 351 and 352:

Division: Local Court Programs Expe

- Page 353 and 354:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 355 and 356:

TABLE OF CONTENTS CAPITAL IMPROVEME

- Page 357 and 358:

CAPITAL IMPROVEMENTS PROGRAM BUDGET

- Page 359 and 360:

CAPITAL IMPROVEMENTS PROGRAM Capita

- Page 361 and 362:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 363 and 364:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 365 and 366:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 367 and 368:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 369 and 370:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 371 and 372:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 373 and 374:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 375 and 376:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 377 and 378:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 379 and 380:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 381 and 382:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 383 and 384:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 385 and 386:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 387 and 388:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 389 and 390:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 391 and 392:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 393 and 394:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 395 and 396:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 397 and 398:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 399 and 400:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 401 and 402:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 403 and 404:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 405 and 406:

PROPOSED CIP - BY DEPARTMENT / DIVI

- Page 407 and 408:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 409 and 410:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 411 and 412:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 413 and 414:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 415 and 416:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 417 and 418:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 419 and 420:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 421 and 422:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 423 and 424:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 425 and 426:

PROPOSED CIP - BY FUND FY 2012/13 -

- Page 427 and 428:

INDEX 911 Fees ....................

- Page 429 and 430:

G - H General Fund Budget Compariso

- Page 431:

Utilities Organizational Chart ....