THE ANNUAL REVIEW 2010 - PEI Media

THE ANNUAL REVIEW 2010 - PEI Media

THE ANNUAL REVIEW 2010 - PEI Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

page 80 private equity annual review <strong>2010</strong><br />

d i s t r i b u t i o n s<br />

Cash back<br />

Money started to flow back to LPs in <strong>2010</strong> … assuming<br />

they had a mature portfolio of fund interests, reports<br />

Christopher Witkowsky<br />

Limited partners were given some breathing<br />

space last year by their private equity<br />

managers, who began to return capital at<br />

levels not seen since before the financial<br />

crash in 2008.<br />

In the first half of the year, the amount of<br />

cash coming in to LPs through distributions<br />

almost caught up with the amount going<br />

out in the form of capital calls, according<br />

to numbers from Cambridge Associates, an<br />

advisor to private equity limited partners.<br />

Cambridge reported in November that<br />

during the first half of <strong>2010</strong>, capital calls<br />

outpaced distributions by only 1.4 times.<br />

Money was still being called faster than<br />

it was being distributed, but the gap had<br />

narrowed to the smallest margin in two<br />

years.<br />

In 2009, calls for capital by GPs had<br />

outpaced distributions by 1.9 times. In the<br />

previous year, LPs had had the toughest time<br />

in terms of private equity cash management,<br />

with capital calls out-pacing distributions<br />

by about 2.5 times, the widest margin in<br />

the time period Cambridge studied, which<br />

stretched back to 1996. Cambridge’s<br />

information comes from a universe of about<br />

850 funds.<br />

Wilshire Associates, another advisory<br />

firm, noted similar flows. It observed a<br />

60/40 split between dollars going out and<br />

dollars coming in, based on data from about<br />

450 funds.<br />

Private equity portfolios which were<br />

adequately diversified across vintage years,<br />

therefore, began to have an easier time in<br />

terms of cash flow; for these portfolios,<br />

the distribution vs. capital call cycle had<br />

“normalized”. For less mature programmes,<br />

however, the cycle remained imbalanced.<br />

The $31.8 billion Maryland Retirement<br />

System, for example, in November<br />

announced that it had pulled back from<br />

private equity commitments in recent<br />

months because the “normal cycle of<br />

calldowns and distributions [had] been<br />

broken since late 2008”.<br />

Maryland was likely feeling ongoing<br />

pressure because the pension made a big<br />

push into the asset class starting in 2008,<br />

when it ramped up its allocation to private<br />

equity from 5 to 15 percent. Maryland made<br />

more than $1 billion of commitments to<br />

private equity since it raised its allocation.<br />

Unfortunately for Maryland, and the many<br />

other institutional investors which upped<br />

the private equity exposure between 2005<br />

and 2008, funds raised during this period<br />

are well into the process of calling down<br />

capital, but are not necessarily returning<br />

capital to LPs.<br />

Triago, a placement agent and secondaries<br />

advisor, found that within the universe of<br />

about 200 funds it tracks, capital calls during<br />

<strong>2010</strong> outpaced distributions by a significant<br />

amount. According to the firm, capital calls<br />

accounted for 11.5 percent of committed<br />

capital, while distributions were just 6.3<br />

percent. The disparity between Triago’s<br />

and the other two advisers’ numbers is<br />

likely down to the fact that the universe for<br />

Triago’s study consists of funds it sees in the<br />

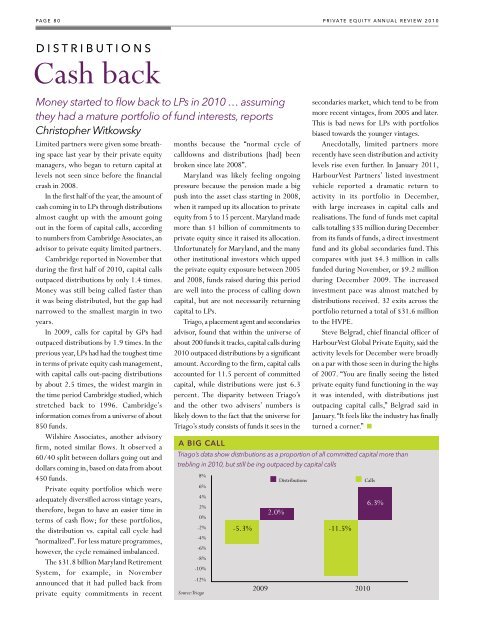

a big call<br />

Source: Triago<br />

secondaries market, which tend to be from<br />

more recent vintages, from 2005 and later.<br />

This is bad news for LPs with portfolios<br />

biased towards the younger vintages.<br />

Anecdotally, limited partners more<br />

recently have seen distribution and activity<br />

levels rise even further. In January 2011,<br />

HarbourVest Partners’ listed investment<br />

vehicle reported a dramatic return to<br />

activity in its portfolio in December,<br />

with large increases in capital calls and<br />

realisations. The fund of funds met capital<br />

calls totalling $35 million during December<br />

from its funds of funds, a direct investment<br />

fund and its global secondaries fund. This<br />

compares with just $4.3 million in calls<br />

funded during November, or $9.2 million<br />

during December 2009. The increased<br />

investment pace was almost matched by<br />

distributions received. 32 exits across the<br />

portfolio returned a total of $31.6 million<br />

to the HVPE.<br />

Steve Belgrad, chief financial officer of<br />

HarbourVest Global Private Equity, said the<br />

activity levels for December were broadly<br />

on a par with those seen in during the highs<br />

of 2007. “You are finally seeing the listed<br />

private equity fund functioning in the way<br />

it was intended, with distributions just<br />

outpacing capital calls,” Belgrad said in<br />

January. “It feels like the industry has finally<br />

turned a corner.” n<br />

Triago’s data show distributions as a proportion of all committed capital more than<br />

trebling in <strong>2010</strong>, but still be ing outpaced by capital calls<br />

8%<br />

n Distributions<br />

n Calls<br />

6%<br />

4%<br />

6.3%<br />

2%<br />

2.0%<br />

0%<br />

-2% -5.3%<br />

-11.5%<br />

-4%<br />

-6%<br />

-8%<br />

-10%<br />

-12%<br />

2009 <strong>2010</strong>