Arrow Prospectus - PGS

Arrow Prospectus - PGS

Arrow Prospectus - PGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

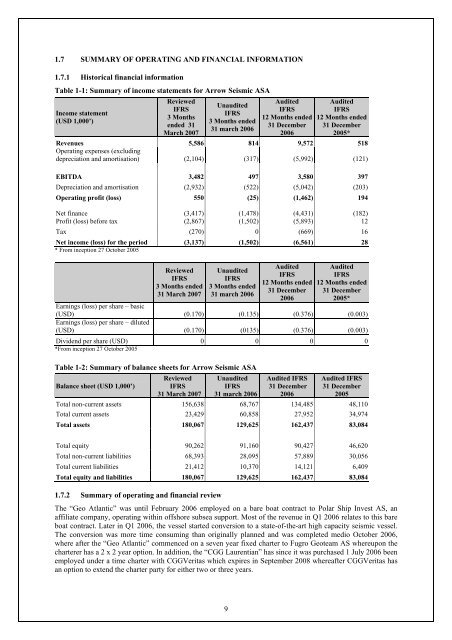

1.7 SUMMARY OF OPERATING AND FINANCIAL INFORMATION<br />

1.7.1 Historical financial information<br />

Table 1-1: Summary of income statements for <strong>Arrow</strong> Seismic ASA<br />

Income statement<br />

(USD 1,000’)<br />

Reviewed<br />

IFRS<br />

3 Months<br />

ended 31<br />

March 2007<br />

Unaudited<br />

IFRS<br />

3 Months ended<br />

31 march 2006<br />

Audited<br />

IFRS<br />

12 Months ended<br />

31 December<br />

2006<br />

Audited<br />

IFRS<br />

12 Months ended<br />

31 December<br />

2005*<br />

Revenues 5,586 814 9,572 518<br />

Operating expenses (excluding<br />

depreciation and amortisation) (2,104) (317) (5,992) (121)<br />

EBITDA 3,482 497 3,580 397<br />

Depreciation and amortisation (2,932) (522) (5,042) (203)<br />

Operating profit (loss) 550 (25) (1,462) 194<br />

Net finance (3,417) (1,478) (4,431) (182)<br />

Profit (loss) before tax (2,867) (1,502) (5,893) 12<br />

Tax (270) 0 (669) 16<br />

Net income (loss) for the period (3,137) (1,502) (6,561) 28<br />

* From inception 27 October 2005<br />

Reviewed<br />

IFRS<br />

3 Months ended<br />

31 March 2007<br />

Unaudited<br />

IFRS<br />

3 Months ended<br />

31 march 2006<br />

Audited<br />

IFRS<br />

12 Months ended<br />

31 December<br />

2006<br />

Audited<br />

IFRS<br />

12 Months ended<br />

31 December<br />

2005*<br />

Earnings (loss) per share – basic<br />

(USD) (0.170) (0.135) (0.376) (0.003)<br />

Earnings (loss) per share – diluted<br />

(USD) (0.170) (0135) (0.376) (0.003)<br />

Dividend per share (USD) 0 0 0 0<br />

*From inception 27 October 2005<br />

Table 1-2: Summary of balance sheets for <strong>Arrow</strong> Seismic ASA<br />

Balance sheet (USD 1,000’)<br />

Reviewed<br />

IFRS<br />

31 March 2007<br />

Unaudited<br />

IFRS<br />

31 march 2006<br />

Audited IFRS<br />

31 December<br />

2006<br />

Audited IFRS<br />

31 December<br />

2005<br />

Total non-current assets 156,638 68,767 134,485 48,110<br />

Total current assets 23,429 60,858 27,952 34,974<br />

Total assets 180,067 129,625 162,437 83,084<br />

Total equity 90,262 91,160 90,427 46,620<br />

Total non-current liabilities 68,393 28,095 57,889 30,056<br />

Total current liabilities 21,412 10,370 14,121 6,409<br />

Total equity and liabilities 180,067 129,625 162,437 83,084<br />

1.7.2 Summary of operating and financial review<br />

The “Geo Atlantic” was until February 2006 employed on a bare boat contract to Polar Ship Invest AS, an<br />

affiliate company, operating within offshore subsea support. Most of the revenue in Q1 2006 relates to this bare<br />

boat contract. Later in Q1 2006, the vessel started conversion to a state-of-the-art high capacity seismic vessel.<br />

The conversion was more time consuming than originally planned and was completed medio October 2006,<br />

where after the “Geo Atlantic” commenced on a seven year fixed charter to Fugro Geoteam AS whereupon the<br />

charterer has a 2 x 2 year option. In addition, the “CGG Laurentian” has since it was purchased 1 July 2006 been<br />

employed under a time charter with CGGVeritas which expires in September 2008 whereafter CGGVeritas has<br />

an option to extend the charter party for either two or three years.<br />

9