Arrow Prospectus - PGS

Arrow Prospectus - PGS

Arrow Prospectus - PGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ARROW SEISMIC ASA – INITIAL PUBLIC OFFERING<br />

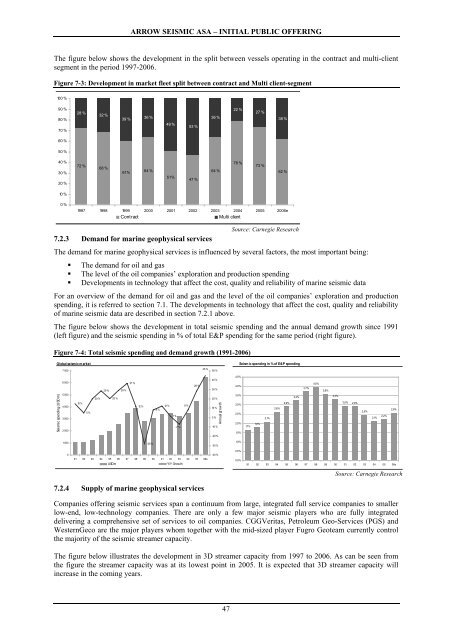

The figure below shows the development in the split between vessels operating in the contract and multi-client<br />

segment in the period 1997-2006.<br />

Figure 7-3: Development in market fleet split between contract and Multi client-segment<br />

100 %<br />

90 %<br />

80 %<br />

70 %<br />

28 %<br />

32 %<br />

39 %<br />

36 %<br />

49 %<br />

53 %<br />

36 %<br />

22 %<br />

27 %<br />

38 %<br />

60 %<br />

50 %<br />

40 %<br />

30 %<br />

20 %<br />

72 %<br />

68 %<br />

61 %<br />

64 %<br />

51 %<br />

47 %<br />

64 %<br />

78 %<br />

73 %<br />

62 %<br />

10 %<br />

0 %<br />

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006e<br />

Contract<br />

Multi client<br />

7.2.3 Demand for marine geophysical services<br />

The demand for marine geophysical services is influenced by several factors, the most important being:<br />

• The demand for oil and gas<br />

• The level of the oil companies’ exploration and production spending<br />

• Developments in technology that affect the cost, quality and reliability of marine seismic data<br />

For an overview of the demand for oil and gas and the level of the oil companies’ exploration and production<br />

spending, it is referred to section 7.1. The developments in technology that affect the cost, quality and reliability<br />

of marine seismic data are described in section 7.2.1 above.<br />

The figure below shows the development in total seismic spending and the annual demand growth since 1991<br />

(left figure) and the seismic spending in % of total E&P spending for the same period (right figure).<br />

Figure 7-4: Total seismic spending and demand growth (1991-2006)<br />

Source: Carnegie Research<br />

Global seismic m arket<br />

Seism ic spending in % of E&P spending<br />

7 000<br />

45 %<br />

50 %<br />

6 000<br />

29 %<br />

29 %<br />

37 %<br />

28 %<br />

40 %<br />

30 %<br />

4,5%<br />

4,0%<br />

3,7%<br />

4,0%<br />

3,6%<br />

Seismic spending (USDm)<br />

5 000<br />

4 000<br />

3 000<br />

2 000<br />

15 %<br />

5 %<br />

20 %<br />

20 %<br />

12 %<br />

8 %<br />

12 %<br />

1 %<br />

-7 %<br />

8 %<br />

20 %<br />

10 %<br />

0 %<br />

-10 %<br />

-20 %<br />

Annual growth<br />

3,5%<br />

3,0%<br />

2,5%<br />

2,0%<br />

1,5%<br />

1,7%<br />

1,8%<br />

2,1%<br />

2,6%<br />

2,9%<br />

3,2%<br />

3,3%<br />

3,0% 2,9%<br />

2,5%<br />

2,1% 2,2% 2,6%<br />

1 000<br />

-28 %<br />

-30 %<br />

1,0%<br />

0,5%<br />

0<br />

-40 %<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06e<br />

USDm<br />

Y/Y Growth<br />

0,0%<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06e<br />

Source: Carnegie Research<br />

7.2.4 Supply of marine geophysical services<br />

Companies offering seismic services span a continuum from large, integrated full service companies to smaller<br />

low-end, low-technology companies. There are only a few major seismic players who are fully integrated<br />

delivering a comprehensive set of services to oil companies. CGGVeritas, Petroleum Geo-Services (<strong>PGS</strong>) and<br />

WesternGeco are the major players whom together with the mid-sized player Fugro Geoteam currently control<br />

the majority of the seismic streamer capacity.<br />

The figure below illustrates the development in 3D streamer capacity from 1997 to 2006. As can be seen from<br />

the figure the streamer capacity was at its lowest point in 2005. It is expected that 3D streamer capacity will<br />

increase in the coming years.<br />

47