Arrow Prospectus - PGS

Arrow Prospectus - PGS

Arrow Prospectus - PGS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ARROW SEISMIC ASA – INITIAL PUBLIC OFFERING<br />

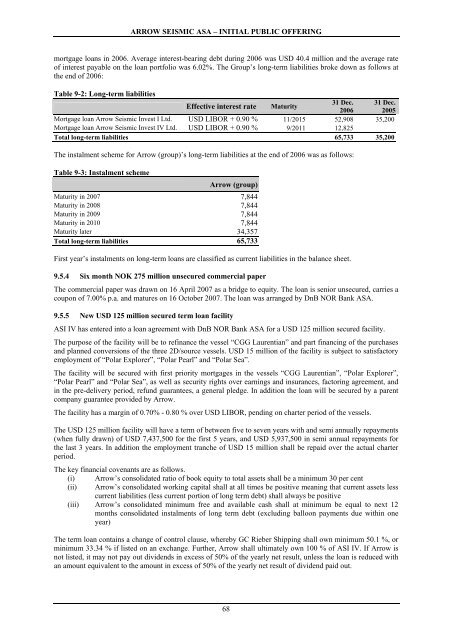

mortgage loans in 2006. Average interest-bearing debt during 2006 was USD 40.4 million and the average rate<br />

of interest payable on the loan portfolio was 6.02%. The Group’s long-term liabilities broke down as follows at<br />

the end of 2006:<br />

Table 9-2: Long-term liabilities<br />

31 Dec. 31 Dec.<br />

Effective interest rate Maturity<br />

2006 2005<br />

Mortgage loan <strong>Arrow</strong> Seismic Invest I Ltd. USD LIBOR + 0.90 % 11/2015 52,908 35,200<br />

Mortgage loan <strong>Arrow</strong> Seismic Invest IV Ltd. USD LIBOR + 0.90 % 9/2011 12,825<br />

Total long-term liabilities 65,733 35,200<br />

The instalment scheme for <strong>Arrow</strong> (group)’s long-term liabilities at the end of 2006 was as follows:<br />

Table 9-3: Instalment scheme<br />

First year’s instalments on long-term loans are classified as current liabilities in the balance sheet.<br />

9.5.4 Six month NOK 275 million unsecured commercial paper<br />

The commercial paper was drawn on 16 April 2007 as a bridge to equity. The loan is senior unsecured, carries a<br />

coupon of 7.00% p.a. and matures on 16 October 2007. The loan was arranged by DnB NOR Bank ASA.<br />

9.5.5 New USD 125 million secured term loan facility<br />

ASI IV has entered into a loan agreement with DnB NOR Bank ASA for a USD 125 million secured facility.<br />

The purpose of the facility will be to refinance the vessel “CGG Laurentian” and part financing of the purchases<br />

and planned conversions of the three 2D/source vessels. USD 15 million of the facility is subject to satisfactory<br />

employment of “Polar Explorer”, “Polar Pearl” and “Polar Sea”.<br />

The facility will be secured with first priority mortgages in the vessels “CGG Laurentian”, “Polar Explorer”,<br />

“Polar Pearl” and “Polar Sea”, as well as security rights over earnings and insurances, factoring agreement, and<br />

in the pre-delivery period, refund guarantees, a general pledge. In addition the loan will be secured by a parent<br />

company guarantee provided by <strong>Arrow</strong>.<br />

The facility has a margin of 0.70% - 0.80 % over USD LIBOR, pending on charter period of the vessels.<br />

The USD 125 million facility will have a term of between five to seven years with and semi annually repayments<br />

(when fully drawn) of USD 7,437,500 for the first 5 years, and USD 5,937,500 in semi annual repayments for<br />

the last 3 years. In addition the employment tranche of USD 15 million shall be repaid over the actual charter<br />

period.<br />

The key financial covenants are as follows.<br />

(i)<br />

(ii)<br />

<strong>Arrow</strong> (group)<br />

Maturity in 2007 7,844<br />

Maturity in 2008 7,844<br />

Maturity in 2009 7,844<br />

Maturity in 2010 7,844<br />

Maturity later 34,357<br />

Total long-term liabilities 65,733<br />

<strong>Arrow</strong>’s consolidated ratio of book equity to total assets shall be a minimum 30 per cent<br />

<strong>Arrow</strong>’s consolidated working capital shall at all times be positive meaning that current assets less<br />

current liabilities (less current portion of long term debt) shall always be positive<br />

(iii) <strong>Arrow</strong>’s consolidated minimum free and available cash shall at minimum be equal to next 12<br />

months consolidated instalments of long term debt (excluding balloon payments due within one<br />

year)<br />

The term loan contains a change of control clause, whereby GC Rieber Shipping shall own minimum 50.1 %, or<br />

minimum 33.34 % if listed on an exchange. Further, <strong>Arrow</strong> shall ultimately own 100 % of ASI IV. If <strong>Arrow</strong> is<br />

not listed, it may not pay out dividends in excess of 50% of the yearly net result, unless the loan is reduced with<br />

an amount equivalent to the amount in excess of 50% of the yearly net result of dividend paid out.<br />

68