Arrow Prospectus - PGS

Arrow Prospectus - PGS

Arrow Prospectus - PGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ARROW SEISMIC ASA – INITIAL PUBLIC OFFERING<br />

Institutional Offering. The Company and the global coordinator, Carnegie, reserve the right to change the<br />

indicated allocation between the Retail Offering and the Institutional Offering without notice and at their sole<br />

discretion. For a description of the guidelines for allocation of the Offer Shares, see section 5.10 “Allocation of<br />

Offer Shares”.<br />

The Retail Offering will be marketed only in Norway.<br />

A non-binding indicative price range for the Offering Price of NOK 65 – NOK 73 has been set by the Board<br />

after consultation with the Managers. However, the final Offering Price may be set above or below this nonbinding<br />

indicative price range. See section 5.6.2 “Indicative price range and Offering Price” and section 5.7.2<br />

“Offering Price”.<br />

5.5 DILUTION<br />

The immediate dilutive effect of the Offering will be 24.6 % if all New Shares are issued and the entire Overallotment<br />

Option is exercised.<br />

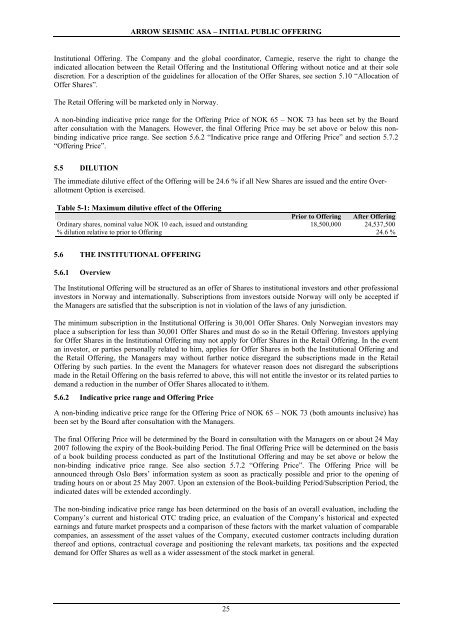

Table 5-1: Maximum dilutive effect of the Offering<br />

Prior to Offering After Offering<br />

Ordinary shares, nominal value NOK 10 each, issued and outstanding 18,500,000 24,537,500<br />

% dilution relative to prior to Offering 24.6 %<br />

5.6 THE INSTITUTIONAL OFFERING<br />

5.6.1 Overview<br />

The Institutional Offering will be structured as an offer of Shares to institutional investors and other professional<br />

investors in Norway and internationally. Subscriptions from investors outside Norway will only be accepted if<br />

the Managers are satisfied that the subscription is not in violation of the laws of any jurisdiction.<br />

The minimum subscription in the Institutional Offering is 30,001 Offer Shares. Only Norwegian investors may<br />

place a subscription for less than 30,001 Offer Shares and must do so in the Retail Offering. Investors applying<br />

for Offer Shares in the Institutional Offering may not apply for Offer Shares in the Retail Offering. In the event<br />

an investor, or parties personally related to him, applies for Offer Shares in both the Institutional Offering and<br />

the Retail Offering, the Managers may without further notice disregard the subscriptions made in the Retail<br />

Offering by such parties. In the event the Managers for whatever reason does not disregard the subscriptions<br />

made in the Retail Offering on the basis referred to above, this will not entitle the investor or its related parties to<br />

demand a reduction in the number of Offer Shares allocated to it/them.<br />

5.6.2 Indicative price range and Offering Price<br />

A non-binding indicative price range for the Offering Price of NOK 65 – NOK 73 (both amounts inclusive) has<br />

been set by the Board after consultation with the Managers.<br />

The final Offering Price will be determined by the Board in consultation with the Managers on or about 24 May<br />

2007 following the expiry of the Book-building Period. The final Offering Price will be determined on the basis<br />

of a book building process conducted as part of the Institutional Offering and may be set above or below the<br />

non-binding indicative price range. See also section 5.7.2 “Offering Price”. The Offering Price will be<br />

announced through Oslo Børs’ information system as soon as practically possible and prior to the opening of<br />

trading hours on or about 25 May 2007. Upon an extension of the Book-building Period/Subscription Period, the<br />

indicated dates will be extended accordingly.<br />

The non-binding indicative price range has been determined on the basis of an overall evaluation, including the<br />

Company’s current and historical OTC trading price, an evaluation of the Company’s historical and expected<br />

earnings and future market prospects and a comparison of these factors with the market valuation of comparable<br />

companies, an assessment of the asset values of the Company, executed customer contracts including duration<br />

thereof and options, contractual coverage and positioning the relevant markets, tax positions and the expected<br />

demand for Offer Shares as well as a wider assessment of the stock market in general.<br />

25