Arrow Prospectus - PGS

Arrow Prospectus - PGS

Arrow Prospectus - PGS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ARROW SEISMIC ASA – INITIAL PUBLIC OFFERING<br />

7.3 THE POSITION OF ARROW<br />

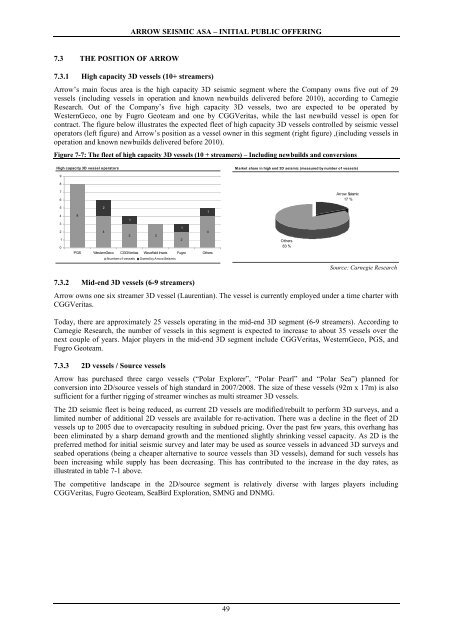

7.3.1 High capacity 3D vessels (10+ streamers)<br />

<strong>Arrow</strong>’s main focus area is the high capacity 3D seismic segment where the Company owns five out of 29<br />

vessels (including vessels in operation and known newbuilds delivered before 2010), according to Carnegie<br />

Research. Out of the Company’s five high capacity 3D vessels, two are expected to be operated by<br />

WesternGeco, one by Fugro Geoteam and one by CGGVeritas, while the last newbuild vessel is open for<br />

contract. The figure below illustrates the expected fleet of high capacity 3D vessels controlled by seismic vessel<br />

operators (left figure) and <strong>Arrow</strong>’s position as a vessel owner in this segment (right figure) ,(including vessels in<br />

operation and known newbuilds delivered before 2010).<br />

Figure 7-7: The fleet of high capacity 3D vessels (10 + streamers) – Including newbuilds and conversions<br />

High capacity 3D vessel operators<br />

M arket share in high end 3D seismic (measured by number of vessels)<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

2<br />

1<br />

8<br />

1<br />

1<br />

4<br />

4<br />

3 3<br />

2<br />

<strong>PGS</strong> WesternGeco CGGVeritas Wavefield Inseis Fugro Others<br />

Number of vessels Owned by <strong>Arrow</strong> Seismic<br />

Others<br />

83 %<br />

<strong>Arrow</strong> Seismic<br />

17 %<br />

Source: Carnegie Research<br />

7.3.2 Mid-end 3D vessels (6-9 streamers)<br />

<strong>Arrow</strong> owns one six streamer 3D vessel (Laurentian). The vessel is currently employed under a time charter with<br />

CGGVeritas.<br />

Today, there are approximately 25 vessels operating in the mid-end 3D segment (6-9 streamers). According to<br />

Carnegie Research, the number of vessels in this segment is expected to increase to about 35 vessels over the<br />

next couple of years. Major players in the mid-end 3D segment include CGGVeritas, WesternGeco, <strong>PGS</strong>, and<br />

Fugro Geoteam.<br />

7.3.3 2D vessels / Source vessels<br />

<strong>Arrow</strong> has purchased three cargo vessels (“Polar Explorer”, “Polar Pearl” and “Polar Sea”) planned for<br />

conversion into 2D/source vessels of high standard in 2007/2008. The size of these vessels (92m x 17m) is also<br />

sufficient for a further rigging of streamer winches as multi streamer 3D vessels.<br />

The 2D seismic fleet is being reduced, as current 2D vessels are modified/rebuilt to perform 3D surveys, and a<br />

limited number of additional 2D vessels are available for re-activation. There was a decline in the fleet of 2D<br />

vessels up to 2005 due to overcapacity resulting in subdued pricing. Over the past few years, this overhang has<br />

been eliminated by a sharp demand growth and the mentioned slightly shrinking vessel capacity. As 2D is the<br />

preferred method for initial seismic survey and later may be used as source vessels in advanced 3D surveys and<br />

seabed operations (being a cheaper alternative to source vessels than 3D vessels), demand for such vessels has<br />

been increasing while supply has been decreasing. This has contributed to the increase in the day rates, as<br />

illustrated in table 7-1 above.<br />

The competitive landscape in the 2D/source segment is relatively diverse with larges players including<br />

CGGVeritas, Fugro Geoteam, SeaBird Exploration, SMNG and DNMG.<br />

49