Arrow Prospectus - PGS

Arrow Prospectus - PGS

Arrow Prospectus - PGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1.9 MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS<br />

1.9.1 Major shareholders<br />

The major shareholders of <strong>Arrow</strong> are GC Rieber Shipping and Odin Offshore, with 54.1% and 6.1%,<br />

respectively. <strong>Arrow</strong> is not aware of any other shareholders owning more than 5% of the Shares.<br />

As of 9 May 2007, the Company had 152 shareholders in total, of which 136 were Norwegian and 16 were non<br />

Norwegian.<br />

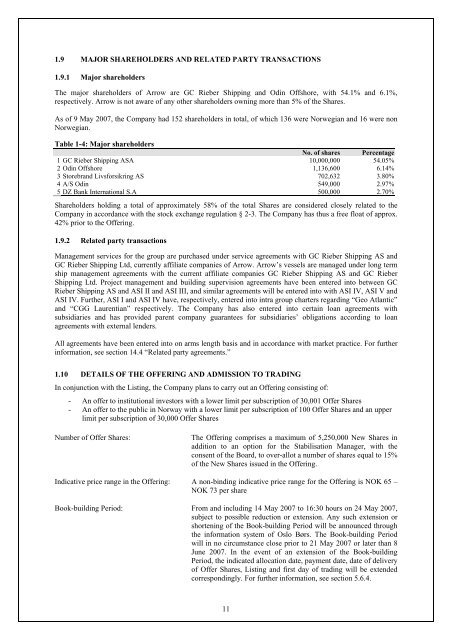

Table 1-4: Major shareholders<br />

No. of shares Percentage<br />

1 GC Rieber Shipping ASA 10,000,000 54.05%<br />

2 Odin Offshore 1,136,600 6.14%<br />

3 Storebrand Livsforsikring AS 702,632 3.80%<br />

4 A/S Odin 549,000 2.97%<br />

5 DZ Bank International S.A 500,000 2.70%<br />

Shareholders holding a total of approximately 58% of the total Shares are considered closely related to the<br />

Company in accordance with the stock exchange regulation § 2-3. The Company has thus a free float of approx.<br />

42% prior to the Offering.<br />

1.9.2 Related party transactions<br />

Management services for the group are purchased under service agreements with GC Rieber Shipping AS and<br />

GC Rieber Shipping Ltd, currently affiliate companies of <strong>Arrow</strong>. <strong>Arrow</strong>’s vessels are managed under long term<br />

ship management agreements with the current affiliate companies GC Rieber Shipping AS and GC Rieber<br />

Shipping Ltd. Project management and building supervision agreements have been entered into between GC<br />

Rieber Shipping AS and ASI II and ASI III, and similar agreements will be entered into with ASI IV, ASI V and<br />

ASI IV. Further, ASI I and ASI IV have, respectively, entered into intra group charters regarding “Geo Atlantic”<br />

and “CGG Laurentian” respectively. The Company has also entered into certain loan agreements with<br />

subsidiaries and has provided parent company guarantees for subsidiaries’ obligations according to loan<br />

agreements with external lenders.<br />

All agreements have been entered into on arms length basis and in accordance with market practice. For further<br />

information, see section 14.4 “Related party agreements.”<br />

1.10 DETAILS OF THE OFFERING AND ADMISSION TO TRADING<br />

In conjunction with the Listing, the Company plans to carry out an Offering consisting of:<br />

- An offer to institutional investors with a lower limit per subscription of 30,001 Offer Shares<br />

- An offer to the public in Norway with a lower limit per subscription of 100 Offer Shares and an upper<br />

limit per subscription of 30,000 Offer Shares<br />

Number of Offer Shares:<br />

The Offering comprises a maximum of 5,250,000 New Shares in<br />

addition to an option for the Stabilisation Manager, with the<br />

consent of the Board, to over-allot a number of shares equal to 15%<br />

of the New Shares issued in the Offering.<br />

Indicative price range in the Offering: A non-binding indicative price range for the Offering is NOK 65 –<br />

NOK 73 per share<br />

Book-building Period: From and including 14 May 2007 to 16:30 hours on 24 May 2007,<br />

subject to possible reduction or extension. Any such extension or<br />

shortening of the Book-building Period will be announced through<br />

the information system of Oslo Børs. The Book-building Period<br />

will in no circumstance close prior to 21 May 2007 or later than 8<br />

June 2007. In the event of an extension of the Book-building<br />

Period, the indicated allocation date, payment date, date of delivery<br />

of Offer Shares, Listing and first day of trading will be extended<br />

correspondingly. For further information, see section 5.6.4.<br />

11