Chapter 2: Graphs, Charts, and Tables--Describing Your Data

Chapter 2: Graphs, Charts, and Tables--Describing Your Data

Chapter 2: Graphs, Charts, and Tables--Describing Your Data

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60 CHAPTER 2 • GRAPHS, CHARTS, AND TABLES—DESCRIBING YOUR DATA<br />

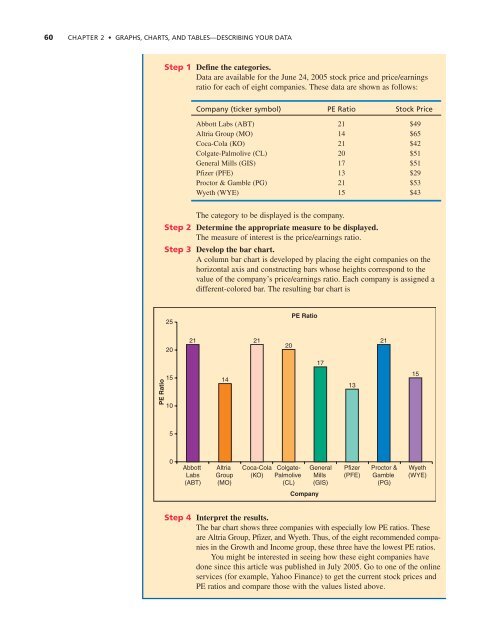

Step 1 Define the categories.<br />

<strong>Data</strong> are available for the June 24, 2005 stock price <strong>and</strong> price/earnings<br />

ratio for each of eight companies. These data are shown as follows:<br />

Company (ticker symbol) PE Ratio Stock Price<br />

Abbott Labs (ABT) 21 $49<br />

Altria Group (MO) 14 $65<br />

Coca-Cola (KO) 21 $42<br />

Colgate-Palmolive (CL) 20 $51<br />

General Mills (GIS) 17 $51<br />

Pfizer (PFE) 13 $29<br />

Proctor & Gamble (PG) 21 $53<br />

Wyeth (WYE) 15 $43<br />

The category to be displayed is the company.<br />

Step 2 Determine the appropriate measure to be displayed.<br />

The measure of interest is the price/earnings ratio.<br />

Step 3 Develop the bar chart.<br />

A column bar chart is developed by placing the eight companies on the<br />

horizontal axis <strong>and</strong> constructing bars whose heights correspond to the<br />

value of the company’s price/earnings ratio. Each company is assigned a<br />

different-colored bar. The resulting bar chart is<br />

25<br />

PE Ratio<br />

20<br />

21<br />

21<br />

20<br />

21<br />

17<br />

10<br />

PE Ratio15<br />

14<br />

13<br />

15<br />

5<br />

0<br />

Abbott<br />

Labs<br />

(ABT)<br />

Altria<br />

Group<br />

(MO)<br />

Coca-Cola<br />

(KO)<br />

Colgate-<br />

Palmolive<br />

(CL)<br />

General<br />

Mills<br />

(GIS)<br />

Pfizer<br />

(PFE)<br />

Proctor &<br />

Gamble<br />

(PG)<br />

Wyeth<br />

(WYE)<br />

Company<br />

Step 4 Interpret the results.<br />

The bar chart shows three companies with especially low PE ratios. These<br />

are Altria Group, Pfizer, <strong>and</strong> Wyeth. Thus, of the eight recommended companies<br />

in the Growth <strong>and</strong> Income group, these three have the lowest PE ratios.<br />

You might be interested in seeing how these eight companies have<br />

done since this article was published in July 2005. Go to one of the online<br />

services (for example, Yahoo Finance) to get the current stock prices <strong>and</strong><br />

PE ratios <strong>and</strong> compare those with the values listed above.