Every day counts - Deutsche Beteiligungs AG

Every day counts - Deutsche Beteiligungs AG

Every day counts - Deutsche Beteiligungs AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

80<br />

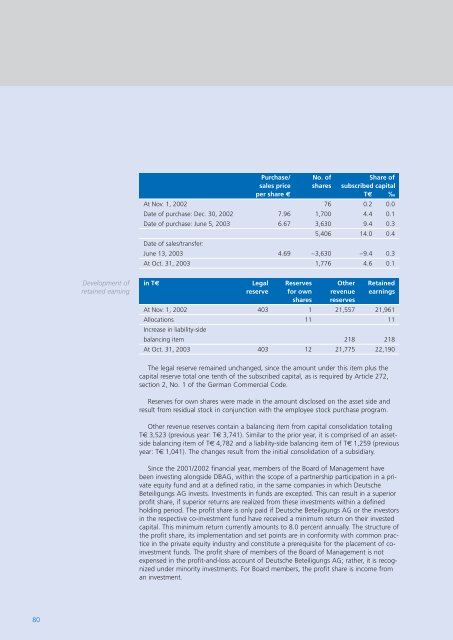

Development of<br />

retained earning<br />

Purchase/ No. of Share of<br />

sales price shares subscribed capital<br />

per share € T€ ‰<br />

At Nov. 1, 2002 76 0.2 0.0<br />

Date of purchase: Dec. 30, 2002 7.96 1,700 4.4 0.1<br />

Date of purchase: June 5, 2003 6.67 3,630 9.4 0.3<br />

Date of sales/transfer:<br />

5,406 14.0 0.4<br />

June 13, 2003 4.69 –3,630 –9.4 0.3<br />

At Oct. 31, 2003 1,776 4.6 0.1<br />

in T€ Legal Reserves Other Retained<br />

reserve for own revenue earnings<br />

shares reserves<br />

At Nov. 1, 2002 403 1 21,557 21,961<br />

Allocations<br />

Increase in liability-side<br />

11 11<br />

balancing item 218 218<br />

At Oct. 31, 2003 403 12 21,775 22,190<br />

The legal reserve remained unchanged, since the amount under this item plus the<br />

capital reserve total one tenth of the subscribed capital, as is required by Article 272,<br />

section 2, No. 1 of the German Commercial Code.<br />

Reserves for own shares were made in the amount disclosed on the asset side and<br />

result from residual stock in conjunction with the employee stock purchase program.<br />

Other revenue reserves contain a balancing item from capital consolidation totaling<br />

T€ 3,523 (previous year: T€ 3,741). Similar to the prior year, it is comprised of an assetside<br />

balancing item of T€ 4,782 and a liability-side balancing item of T€ 1,259 (previous<br />

year: T€ 1,041). The changes result from the initial consolidation of a subsidiary.<br />

Since the 2001/2002 financial year, members of the Board of Management have<br />

been investing alongside DB<strong>AG</strong>, within the scope of a partnership participation in a private<br />

equity fund and at a defined ratio, in the same companies in which <strong>Deutsche</strong><br />

<strong>Beteiligungs</strong> <strong>AG</strong> invests. Investments in funds are excepted. This can result in a superior<br />

profit share, if superior returns are realized from these investments within a defined<br />

holding period. The profit share is only paid if <strong>Deutsche</strong> <strong>Beteiligungs</strong> <strong>AG</strong> or the investors<br />

in the respective co-investment fund have received a minimum return on their invested<br />

capital. This minimum return currently amounts to 8.0 percent annually. The structure of<br />

the profit share, its implementation and set points are in conformity with common practice<br />

in the private equity industry and constitute a prerequisite for the placement of coinvestment<br />

funds. The profit share of members of the Board of Management is not<br />

expensed in the profit-and-loss account of <strong>Deutsche</strong> <strong>Beteiligungs</strong> <strong>AG</strong>; rather, it is recognized<br />

under minority investments. For Board members, the profit share is income from<br />

an investment.