2005-2006 Financial Statements and Management Report

2005-2006 Financial Statements and Management Report

2005-2006 Financial Statements and Management Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

54<br />

GROWTH, EFFICIENCY AND<br />

OPTIMIZATION OF CAPITAL EMPLOYED<br />

ARE LEVERS TO INCREASE VALUE.<br />

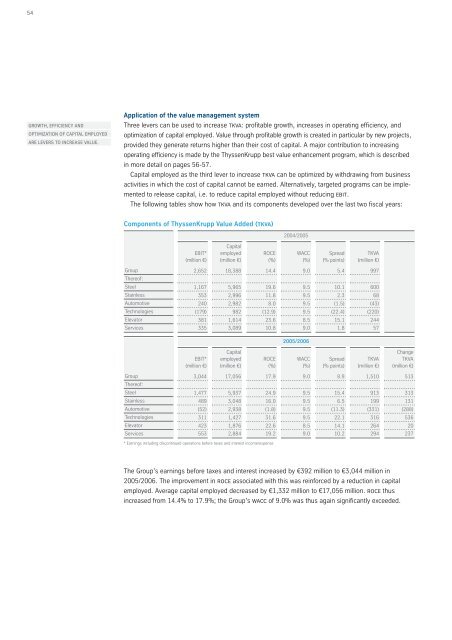

Application of the value management system<br />

Three levers can be used to increase tkva: profitable growth, increases in operating efficiency, <strong>and</strong><br />

optimization of capital employed. Value through profitable growth is created in particular by new projects,<br />

provided they generate returns higher than their cost of capital. A major contribution to increasing<br />

operating efficiency is made by the ThyssenKrupp best value enhancement program, which is described<br />

in more detail on pages 56-57.<br />

Capital employed as the third lever to increase tkva can be optimized by withdrawing from business<br />

activities in which the cost of capital cannot be earned. Alternatively, targeted programs can be implemented<br />

to release capital, i.e. to reduce capital employed without reducing ebit.<br />

The following tables show how tkva <strong>and</strong> its components developed over the last two fiscal years:<br />

Components of ThyssenKrupp Value Added (tkva)<br />

Group<br />

Thereof:<br />

Steel<br />

Stainless<br />

Automotive<br />

Technologies<br />

Elevator<br />

Services<br />

Group<br />

Thereof:<br />

Steel<br />

Stainless<br />

Automotive<br />

Technologies<br />

Elevator<br />

Services<br />

EBIT*<br />

(million €)<br />

2,652<br />

1,167<br />

353<br />

240<br />

(179)<br />

381<br />

335<br />

EBIT*<br />

(million €)<br />

3,044<br />

1,477<br />

489<br />

(52)<br />

311<br />

423<br />

553<br />

Capital<br />

employed<br />

(million €)<br />

18,388<br />

5,965<br />

2,996<br />

2,982<br />

982<br />

1,614<br />

3,089<br />

Capital<br />

employed<br />

(million €)<br />

17,056<br />

5,937<br />

3,048<br />

2,938<br />

1,427<br />

1,876<br />

2,884<br />

WACC<br />

(%)<br />

Spread<br />

(% points)<br />

TKVA<br />

(million €)<br />

The Group’s earnings before taxes <strong>and</strong> interest increased by €392 million to €3,044 million in<br />

<strong>2005</strong>/<strong>2006</strong>. The improvement in roce associated with this was reinforced by a reduction in capital<br />

employed. Average capital employed decreased by €1,332 million to €17,056 million. roce thus<br />

increased from 14.4% to 17.9%; the Group’s wacc of 9.0% was thus again significantly exceeded.<br />

ROCE<br />

(%)<br />

14.4<br />

19.6<br />

11.8<br />

8.0<br />

(12.9)<br />

23.6<br />

10.8<br />

ROCE<br />

(%)<br />

17.9<br />

24.9<br />

16.0<br />

(1.8)<br />

31.6<br />

22.6<br />

19.2<br />

* Earnings including discontinued operations before taxes <strong>and</strong> interest income/expense<br />

2004/<strong>2005</strong><br />

9.0<br />

9.5<br />

9.5<br />

9.5<br />

9.5<br />

8.5<br />

9.0<br />

<strong>2005</strong>/<strong>2006</strong><br />

WACC<br />

(%)<br />

9.0<br />

9.5<br />

9.5<br />

9.5<br />

9.5<br />

8.5<br />

9.0<br />

5.4<br />

10.1<br />

2.3<br />

(1.5)<br />

(22.4)<br />

15.1<br />

1.8<br />

Spread<br />

(% points)<br />

8.9<br />

15.4<br />

6.5<br />

(11.3)<br />

22.1<br />

14.1<br />

10.2<br />

997<br />

600<br />

68<br />

(43)<br />

(220)<br />

244<br />

57<br />

TKVA<br />

(million €)<br />

1,510<br />

913<br />

199<br />

(331)<br />

316<br />

264<br />

294<br />

Change<br />

TKVA<br />

(million €)<br />

513<br />

313<br />

131<br />

(288)<br />

536<br />

20<br />

237