2005-2006 Financial Statements and Management Report

2005-2006 Financial Statements and Management Report

2005-2006 Financial Statements and Management Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

22 TAXES ON INCOME<br />

Taxes on income include own corporation <strong>and</strong> trade tax for the<br />

past <strong>2005</strong>/<strong>2006</strong> fiscal year arising after offsetting against the tax<br />

loss carryforwards from the previous year, as well as tax refunds<br />

for previous years.<br />

Income taxes impact income from ordinary activities in the<br />

amount of €125.1 million <strong>and</strong> extraordinary income in the amount<br />

of €49.1 million.<br />

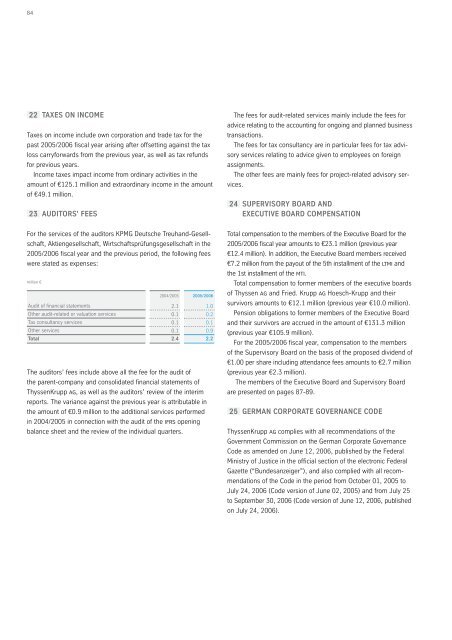

23 AUDITORS’ FEES<br />

For the services of the auditors KPMG Deutsche Treuh<strong>and</strong>-Gesellschaft,<br />

Aktiengesellschaft, Wirtschaftsprüfungsgesellschaft in the<br />

<strong>2005</strong>/<strong>2006</strong> fiscal year <strong>and</strong> the previous period, the following fees<br />

were stated as expenses:<br />

million €<br />

Audit of financial statements<br />

Other audit-related or valuation services<br />

Tax consultancy services<br />

Other services<br />

Total<br />

2004/<strong>2005</strong><br />

2.1<br />

0.1<br />

0.1<br />

0.1<br />

2.4<br />

<strong>2005</strong>/<strong>2006</strong><br />

The auditors’ fees include above all the fee for the audit of<br />

the parent-company <strong>and</strong> consolidated financial statements of<br />

ThyssenKrupp ag, as well as the auditors’ review of the interim<br />

reports. The variance against the previous year is attributable in<br />

the amount of €0.9 million to the additional services performed<br />

in 2004/<strong>2005</strong> in connection with the audit of the ifrs opening<br />

balance sheet <strong>and</strong> the review of the individual quarters.<br />

1.0<br />

0.2<br />

0.1<br />

0.9<br />

2.2<br />

The fees for audit-related services mainly include the fees for<br />

advice relating to the accounting for ongoing <strong>and</strong> planned business<br />

transactions.<br />

The fees for tax consultancy are in particular fees for tax advisory<br />

services relating to advice given to employees on foreign<br />

assignments.<br />

The other fees are mainly fees for project-related advisory services.<br />

24 SUPERVISORY BOARD AND<br />

EXECUTIVE BOARD COMPENSATION<br />

Total compensation to the members of the Executive Board for the<br />

<strong>2005</strong>/<strong>2006</strong> fiscal year amounts to €23.1 million (previous year<br />

€12.4 million). In addition, the Executive Board members received<br />

€7.2 million from the payout of the 5th installment of the ltmi <strong>and</strong><br />

the 1st installment of the mti.<br />

Total compensation to former members of the executive boards<br />

of Thyssen ag <strong>and</strong> Fried. Krupp ag Hoesch-Krupp <strong>and</strong> their<br />

survivors amounts to €12.1 million (previous year €10.0 million).<br />

Pension obligations to former members of the Executive Board<br />

<strong>and</strong> their survivors are accrued in the amount of €131.3 million<br />

(previous year €105.9 million).<br />

For the <strong>2005</strong>/<strong>2006</strong> fiscal year, compensation to the members<br />

of the Supervisory Board on the basis of the proposed dividend of<br />

€1.00 per share including attendance fees amounts to €2.7 million<br />

(previous year €2.3 million).<br />

The members of the Executive Board <strong>and</strong> Supervisory Board<br />

are presented on pages 87-89.<br />

25 GERMAN CORPORATE GOVERNANCE CODE<br />

ThyssenKrupp ag complies with all recommendations of the<br />

Government Commission on the German Corporate Governance<br />

Code as amended on June 12, <strong>2006</strong>, published by the Federal<br />

Ministry of Justice in the official section of the electronic Federal<br />

Gazette (“Bundesanzeiger”), <strong>and</strong> also complied with all recommendations<br />

of the Code in the period from October 01, <strong>2005</strong> to<br />

July 24, <strong>2006</strong> (Code version of June 02, <strong>2005</strong>) <strong>and</strong> from July 25<br />

to September 30, <strong>2006</strong> (Code version of June 12, <strong>2006</strong>, published<br />

on July 24, <strong>2006</strong>).