Issue of Annual Report 2010

Issue of Annual Report 2010

Issue of Annual Report 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Performance Review and Plan<br />

(Performance review figures are based on the segment structure prior to reorganization in <strong>2010</strong>.<br />

Plan figures relate to the new post-reorganization structure)<br />

Alcoholic Beverages (Japan)<br />

Sapporo Breweries Ltd.<br />

The Japanese beer and beer-type beverages market saw total<br />

demand decrease by an estimated 2% year on year. By genre,<br />

while demand for beer and happo-shu (low-malt beer) declined,<br />

demand for new product genres grew by 10% as the shift in consumption<br />

to lower-priced products continues. Against this backdrop, net sales in<br />

our Alcoholic Beverages (Japan) business declined by ¥4.1 billion, or<br />

1.4%, to ¥278.8 billion. In contrast, operating income rose ¥1.8 billion, or<br />

24.3%, to ¥9.3 billion. Income growth reflected increased earnings atop<br />

higher sales volume in beer, coupled with reductions in manufacturing<br />

costs. These factors outweighed increased depreciation expenses from<br />

the transition to a new sales and logistics system.<br />

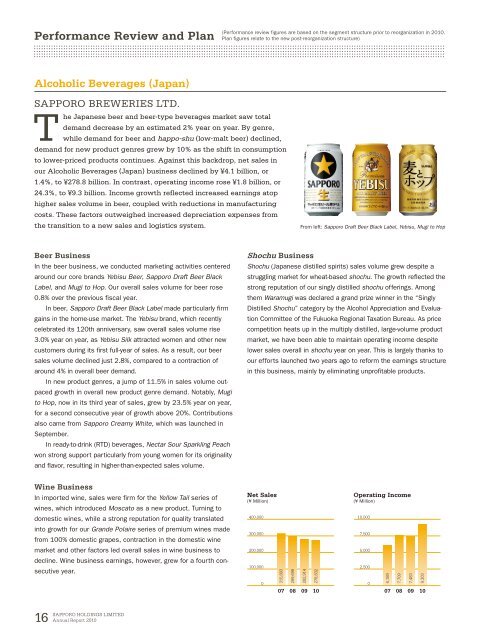

From left: Sapporo Draft Beer Black Label, Yebisu, Mugi to Hop<br />

Beer Business<br />

In the beer business, we conducted marketing activities centered<br />

around our core brands Yebisu Beer, Sapporo Draft Beer Black<br />

Label, and Mugi to Hop. Our overall sales volume for beer rose<br />

0.8% over the previous fiscal year.<br />

In beer, Sapporo Draft Beer Black Label made particularly firm<br />

gains in the home-use market. The Yebisu brand, which recently<br />

celebrated its 120th anniversary, saw overall sales volume rise<br />

3.0% year on year, as Yebisu Silk attracted women and other new<br />

customers during its first full-year <strong>of</strong> sales. As a result, our beer<br />

sales volume declined just 2.8%, compared to a contraction <strong>of</strong><br />

around 4% in overall beer demand.<br />

In new product genres, a jump <strong>of</strong> 11.5% in sales volume outpaced<br />

growth in overall new product genre demand. Notably, Mugi<br />

to Hop, now in its third year <strong>of</strong> sales, grew by 23.5% year on year,<br />

for a second consecutive year <strong>of</strong> growth above 20%. Contributions<br />

also came from Sapporo Creamy White, which was launched in<br />

September.<br />

In ready-to-drink (RTD) beverages, Nectar Sour Sparkling Peach<br />

won strong support particularly from young women for its originality<br />

and flavor, resulting in higher-than-expected sales volume.<br />

Shochu Business<br />

Shochu (Japanese distilled spirits) sales volume grew despite a<br />

struggling market for wheat-based shochu. The growth reflected the<br />

strong reputation <strong>of</strong> our singly distilled shochu <strong>of</strong>ferings. Among<br />

them Waramugi was declared a grand prize winner in the “Singly<br />

Distilled Shochu” category by the Alcohol Appreciation and Evaluation<br />

Committee <strong>of</strong> the Fukuoka Regional Taxation Bureau. As price<br />

competition heats up in the multiply distilled, large-volume product<br />

market, we have been able to maintain operating income despite<br />

lower sales overall in shochu year on year. This is largely thanks to<br />

our efforts launched two years ago to reform the earnings structure<br />

in this business, mainly by eliminating unpr<strong>of</strong>itable products.<br />

Wine Business<br />

In imported wine, sales were firm for the Yellow Tail series <strong>of</strong><br />

wines, which introduced Moscato as a new product. Turning to<br />

Net Sales<br />

(¥ Million)<br />

Operating Income<br />

(¥ Million)<br />

domestic wines, while a strong reputation for quality translated<br />

400,000<br />

10,000<br />

into growth for our Grande Polaire series <strong>of</strong> premium wines made<br />

from 100% domestic grapes, contraction in the domestic wine<br />

300,000<br />

7,500<br />

market and other factors led overall sales in wine business to<br />

200,000<br />

5,000<br />

decline. Wine business earnings, however, grew for a fourth consecutive<br />

year.<br />

100,000<br />

0<br />

315,893<br />

07<br />

299,699<br />

08<br />

282,914<br />

09<br />

278,832<br />

10<br />

2,500<br />

0<br />

6,189<br />

07<br />

7,709<br />

08<br />

7,483<br />

09<br />

9,303<br />

10<br />

16<br />

SAPPORO HOLDINGS LIMITED<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>