Issue of Annual Report 2010

Issue of Annual Report 2010

Issue of Annual Report 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Performance Review and Plan<br />

S<strong>of</strong>t Drinks<br />

Sapporo Beverage Co., Ltd.<br />

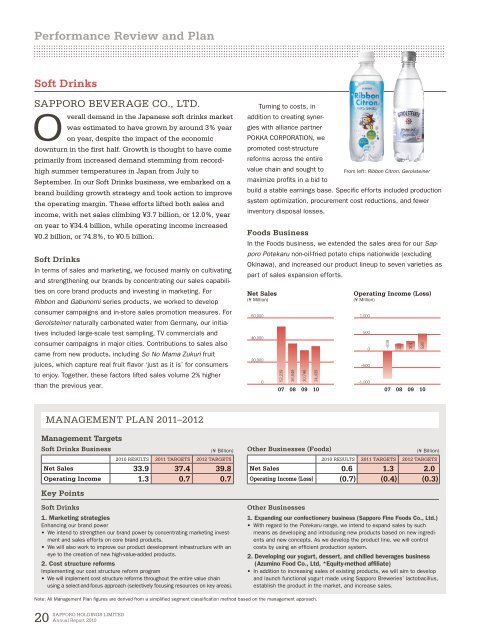

Overall demand in the Japanese s<strong>of</strong>t drinks market<br />

was estimated to have grown by around 3% year<br />

on year, despite the impact <strong>of</strong> the economic<br />

downturn in the first half. Growth is thought to have come<br />

primarily from increased demand stemming from recordhigh<br />

summer temperatures in Japan from July to<br />

September. In our S<strong>of</strong>t Drinks business, we embarked on a<br />

brand building growth strategy and took action to improve<br />

the operating margin. These efforts lifted both sales and<br />

income, with net sales climbing ¥3.7 billion, or 12.0%, year<br />

on year to ¥34.4 billion, while operating income increased<br />

¥0.2 billion, or 74.8%, to ¥0.5 billion.<br />

S<strong>of</strong>t Drinks<br />

In terms <strong>of</strong> sales and marketing, we focused mainly on cultivating<br />

and strengthening our brands by concentrating our sales capabilities<br />

on core brand products and investing in marketing. For<br />

Ribbon and Gabunomi series products, we worked to develop<br />

consumer campaigns and in-store sales promotion measures. For<br />

Gerolsteiner naturally carbonated water from Germany, our initiatives<br />

included large-scale test sampling, TV commercials and<br />

consumer campaigns in major cities. Contributions to sales also<br />

came from new products, including So No Mama Zukuri fruit<br />

juices, which capture real fruit flavor ‘just as it is’ for consumers<br />

to enjoy. Together, these factors lifted sales volume 2% higher<br />

than the previous year.<br />

60,000<br />

40,000<br />

20,000<br />

Turning to costs, in<br />

addition to creating synergies<br />

with alliance partner<br />

POKKA CORPORATION, we<br />

promoted cost-structure<br />

reforms across the entire<br />

value chain and sought to From left: Ribbon Citron, Gerolsteiner<br />

maximize pr<strong>of</strong>its in a bid to<br />

build a stable earnings base. Specific efforts included production<br />

system optimization, procurement cost reductions, and fewer<br />

inventory disposal losses.<br />

Foods Business<br />

In the Foods business, we extended the sales area for our Sapporo<br />

Potekaru non-oil-fried potato chips nationwide (excluding<br />

Okinawa), and increased our product lineup to seven varieties as<br />

part <strong>of</strong> sales expansion efforts.<br />

Net Sales<br />

(¥ Million)<br />

0<br />

52,239<br />

07<br />

36,849<br />

08<br />

30,746<br />

09<br />

34,439<br />

10<br />

Operating Income (Loss)<br />

(¥ Million)<br />

1,000<br />

500<br />

0<br />

–500<br />

–1,000<br />

–839<br />

07<br />

221<br />

08<br />

301<br />

09<br />

526<br />

10<br />

Management Plan 2011–2012<br />

Management Targets<br />

S<strong>of</strong>t Drinks Business<br />

<strong>2010</strong> results 2011 targets 2012 targets<br />

Net Sales 33.9 37.4 39.8<br />

Operating Income 1.3 0.7 0.7<br />

Key Points<br />

(¥ Billion) Other Businesses (Foods)<br />

(¥ Billion)<br />

<strong>2010</strong> results 2011 targets 2012 targets<br />

Net Sales 0.6 1.3 2.0<br />

Operating Income (Loss) (0.7) (0.4) (0.3)<br />

S<strong>of</strong>t Drinks<br />

1. Marketing strategies<br />

Enhancing our brand power<br />

• We intend to strengthen our brand power by concentrating marketing investment<br />

and sales efforts on core brand products.<br />

• We will also work to improve our product development infrastructure with an<br />

eye to the creation <strong>of</strong> new high-value-added products.<br />

2. Cost structure reforms<br />

Implementing our cost structure reform program<br />

• We will implement cost structure reforms throughout the entire value chain<br />

using a select-and-focus approach (selectively focusing resources on key areas).<br />

Other Businesses<br />

1. Expanding our confectionery business (Sapporo Fine Foods Co., Ltd.)<br />

• With regard to the Potekaru range, we intend to expand sales by such<br />

means as developing and introducing new products based on new ingredients<br />

and new concepts. As we develop the product line, we will control<br />

costs by using an efficient production system.<br />

2. Developing our yogurt, dessert, and chilled beverages business<br />

(Azumino Food Co., Ltd, *Equity-method affiliate)<br />

• In addition to increasing sales <strong>of</strong> existing products, we will aim to develop<br />

and launch functional yogurt made using Sapporo Breweries’ lactobacillus,<br />

establish the product in the market, and increase sales.<br />

Note: All Management Plan figures are derived from a simplified segment classification method based on the management approach.<br />

20<br />

SAPPORO HOLDINGS LIMITED<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>