Issue of Annual Report 2010

Issue of Annual Report 2010

Issue of Annual Report 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

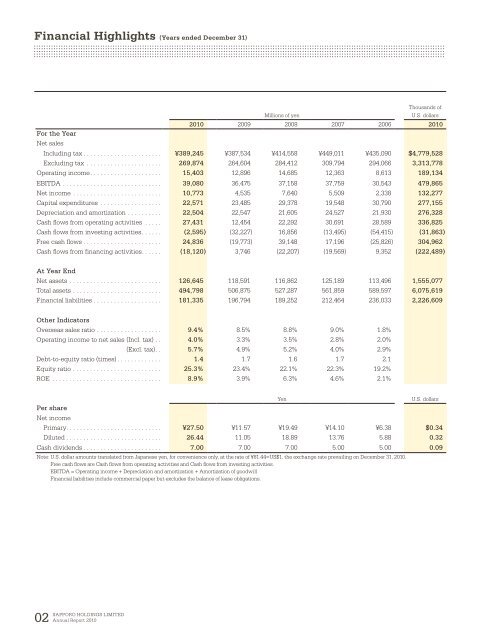

Financial Highlights (Years ended December 31)<br />

Thousands <strong>of</strong><br />

Millions <strong>of</strong> yen<br />

U.S. dollars<br />

<strong>2010</strong> 2009 2008 2007 2006 <strong>2010</strong><br />

For the Year<br />

Net sales<br />

Including tax . . . . . . . . . . . . . . . . . . . . . . . ¥389,245 ¥387,534 ¥414,558 ¥449,011 ¥435,090 $4,779,528<br />

Excluding tax . . . . . . . . . . . . . . . . . . . . . . 269,874 264,604 284,412 309,794 294,066 3,313,778<br />

Operating income . . . . . . . . . . . . . . . . . . . . . 15,403 12,896 14,685 12,363 8,613 189,134<br />

EBITDA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39,080 36,475 37,158 37,759 30,543 479,865<br />

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . 10,773 4,535 7,640 5,509 2,338 132,277<br />

Capital expenditures . . . . . . . . . . . . . . . . . . 22,571 23,485 29,378 19,548 30,790 277,155<br />

Depreciation and amortization . . . . . . . . . . 22,504 22,547 21,605 24,527 21,930 276,328<br />

Cash flows from operating activities . . . . . 27,431 12,454 22,292 30,691 28,589 336,825<br />

Cash flows from investing activities . . . . . . (2,595) (32,227) 16,856 (13,495) (54,415) (31,863)<br />

Free cash flows . . . . . . . . . . . . . . . . . . . . . . . 24,836 (19,773) 39,148 17,196 (25,826) 304,962<br />

Cash flows from financing activities. . . . . . (18,120) 3,746 (22,207) (19,569) 9,352 (222,489)<br />

At Year End<br />

Net assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 126,645 118,591 116,862 125,189 113,496 1,555,077<br />

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . 494,798 506,875 527,287 561,859 589,597 6,075,619<br />

Financial liabilities . . . . . . . . . . . . . . . . . . . . 181,335 196,794 189,252 212,464 236,033 2,226,609<br />

Other Indicators<br />

Overseas sales ratio . . . . . . . . . . . . . . . . . . . 9.4% 8.5% 8.8% 9.0% 1.8%<br />

Operating income to net sales (Incl. tax) . . 4.0% 3.3% 3.5% 2.8% 2.0%<br />

(Excl. tax) . . 5.7% 4.9% 5.2% 4.0% 2.9%<br />

Debt-to-equity ratio (times) . . . . . . . . . . . . . 1.4 1.7 1.6 1.7 2.1<br />

Equity ratio . . . . . . . . . . . . . . . . . . . . . . . . . . 25.3% 23.4% 22.1% 22.3% 19.2%<br />

ROE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.9% 3.9% 6.3% 4.6% 2.1%<br />

Yen<br />

U.S. dollars<br />

Per share<br />

Net income<br />

Primary . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥27.50 ¥11.57 ¥19.49 ¥14.10 ¥6.38 $0.34<br />

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.44 11.05 18.89 13.76 5.88 0.32<br />

Cash dividends . . . . . . . . . . . . . . . . . . . . . . . 7.00 7.00 7.00 5.00 5.00 0.09<br />

Note: U.S. dollar amounts translated from Japanese yen, for convenience only, at the rate <strong>of</strong> ¥81.44=US$1, the exchange rate prevailing on December 31, <strong>2010</strong>.<br />

Free cash flows are Cash flows from operating activities and Cash flows from investing activities.<br />

EBITDA = Operating income + Depreciation and amortization + Amortization <strong>of</strong> goodwill<br />

Financial liabilities include commercial paper but excludes the balance <strong>of</strong> lease obligations.<br />

02<br />

SAPPORO HOLDINGS LIMITED<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>