Issue of Annual Report 2010

Issue of Annual Report 2010

Issue of Annual Report 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Company also recorded a gain on the sales <strong>of</strong> property, plant<br />

and equipment <strong>of</strong> ¥16,576 million, mainly due to selling the former<br />

Osaka Plant site to generate part <strong>of</strong> the cash flow for strategic investments<br />

going forward.<br />

The Company recorded loss on disposal <strong>of</strong> property, plant and<br />

equipment <strong>of</strong> ¥1,724 million, mainly due to concentrating production<br />

facilities to further improve manufacturing efficiency.<br />

Loss on the sales <strong>of</strong> property, plant and equipment was ¥8,410<br />

million. This was due to the Company selling its Keiyo Physical<br />

Distribution Center as part <strong>of</strong> a company-wide effort to restructure<br />

and optimize the distribution network and improve the efficiency and<br />

liquidity <strong>of</strong> assets.<br />

The Company booked a loss on impairment <strong>of</strong> property, plant and<br />

equipment <strong>of</strong> ¥2,375 million. The main reason for this was the<br />

Company amortized goodwill and other intangibles recorded at<br />

SLEEMAN BREWERIES LTD., and approved a resolution to close<br />

unpr<strong>of</strong>itable locations in the Restaurants business, following revisions<br />

in the business plan.<br />

Income Before Income Taxes and Minority Interests<br />

As a result <strong>of</strong> the above and other factors, income before income taxes<br />

and minority interests increased ¥8,888 million to ¥17,762 million.<br />

Income Taxes and Net Income<br />

Income taxes applicable to the Company, calculated as the sum <strong>of</strong><br />

corporation, inhabitants’ and enterprise taxes, were ¥6,994 million.<br />

Income taxes accounted for 39.4% <strong>of</strong> income before income<br />

taxes and minority interests. The difference between this percentage<br />

and the statutory effective tax rate <strong>of</strong> 40.7% mainly reflected the<br />

recording <strong>of</strong> a valuation allowance.<br />

As a result, net income was ¥10,773 million, up 137.5% year on year.<br />

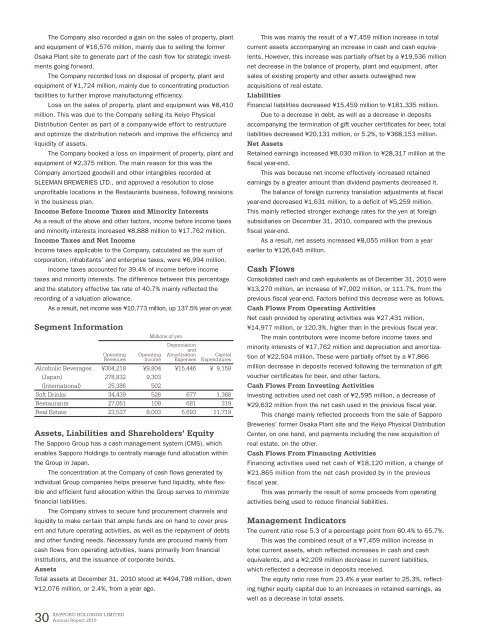

Segment Information<br />

Operating<br />

Revenues<br />

Millions <strong>of</strong> yen<br />

Operating<br />

Income<br />

Depreciation<br />

and<br />

Amortization<br />

Expenses<br />

Capital<br />

Expenditures<br />

Alcoholic Beverages ¥304,218 ¥9,804 ¥15,446 ¥ 9,159<br />

(Japan) 278,832 9,303<br />

(International) 25,386 502<br />

S<strong>of</strong>t Drinks 34,439 526 677 1,368<br />

Restaurants 27,051 109 681 319<br />

Real Estate 23,537 8,003 5,693 11,719<br />

Assets, Liabilities and Shareholders’ Equity<br />

The Sapporo Group has a cash management system (CMS), which<br />

enables Sapporo Holdings to centrally manage fund allocation within<br />

the Group in Japan.<br />

The concentration at the Company <strong>of</strong> cash flows generated by<br />

individual Group companies helps preserve fund liquidity, while flexible<br />

and efficient fund allocation within the Group serves to minimize<br />

financial liabilities.<br />

The Company strives to secure fund procurement channels and<br />

liquidity to make certain that ample funds are on hand to cover present<br />

and future operating activities, as well as the repayment <strong>of</strong> debts<br />

and other funding needs. Necessary funds are procured mainly from<br />

cash flows from operating activities, loans primarily from financial<br />

institutions, and the issuance <strong>of</strong> corporate bonds.<br />

Assets<br />

Total assets at December 31, <strong>2010</strong> stood at ¥494,798 million, down<br />

¥12,076 million, or 2.4%, from a year ago.<br />

This was mainly the result <strong>of</strong> a ¥7,459 million increase in total<br />

current assets accompanying an increase in cash and cash equivalents.<br />

However, this increase was partially <strong>of</strong>fset by a ¥19,536 million<br />

net decrease in the balance <strong>of</strong> property, plant and equipment, after<br />

sales <strong>of</strong> existing property and other assets outweighed new<br />

acquisitions <strong>of</strong> real estate.<br />

Liabilities<br />

Financial liabilities decreased ¥15,459 million to ¥181,335 million.<br />

Due to a decrease in debt, as well as a decrease in deposits<br />

accompanying the termination <strong>of</strong> gift voucher certificates for beer, total<br />

liabilities decreased ¥20,131 million, or 5.2%, to ¥368,153 million.<br />

Net Assets<br />

Retained earnings increased ¥8,030 million to ¥28,317 million at the<br />

fiscal year-end.<br />

This was because net income effectively increased retained<br />

earnings by a greater amount than dividend payments decreased it.<br />

The balance <strong>of</strong> foreign currency translation adjustments at fiscal<br />

year-end decreased ¥1,631 million, to a deficit <strong>of</strong> ¥5,259 million.<br />

This mainly reflected stronger exchange rates for the yen at foreign<br />

subsidiaries on December 31, <strong>2010</strong>, compared with the previous<br />

fiscal year-end.<br />

As a result, net assets increased ¥8,055 million from a year<br />

earlier to ¥126,645 million.<br />

Cash Flows<br />

Consolidated cash and cash equivalents as <strong>of</strong> December 31, <strong>2010</strong> were<br />

¥13,270 million, an increase <strong>of</strong> ¥7,002 million, or 111.7%, from the<br />

previous fiscal year-end. Factors behind this decrease were as follows.<br />

Cash Flows From Operating Activities<br />

Net cash provided by operating activities was ¥27,431 million,<br />

¥14,977 million, or 120.3%, higher than in the previous fiscal year.<br />

The main contributors were income before income taxes and<br />

minority interests <strong>of</strong> ¥17,762 million and depreciation and amortization<br />

<strong>of</strong> ¥22,504 million. These were partially <strong>of</strong>fset by a ¥7,866<br />

million decrease in deposits received following the termination <strong>of</strong> gift<br />

voucher certificates for beer, and other factors.<br />

Cash Flows From Investing Activities<br />

Investing activities used net cash <strong>of</strong> ¥2,595 million, a decrease <strong>of</strong><br />

¥29,632 million from the net cash used in the previous fiscal year.<br />

This change mainly reflected proceeds from the sale <strong>of</strong> Sapporo<br />

Breweries’ former Osaka Plant site and the Keiyo Physical Distribution<br />

Center, on one hand, and payments including the new acquisition <strong>of</strong><br />

real estate, on the other.<br />

Cash Flows From Financing Activities<br />

Financing activities used net cash <strong>of</strong> ¥18,120 million, a change <strong>of</strong><br />

¥21,865 million from the net cash provided by in the previous<br />

fiscal year.<br />

This was primarily the result <strong>of</strong> some proceeds from operating<br />

activities being used to reduce financial liabilities.<br />

Management Indicators<br />

The current ratio rose 5.3 <strong>of</strong> a percentage point from 60.4% to 65.7%.<br />

This was the combined result <strong>of</strong> a ¥7,459 million increase in<br />

total current assets, which reflected increases in cash and cash<br />

equivalents, and a ¥2,209 million decrease in current liabilities,<br />

which reflected a decrease in deposits received.<br />

The equity ratio rose from 23.4% a year earlier to 25.3%, reflecting<br />

higher equity capital due to an increases in retained earnings, as<br />

well as a decrease in total assets.<br />

30<br />

SAPPORO HOLDINGS LIMITED<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>