Issue of Annual Report 2010

Issue of Annual Report 2010

Issue of Annual Report 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 Management <strong>of</strong> market risks (risks from exchange-rate and interest-rate volatility)<br />

With regard to operating receivables and payables denominated in foreign currencies, the Company and certain <strong>of</strong> its subsidiaries use<br />

forward foreign exchange contracts to limit to within a certain scope risks stemming from exchange-rate volatility. Interest rate swaps are<br />

also used to control volatility risks involved in the interest rates on borrowings.<br />

For marketable and investment securities, the Company and its major subsidiaries periodically assess the market value <strong>of</strong> the securities<br />

and the financial condition, etc. <strong>of</strong> the issuer (business partners), and, as necessary, review the holding status <strong>of</strong> such securities,<br />

taking into account their relationship with the business partner in question.<br />

Derivative transactions are executed and managed pursuant to standards <strong>of</strong> internal control. These controls clearly stipulate matters<br />

pertaining to derivatives, including their purpose, product range, transaction counterparties, settlement approval procedures, the segregation<br />

<strong>of</strong> duties within executive departments, and the system for reporting such transactions. The balance and status <strong>of</strong> income (loss) for<br />

derivative transactions is reported periodically to the Board <strong>of</strong> Directors.<br />

3 Management <strong>of</strong> liquidity risk associated with fund procurement (risk <strong>of</strong> failing to meet payment due dates)<br />

To minimize financial liabilities, the Sapporo Group has a cash management system (CMS) to centrally manage fund allocation to the<br />

Company and its significant subsidiaries. Financial divisions within the Group formulate plans for fund procurement and fund management<br />

in an effort to manage liquidity risk.<br />

(4) Supplementary Explanation <strong>of</strong> Matters Concerning Fair Value, Etc., <strong>of</strong> Financial Instruments<br />

Market value <strong>of</strong> financial instruments contains fair values that are rationally calculated in cases for which no market price is available. Because<br />

variable factors are incorporated into the calculation <strong>of</strong> this value, the adoption <strong>of</strong> different terms and assumptions can cause fair value to vary.<br />

Furthermore, notional amounts contracted in derivative transactions, as described in the notes pertaining to derivative transactions, are not a<br />

full expression <strong>of</strong> the market risk associated with derivative transactions.<br />

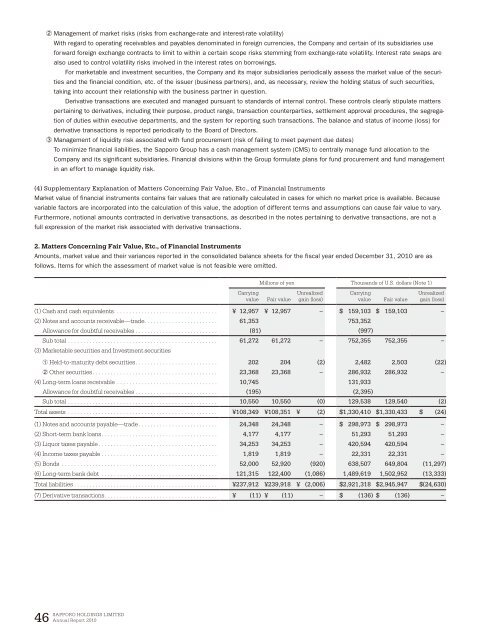

2. Matters Concerning Fair Value, Etc., <strong>of</strong> Financial Instruments<br />

Amounts, market value and their variances reported in the consolidated balance sheets for the fiscal year ended December 31, <strong>2010</strong> are as<br />

follows. Items for which the assessment <strong>of</strong> market value is not feasible were omitted.<br />

Millions <strong>of</strong> yen Thousands <strong>of</strong> U.S. dollars (Note 1)<br />

Carrying<br />

value<br />

Fair value<br />

Unrealized<br />

gain (loss)<br />

Carrying<br />

value<br />

Fair value<br />

Unrealized<br />

gain (loss)<br />

(1) Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 12,957 ¥ 12,957 – $ 159,103 $ 159,103 –<br />

(2) Notes and accounts receivable—trade . . . . . . . . . . . . . . . . . . . . . . . . 61,353 753,352<br />

Allowance for doubtful receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . (81) (997)<br />

Sub total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61,272 61,272 – 752,355 752,355 –<br />

(3) Marketable securities and Investment securities<br />

1 Held-to-maturity debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . 202 204 (2) 2,482 2,503 (22)<br />

2 Other securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,368 23,368 – 286,932 286,932 –<br />

(4) Long-term loans receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,745 131,933<br />

Allowance for doubtful receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . (195) (2,395)<br />

Sub total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,550 10,550 (0) 129,538 129,540 (2)<br />

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥108,349 ¥108,351 ¥ (2) $1,330,410 $1,330,433 $ (24)<br />

(1) Notes and accounts payable—trade . . . . . . . . . . . . . . . . . . . . . . . . . . 24,348 24,348 – $ 298,973 $ 298,973 –<br />

(2) Short-term bank loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,177 4,177 – 51,293 51,293 –<br />

(3) Liquor taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,253 34,253 – 420,594 420,594 –<br />

(4) Income taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,819 1,819 – 22,331 22,331 –<br />

(5) Bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52,000 52,920 (920) 638,507 649,804 (11,297)<br />

(6) Long-term bank debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 121,315 122,400 (1,086) 1,489,619 1,502,952 (13,333)<br />

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥237,912 ¥239,918 ¥ (2,006) $2,921,318 $2,945,947 $(24,630)<br />

(7) Derivative transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ (11) ¥ (11) – $ (136) $ (136) –<br />

SAPPORO HOLDINGS LIMITED<br />

46 <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>