CAFR - sdcera

CAFR - sdcera

CAFR - sdcera

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F I N A N C I A L / M A N A G E M E N T ’ S D I S C U S S I O N A N D A N A L Y S I S<br />

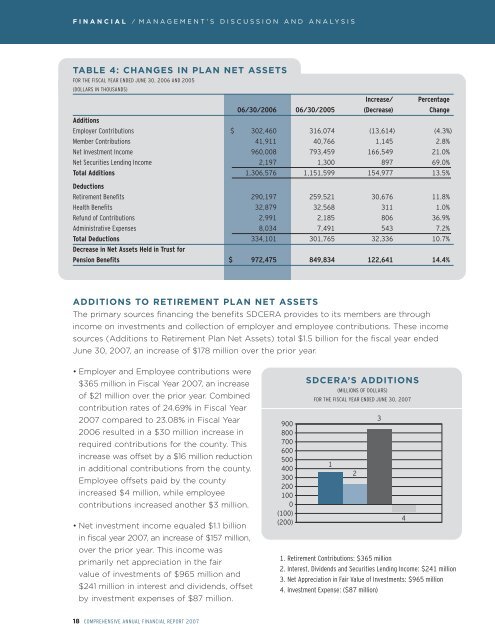

TABLE 4: CHANGES IN PLAN NET ASSETS<br />

FOR THE FISCAL YEAR ENDED JUNE 30, 2006 AND 2005<br />

(DOLLARS IN THOUSANDS)<br />

Increase/ Percentage<br />

06/30/2006 06/30/2005 (Decrease) Change<br />

Additions<br />

Employer Contributions $ 302,460 316,074 (13,614) (4.3%)<br />

Member Contributions 41,911 40,766 1,145 2.8%<br />

Net Investment Income 960,008 793,459 166,549 21.0%<br />

Net Securities Lending Income 2,197 1,300 897 69.0%<br />

Total Additions 1,306,576 1,151,599 154,977 13.5%<br />

Deductions<br />

Retirement Benefits 290,197 259,521 30,676 11.8%<br />

Health Benefits 32,879 32,568 311 1.0%<br />

Refund of Contributions 2,991 2,185 806 36.9%<br />

Administrative Expenses 8,034 7,491 543 7.2%<br />

Total Deductions 9.0<br />

334,101 301,765 32,336 10.7%<br />

Decrease in Net Assets Held in 8.0 Trust for<br />

Pension Benefits 7.0<br />

$ 972,475 849,834 25.00% 122,641 14.4%<br />

6.0<br />

20.00%<br />

5.0<br />

15.00%<br />

4.0<br />

10.00%<br />

ADDITIONS TO RETIREMENT 3.0<br />

PLAN NET ASSETS<br />

5.00%<br />

The primary sources financing<br />

2.0<br />

the benefits SDCERA provides to its members<br />

0.00%<br />

are through<br />

1.0<br />

-5.00%<br />

income on investments and collection of employer and employee contributions. These income<br />

0.0<br />

-10.00%<br />

sources (Additions to Retirement Plan Net Assets) total $1.5 billion for the fiscal year ended<br />

June 30, 2007, an increase of $178 million over the prior year.<br />

Net Assets<br />

• Employer and Employee contributions were<br />

Investment Returns<br />

$365 million in Fiscal Year 2007, an increase<br />

of $21 million over the prior year. Combined<br />

SDCERA’S ADDITIONS<br />

(MILLIONS OF DOLLARS)<br />

FOR THE FISCAL YEAR ENDED JUNE 30, 2007<br />

contribution rates of 24.69% in Fiscal Year<br />

2007 compared to 23.08% in Fiscal Year<br />

2006 resulted in a $30 million increase in<br />

900<br />

800<br />

3<br />

required contributions for the county. This<br />

700<br />

600<br />

increase was offset by a $16 million reduction 500<br />

1<br />

in additional contributions from the county. 400<br />

2<br />

Employee offsets paid by the county<br />

300<br />

200<br />

increased $4 million, while employee<br />

100<br />

contributions increased another $3 million.<br />

0<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

• Net investment income equaled $1.1 billion<br />

in fiscal year 2007, an increase of $157 million,<br />

over the prior year. This income was<br />

primarily net appreciation in the fair<br />

value of investments of $965 million and<br />

$241 million in interest and dividends, offset<br />

by investment expenses of $87 million.<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

(100)<br />

(200)<br />

1. Retirement Contributions: $365 million<br />

2. Interest, Dividends and Securities Lending Income: $241 million<br />

3. Net Appreciation in Fair Value of Investments: $965 million<br />

4. Investment Expense: ($87 million)<br />

350<br />

4<br />

2<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

18 COMPREHENSIVE ANNUAL FINANCIAL REPORT 2007<br />

300<br />

250