CAFR - sdcera

CAFR - sdcera

CAFR - sdcera

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F I N A N C I A L / N O T E S T O T H E B A S I C F I N A N C I A L S T A T E M E N T S<br />

SECURITY LENDING<br />

SDCERA lends U.S. government obligations, domestic and international bonds, and equities to<br />

various brokers with a simultaneous agreement to return collateral for the same securities plus<br />

a fee in the future. The securities lending agent manages the securities lending program and<br />

receives securities and cash as collateral. Collateral cash is pledged at 102% and 105% of the fair<br />

value of domestic securities and non-domestic securities lent, respectively. There are no restrictions<br />

on the amount of securities that can be lent at one time. The term to maturity of the loaned securities<br />

is generally not matched with the term to maturity of the investment of the cash collateral.<br />

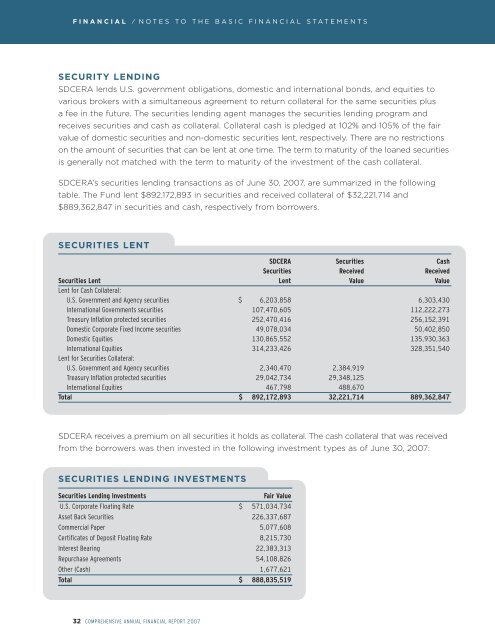

SDCERA’s securities lending transactions as of June 30, 2007, are summarized in the following<br />

table. The Fund lent $892,172,893 in securities and received collateral of $32,221,714 and<br />

$889,362,847 in securities and cash, respectively from borrowers.<br />

SECURITIES LENT<br />

SDCERA Securities Cash<br />

Securities Received Received<br />

Securities Lent Lent Value Value<br />

Lent for Cash Collateral:<br />

U.S. Government and Agency securities $ 6,203,858 6,303,430<br />

International Governments securities 107,470,605 112,222,273<br />

Treasury Inflation protected securities 252,470,416 256,152,391<br />

Domestic Corporate Fixed Income securities 49,078,034 50,402,850<br />

Domestic Equities 130,865,552 135,930,363<br />

International Equities 314,233,426 328,351,540<br />

Lent for Securities Collateral:<br />

U.S. Government and Agency securities 2,340,470 2,384,919<br />

Treasury Inflation protected securities 29,042,734 29,348,125<br />

International Equities 467,798 488,670<br />

Total $ 892,172,893 32,221,714 889,362,847<br />

SDCERA receives a premium on all securities it holds as collateral. The cash collateral that was received<br />

from the borrowers was then invested in the following investment types as of June 30, 2007:<br />

SECURITIES LENDING INVESTMENTS<br />

Securities Lending Investments<br />

Fair Value<br />

U.S. Corporate Floating Rate $ 571,034,734<br />

Asset Back Securities 226,337,687<br />

Commercial Paper 5,077,608<br />

Certificates of Deposit Floating Rate 8,215,730<br />

Interest Bearing 22,383,313<br />

Repurchase Agreements 54,108,826<br />

Other (Cash) 1,677,621<br />

Total $ 888,835,519<br />

32 COMPREHENSIVE ANNUAL FINANCIAL REPORT 2007