CAFR - sdcera

CAFR - sdcera

CAFR - sdcera

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

N O T E S T O T H E B A S I C F I N A N C I A L S T A T E M E N T S<br />

/ F I N A N C I A L<br />

As of June 30, 2007, SDCERA had the following futures balances:<br />

Notional Amount<br />

Long/(Short)<br />

Policy Overlay<br />

International equity $ (25,116,873)<br />

Domestic Equity 60,454,630<br />

International Fixed Income 180,817,578<br />

Domestic Fixed Income 127,483,250<br />

S&P 500 Futures Overlay (14,396,300)<br />

Managed Futures Overlay 335,000,000<br />

Total $ 664,242,285<br />

Derivative instruments are designed to provide equivalent exposure to the assets they emulate.<br />

SDCERA’s use of swaps and futures is structured such that market exposure is fundamentally<br />

equivalent to a direct cash investment. SDCERA believes such vehicles offer significant advantages<br />

over a direct investment in the asset, including efficient use of capital, and lower transaction and<br />

custody costs.<br />

INCOME TAXES<br />

The Internal Revenue Service has ruled that plans such as SDCERA’s qualify under Section 401(a)<br />

of the Internal Revenue Code and are not subject to tax under present income tax laws. On March<br />

4, 1998, the Internal Revenue Service issued a favorable Tax Determination Letter. Accordingly, no<br />

provision for income taxes has been made in the accompanying basic financial statements,<br />

as the Plan is exempt from federal and state income taxes under the provisions of the Internal<br />

Revenue Code, Section 401, and the California Revenue and Taxation Code, Section 23701,<br />

respectively.<br />

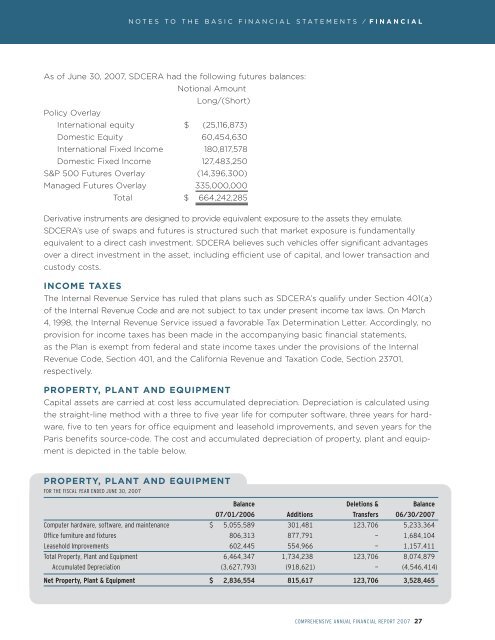

PROPERTY, PLANT AND EQUIPMENT<br />

Capital assets are carried at cost less accumulated depreciation. Depreciation is calculated using<br />

the straight-line method with a three to five year life for computer software, three years for hardware,<br />

five to ten years for office equipment and leasehold improvements, and seven years for the<br />

Paris benefits source-code. The cost and accumulated depreciation of property, plant and equipment<br />

is depicted in the table below.<br />

PROPERTY, PLANT AND EQUIPMENT<br />

FOR THE FISCAL YEAR ENDED JUNE 30, 2007<br />

Balance Deletions & Balance<br />

07/01/2006 Additions Transfers 06/30/2007<br />

Computer hardware, software, and maintenance $ 5,055,589 301,481 123,706 5,233,364<br />

Office furniture and fixtures 806,313 877,791 - 1,684,104<br />

Leasehold Improvements 602,445 554,966 - 1,157,411<br />

Total Property, Plant and Equipment 6,464,347 1,734,238 123,706 8,074,879<br />

Accumulated Depreciation (3,627,793) (918,621) - (4,546,414)<br />

Net Property, Plant & Equipment $ 2,836,554 815,617 123,706 3,528,465<br />

COMPREHENSIVE ANNUAL FINANCIAL REPORT 2007 27