CAFR - sdcera

CAFR - sdcera

CAFR - sdcera

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A C T U A R I A L /<br />

C O S T M E T H O D S & A S S U M P T I O N S<br />

Actual experience of the system will not coincide exactly with assumed experience, regardless of<br />

the choice of the assumptions, the skill of the actuary and the precision of the many<br />

calculations made. Each valuation provides a complete recalculation of assumed future<br />

experience and takes into account all past differences between assumed and actual experience.<br />

The latest experience study was done for the period July 1, 2000 through June 30, 2003, and<br />

resulting assumptions are reflected in the most recent actuarial valuation. The result is a continual<br />

series of adjustments (usually small) to the computed contribution rate. From time to time, it<br />

becomes appropriate to modify one or more of the assumptions, to reflect experience trends<br />

(but not random year-to-year fluctuations).<br />

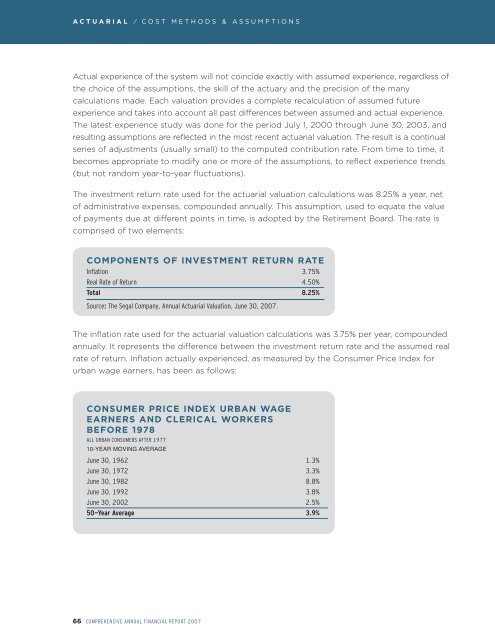

The investment return rate used for the actuarial valuation calculations was 8.25% a year, net<br />

of administrative expenses, compounded annually. This assumption, used to equate the value<br />

of payments due at different points in time, is adopted by the Retirement Board. The rate is<br />

comprised of two elements:<br />

COMPONENTS OF INVESTMENT RETURN RATE<br />

Inflation 3.75%<br />

Real Rate of Return 4.50%<br />

Total 8.25%<br />

Source: The Segal Company, Annual Actuarial Valuation, June 30, 2007.<br />

The inflation rate used for the actuarial valuation calculations was 3.75% per year, compounded<br />

annually. It represents the difference between the investment return rate and the assumed real<br />

rate of return. Inflation actually experienced, as measured by the Consumer Price Index for<br />

urban wage earners, has been as follows:<br />

CONSUMER PRICE INDEX URBAN WAGE<br />

EARNERS AND CLERICAL WORKERS<br />

BEFORE 1978<br />

ALL URBAN CONSUMERS AFTER 1977<br />

10-YEAR MOVING AVERAGE<br />

June 30, 1962 1.3%<br />

June 30, 1972 3.3%<br />

June 30, 1982 8.8%<br />

June 30, 1992 3.8%<br />

June 30, 2002 2.5%<br />

50-Year Average 3.9%<br />

66 COMPREHENSIVE ANNUAL FINANCIAL REPORT 2007