comprehensive annual financial report - City of St. Petersburg

comprehensive annual financial report - City of St. Petersburg

comprehensive annual financial report - City of St. Petersburg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

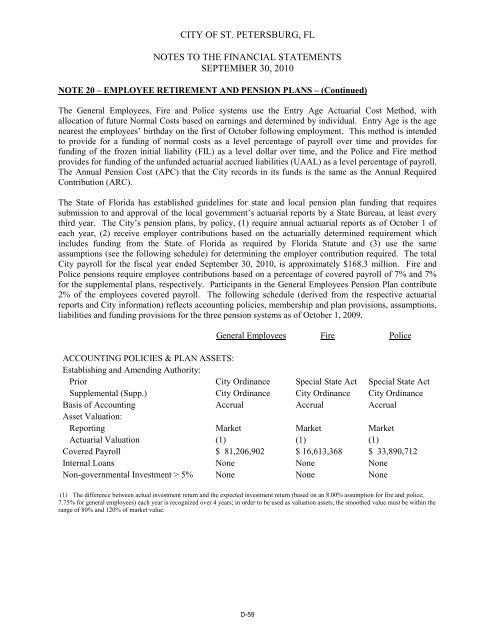

CITY OF ST. PETERSBURG, FL<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

SEPTEMBER 30, 2010<br />

NOTE 20 – EMPLOYEE RETIREMENT AND PENSION PLANS – (Continued)<br />

The General Employees, Fire and Police systems use the Entry Age Actuarial Cost Method, with<br />

allocation <strong>of</strong> future Normal Costs based on earnings and determined by individual. Entry Age is the age<br />

nearest the employees’ birthday on the first <strong>of</strong> October following employment. This method is intended<br />

to provide for a funding <strong>of</strong> normal costs as a level percentage <strong>of</strong> payroll over time and provides for<br />

funding <strong>of</strong> the frozen initial liability (FIL) as a level dollar over time, and the Police and Fire method<br />

provides for funding <strong>of</strong> the unfunded actuarial accrued liabilities (UAAL) as a level percentage <strong>of</strong> payroll.<br />

The Annual Pension Cost (APC) that the <strong>City</strong> records in its funds is the same as the Annual Required<br />

Contribution (ARC).<br />

The <strong>St</strong>ate <strong>of</strong> Florida has established guidelines for state and local pension plan funding that requires<br />

submission to and approval <strong>of</strong> the local government’s actuarial <strong>report</strong>s by a <strong>St</strong>ate Bureau, at least every<br />

third year. The <strong>City</strong>’s pension plans, by policy, (1) require <strong>annual</strong> actuarial <strong>report</strong>s as <strong>of</strong> October 1 <strong>of</strong><br />

each year, (2) receive employer contributions based on the actuarially determined requirement which<br />

includes funding from the <strong>St</strong>ate <strong>of</strong> Florida as required by Florida <strong>St</strong>atute and (3) use the same<br />

assumptions (see the following schedule) for determining the employer contribution required. The total<br />

<strong>City</strong> payroll for the fiscal year ended September 30, 2010, is approximately $168.3 million. Fire and<br />

Police pensions require employee contributions based on a percentage <strong>of</strong> covered payroll <strong>of</strong> 7% and 7%<br />

for the supplemental plans, respectively. Participants in the General Employees Pension Plan contribute<br />

2% <strong>of</strong> the employees covered payroll. The following schedule (derived from the respective actuarial<br />

<strong>report</strong>s and <strong>City</strong> information) reflects accounting policies, membership and plan provisions, assumptions,<br />

liabilities and funding provisions for the three pension systems as <strong>of</strong> October 1, 2009.<br />

General Employees Fire Police<br />

ACCOUNTING POLICIES & PLAN ASSETS:<br />

Establishing and Amending Authority:<br />

Prior <strong>City</strong> Ordinance Special <strong>St</strong>ate Act Special <strong>St</strong>ate Act<br />

Supplemental (Supp.) <strong>City</strong> Ordinance <strong>City</strong> Ordinance <strong>City</strong> Ordinance<br />

Basis <strong>of</strong> Accounting Accrual Accrual Accrual<br />

Asset Valuation:<br />

Reporting Market Market Market<br />

Actuarial Valuation (1) (1) (1)<br />

Covered Payroll $ 81,206,902 $ 16,613,368 $ 33,890,712<br />

Internal Loans None None None<br />

Non-governmental Investment > 5% None None None<br />

(1) The difference between actual investment return and the expected investment return (based on an 8.00% assumption for fire and police,<br />

7.75% for general employees) each year is recognized over 4 years; in order to be used as valuation assets, the smoothed value must be within the<br />

range <strong>of</strong> 80% and 120% <strong>of</strong> market value.<br />

D-59