comprehensive annual financial report - City of St. Petersburg

comprehensive annual financial report - City of St. Petersburg

comprehensive annual financial report - City of St. Petersburg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

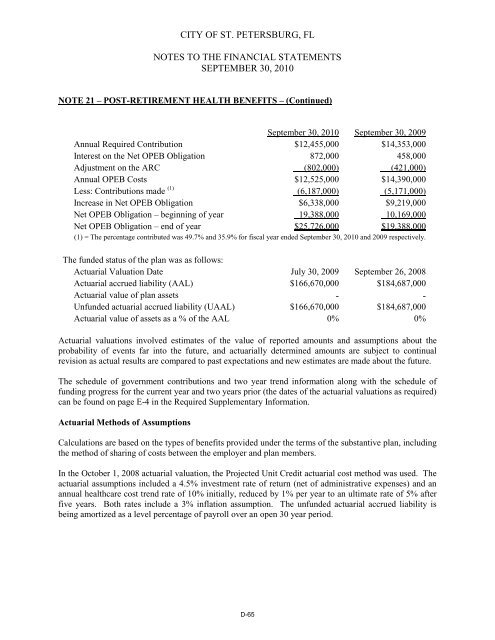

CITY OF ST. PETERSBURG, FL<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

SEPTEMBER 30, 2010<br />

NOTE 21 – POST-RETIREMENT HEALTH BENEFITS – (Continued)<br />

September 30, 2010 September 30, 2009<br />

Annual Required Contribution $12,455,000 $14,353,000<br />

Interest on the Net OPEB Obligation 872,000 458,000<br />

Adjustment on the ARC (802,000) (421,000)<br />

Annual OPEB Costs $12,525,000 $14,390,000<br />

Less: Contributions made (1) (6,187,000) (5,171,000)<br />

Increase in Net OPEB Obligation $6,338,000 $9,219,000<br />

Net OPEB Obligation – beginning <strong>of</strong> year 19,388,000 10,169,000<br />

Net OPEB Obligation – end <strong>of</strong> year $25,726,000 $19,388,000<br />

(1) = The percentage contributed was 49.7% and 35.9% for fiscal year ended September 30, 2010 and 2009 respectively.<br />

The funded status <strong>of</strong> the plan was as follows:<br />

Actuarial Valuation Date July 30, 2009 September 26, 2008<br />

Actuarial accrued liability (AAL) $166,670,000 $184,687,000<br />

Actuarial value <strong>of</strong> plan assets - -<br />

Unfunded actuarial accrued liability (UAAL) $166,670,000 $184,687,000<br />

Actuarial value <strong>of</strong> assets as a % <strong>of</strong> the AAL 0% 0%<br />

Actuarial valuations involved estimates <strong>of</strong> the value <strong>of</strong> <strong>report</strong>ed amounts and assumptions about the<br />

probability <strong>of</strong> events far into the future, and actuarially determined amounts are subject to continual<br />

revision as actual results are compared to past expectations and new estimates are made about the future.<br />

The schedule <strong>of</strong> government contributions and two year trend information along with the schedule <strong>of</strong><br />

funding progress for the current year and two years prior (the dates <strong>of</strong> the actuarial valuations as required)<br />

can be found on page E-4 in the Required Supplementary Information.<br />

Actuarial Methods <strong>of</strong> Assumptions<br />

Calculations are based on the types <strong>of</strong> benefits provided under the terms <strong>of</strong> the substantive plan, including<br />

the method <strong>of</strong> sharing <strong>of</strong> costs between the employer and plan members.<br />

In the October 1, 2008 actuarial valuation, the Projected Unit Credit actuarial cost method was used. The<br />

actuarial assumptions included a 4.5% investment rate <strong>of</strong> return (net <strong>of</strong> administrative expenses) and an<br />

<strong>annual</strong> healthcare cost trend rate <strong>of</strong> 10% initially, reduced by 1% per year to an ultimate rate <strong>of</strong> 5% after<br />

five years. Both rates include a 3% inflation assumption. The unfunded actuarial accrued liability is<br />

being amortized as a level percentage <strong>of</strong> payroll over an open 30 year period.<br />

D-65