comprehensive annual financial report - City of St. Petersburg

comprehensive annual financial report - City of St. Petersburg

comprehensive annual financial report - City of St. Petersburg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY OF ST. PETERSBURG, FL<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

SEPTEMBER 30, 2010<br />

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – (Continued)<br />

Donor-Restricted Endowments<br />

Included in the permanent funds, which are included in the nonmajor governmental funds<br />

presentation, are donor-restricted assets given to the <strong>City</strong> with the stipulation that the original<br />

endowment not be spent, but only the earnings thereon. The total nonmajor endowment restricted<br />

assets at September 30, 2010, total $376,886. The <strong>City</strong>’s policy is to authorize the expenditures<br />

<strong>of</strong> all interest and dividends earned less management fees and to reinvest all appreciated value.<br />

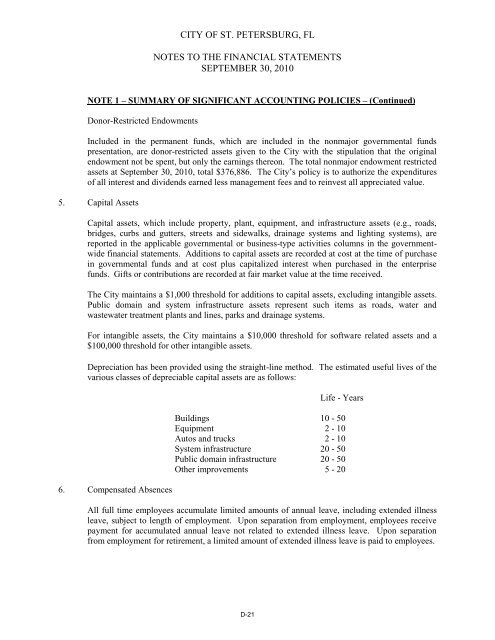

5. Capital Assets<br />

Capital assets, which include property, plant, equipment, and infrastructure assets (e.g., roads,<br />

bridges, curbs and gutters, streets and sidewalks, drainage systems and lighting systems), are<br />

<strong>report</strong>ed in the applicable governmental or business-type activities columns in the governmentwide<br />

<strong>financial</strong> statements. Additions to capital assets are recorded at cost at the time <strong>of</strong> purchase<br />

in governmental funds and at cost plus capitalized interest when purchased in the enterprise<br />

funds. Gifts or contributions are recorded at fair market value at the time received.<br />

The <strong>City</strong> maintains a $1,000 threshold for additions to capital assets, excluding intangible assets.<br />

Public domain and system infrastructure assets represent such items as roads, water and<br />

wastewater treatment plants and lines, parks and drainage systems.<br />

For intangible assets, the <strong>City</strong> maintains a $10,000 threshold for s<strong>of</strong>tware related assets and a<br />

$100,000 threshold for other intangible assets.<br />

Depreciation has been provided using the straight-line method. The estimated useful lives <strong>of</strong> the<br />

various classes <strong>of</strong> depreciable capital assets are as follows:<br />

6. Compensated Absences<br />

Life - Years<br />

Buildings 10 - 50<br />

Equipment 2 - 10<br />

Autos and trucks 2 - 10<br />

System infrastructure 20 - 50<br />

Public domain infrastructure 20 - 50<br />

Other improvements 5 - 20<br />

All full time employees accumulate limited amounts <strong>of</strong> <strong>annual</strong> leave, including extended illness<br />

leave, subject to length <strong>of</strong> employment. Upon separation from employment, employees receive<br />

payment for accumulated <strong>annual</strong> leave not related to extended illness leave. Upon separation<br />

from employment for retirement, a limited amount <strong>of</strong> extended illness leave is paid to employees.<br />

D-21