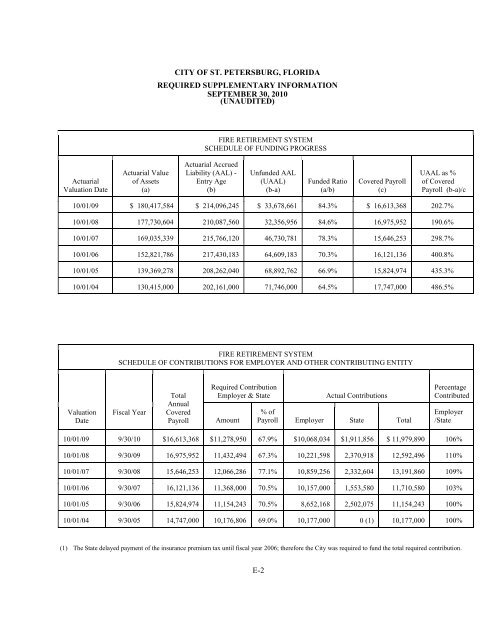

CITY OF ST. PETERSBURG, FLORIDA REQUIRED SUPPLEMENTARY INFORMATION SEPTEMBER 30, 2010 (UNAUDITED) FIRE RETIREMENT SYSTEM SCHEDULE OF FUNDING PROGRESS Actuarial Valuation Date Actuarial Value <strong>of</strong> Assets (a) Actuarial Accrued Liability (AAL) - Entry Age (b) Unfunded AAL (UAAL) (b-a) Funded Ratio (a/b) Covered Payroll (c) UAAL as % <strong>of</strong> Covered Payroll (b-a)/c 10/01/09 $ 180,417,584 $ 214,096,245 $ 33,678,661 84.3% $ 16,613,368 202.7% 10/01/08 177,730,604 210,087,560 32,356,956 84.6% 16,975,952 190.6% 10/01/07 169,035,339 215,766,120 46,730,781 78.3% 15,646,253 298.7% 10/01/06 152,821,786 217,430,183 64,609,183 70.3% 16,121,136 400.8% 10/01/05 139,369,278 208,262,040 68,892,762 66.9% 15,824,974 435.3% 10/01/04 130,415,000 202,161,000 71,746,000 64.5% 17,747,000 486.5% FIRE RETIREMENT SYSTEM SCHEDULE OF CONTRIBUTIONS FOR EMPLOYER AND OTHER CONTRIBUTING ENTITY Valuation Date Fiscal Year Total Annual Covered Payroll Required Contribution Employer & <strong>St</strong>ate Amount Actual Contributions % <strong>of</strong> Payroll Employer <strong>St</strong>ate Total Percentage Contributed Employer /<strong>St</strong>ate 10/01/09 9/30/10 $16,613,368 $11,278,950 67.9% $10,068,034 $1,911,856 $ 11,979,890 106% 10/01/08 9/30/09 16,975,952 11,432,494 67.3% 10,221,598 2,370,918 12,592,496 110% 10/01/07 9/30/08 15,646,253 12,066,286 77.1% 10,859,256 2,332,604 13,191,860 109% 10/01/06 9/30/07 16,121,136 11,368,000 70.5% 10,157,000 1,553,580 11,710,580 103% 10/01/05 9/30/06 15,824,974 11,154,243 70.5% 8,652,168 2,502,075 11,154,243 100% 10/01/04 9/30/05 14,747,000 10,176,806 69.0% 10,177,000 0 (1) 10,177,000 100% (1) The <strong>St</strong>ate delayed payment <strong>of</strong> the insurance premium tax until fiscal year 2006; therefore the <strong>City</strong> was required to fund the total required contribution. E-2

CITY OF ST. PETERSBURG, FLORIDA REQUIRED SUPPLEMENTARY INFORMATION SEPTEMBER 30, 2010 (UNAUDITED) POLICE RETIREMENT SYSTEM SCHEDULE OF FUNDING PROGRESS Actuarial Valuation Date Actuarial Value <strong>of</strong> Assets (a) Actuarial Accrued Liability (AAL) - Entry Age (b) Unfunded AAL (UAAL) (b-a) Funded Ratio (a/b) Covered Payroll (c) UAAL as % <strong>of</strong> Covered Payroll (b-a)/c 10/1/09 $ 307,477,804 $ 337,437,850 $ 29,960,046 91.1% $ 33,890,712 88.4% 10/1/08 305,207,318 328,790,952 23,583,634 92.8% 31,988,348 73.7% 10/1/07 289,252,368 335,692,840 46,440,472 86.2% 30,789,619 150.8% 10/1/06 252,908,430 319,596,093 66,687,663 79.1% 30,265,843 220.3% 10/1/05 222,841,149 305,106,000 82,265,238 73.0% 29,244,546 281.3% 10/1/04 204,414,000 286,678,000 82,264,000 71.3% 26,478,000 310.7% POLICE RETIREMENT SYSTEM SCHEDULE OF CONTRIBUTIONS FOR EMPLOYER AND OTHER CONTRIBUTING ENTITY Valuation Date Fiscal Year Total Annual Covered Payroll Required Contribution Employer & <strong>St</strong>ate Amount Actual Contributions % <strong>of</strong> Payroll Employer <strong>St</strong>ate Total Percentage Contributed Employer /<strong>St</strong>ate 10/1/09 9/30/10 $33,890,712 $11,856,728 35.0% $10,250,894 $ 1,712,441 $ 11,918,335 101% 10/1/08 9/30/09 31,988,348 12,472,818 39.0% 10,843,261 1,768,261 12,611,522 102% 10/1/07 9/30/08 30,789,619 14,511,702 47.1% 13,022,553 1,680,247 14,702,800 101% 10/1/06 9/30/07 30,265,843 14,384,000 47.5% 12,895,000 1,714,181 14,609,181 102% 10/1/05 9/30/06 29,244,546 13,496,809 46.2% 10,275,702 3,221,107 13,496,809 100% 10/1/04 9/30/05 26,478,000 13,012,822 49.1% 13,012,996 0 (1) 13,012,996 100% (1) The <strong>St</strong>ate delayed payment <strong>of</strong> the insurance premium tax until fiscal year 2006; therefore the <strong>City</strong> was required to fund the total required contribution. E-3

- Page 1 and 2:

CITY OF ST. PETERSBURG COMPREHENSIV

- Page 3 and 4:

CITY OF ST. PETERSBURG, FLORIDA MAY

- Page 5 and 6:

Notes to the Financial Statements D

- Page 7 and 8:

IV. REGULATORY SECTION Report of In

- Page 9 and 10:

List of Principal Officials Elected

- Page 11 and 12:

The independent audit of the financ

- Page 13 and 14:

equired a rollback of the millage r

- Page 15 and 16:

All securities are purchased on a d

- Page 17 and 18:

operating and labor costs. Preventi

- Page 21:

Text38: Certificate of Achievement

- Page 25 and 26:

II. FINANCIAL SECTION Report of Ind

- Page 27 and 28:

Report of Independent Certified Pub

- Page 29 and 30:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 31 and 32:

City of St. Petersburg, FL Manageme

- Page 33 and 34:

City of St. Petersburg, FL Manageme

- Page 35 and 36:

City of St. Petersburg, FL Manageme

- Page 37 and 38:

City of St. Petersburg, FL Manageme

- Page 39 and 40:

City of St. Petersburg, FL Manageme

- Page 41 and 42:

City of St. Petersburg, FL Manageme

- Page 43 and 44:

City of St. Petersburg, FL Manageme

- Page 45:

City of St. Petersburg, FL Manageme

- Page 49 and 50:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 51 and 52:

NET REVENUES (EXPENSES) AND CHANGES

- Page 53 and 54:

DOWNTOWN REDEVELOPMENT DISTRICT LOC

- Page 55:

LOCAL OPTION SALES SURTAX IMPROVEME

- Page 58 and 59:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 61:

CITY OF ST. PETERSBURG, FLORIDA REC

- Page 64 and 65:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 66 and 67:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 68 and 69:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 70 and 71:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 72 and 73:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 74 and 75:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 77:

NOTES TO THE FINANCIAL STATEMENTS

- Page 80 and 81:

CITY OF ST. PETERSBURG, FL NOTES TO

- Page 82 and 83:

CITY OF ST. PETERSBURG, FL NOTES TO

- Page 84 and 85:

CITY OF ST. PETERSBURG, FL NOTES TO

- Page 86 and 87: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 88 and 89: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 90 and 91: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 92 and 93: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 94 and 95: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 96 and 97: NOTE 5 - PROPERTY TAXES CITY OF ST.

- Page 98 and 99: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 100 and 101: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 102 and 103: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 104 and 105: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 106 and 107: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 108 and 109: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 110 and 111: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 112 and 113: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 114 and 115: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 116 and 117: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 118 and 119: NOTE 15 - CONDUIT DEBT OBLIGATION C

- Page 120 and 121: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 122 and 123: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 124 and 125: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 126 and 127: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 128 and 129: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 130 and 131: CITY OF ST. PETERSBURG, FL NOTES TO

- Page 133: REQUIRED SUPPLEMENTARY INFORMATION

- Page 138 and 139: REQUIRED SUPPLEMENTARY INFORMATION

- Page 141 and 142: CITY OF ST. PETERSBURG, FLORIDA Non

- Page 143 and 144: CITY OF ST. PETERSBURG, FLORIDA Hou

- Page 146 and 147: SPECIAL REVENUE DEBT SERVICE CAPITA

- Page 148 and 149: LOCAL LAW ENFORCEMENT TRUST EMERGEN

- Page 150 and 151: POLICE GRANTS' FUND POLICE OFFICERS

- Page 152 and 153: LOCAL LAW ENFORCEMENT TRUST EMERGEN

- Page 154 and 155: POLICE GRANTS' FUND POLICE OFFICERS

- Page 156 and 157: PROFESSIONAL SPORTS FACILITY SALES

- Page 158 and 159: PROFESSIONAL SPORTS FACILITY SALES

- Page 160 and 161: TRANSPORTATION IMPROVEMENT ECONOMIC

- Page 162 and 163: TRANSPORTATION IMPROVEMENT ECONOMIC

- Page 164: CITY OF ST. PETERSBURG, FLORIDA COM

- Page 167 and 168: PROFESSIONAL SPORTS FACILITY SALES

- Page 169 and 170: ORIGINAL BUDGET EMERGENCY MEDICAL S

- Page 171 and 172: ORIGINAL BUDGET AMERICAN RECOVERY &

- Page 173 and 174: ORIGINAL BUDGET POLICE OFFICERS TRA

- Page 175 and 176: ORIGINAL BUDGET FINAL BUDGET UTILIT

- Page 177: ORIGINAL BUDGET FINAL BUDGET FIRST

- Page 180 and 181: ASSETS AIRPORT PORT MARINA GOLF COU

- Page 182 and 183: CITY OF ST. PETERSBURG, FLORIDA COM

- Page 184 and 185: CITY OF ST. PETERSBURG, FLORIDA COM

- Page 187 and 188:

CITY OF ST. PETERSBURG, FLORIDA Int

- Page 189 and 190:

BILLING AND COLLECTIONS CONSOLIDATE

- Page 191 and 192:

INFORMATION AND COMMUNICATIONS SERV

- Page 193:

INFORMATION AND COMMUNICATION SERVI

- Page 196 and 197:

CITY OF ST. PETERSBURG, FLORIDA STA

- Page 199:

FINANCIAL TRENDS INFORMATION

- Page 202 and 203:

CITY OF ST. PETERSBURG, FLORIDA CHA

- Page 204 and 205:

CITY OF ST. PETERSBURG, FLORIDA FUN

- Page 206:

CITY OF ST. PETERSBURG, FLORIDA FIN

- Page 210 and 211:

CITY OF ST. PETERSBURG, FLORIDA TAX

- Page 212 and 213:

CITY OF ST. PETERSBURG, FLORIDA PRI

- Page 214:

CITY OF ST. PETERSBURG, FLORIDA REV

- Page 218 and 219:

CITY OF ST. PETERSBURG, FLORIDA RAT

- Page 220 and 221:

CITY OF ST. PETERSBURG, FLORIDA DIR

- Page 222 and 223:

CITY OF ST. PETERSBURG, FLORIDA PLE

- Page 224:

DEMOGRAPHIC AND ECONOMIC INFORMATIO

- Page 227 and 228:

CITY OF ST. PETERSBURG, FLORIDA PRI

- Page 230:

OPERATING INFORMATION

- Page 233 and 234:

Function/Program 2010 2009 2008 200

- Page 235 and 236:

CITY OF ST. PETERSBURG, FLORIDA CAP

- Page 238:

IV. REGULATORY SECTION Report of In

- Page 241 and 242:

We noted certain matters that we re

- Page 243 and 244:

Internal Control over Compliance Th

- Page 245 and 246:

CITY OF ST. PETERSBURG, FLORIDA SCH

- Page 247 and 248:

CITY OF ST. PETERSBURG, FLORIDA SCH

- Page 249:

CITY OF ST. PETERSBURG, FLORIDA SCH

- Page 252 and 253:

CITY OF ST. PETERSBURG, FLORIDA NOT

- Page 254 and 255:

CITY OF ST. PETERSBURG, FLORIDA NOT

- Page 256 and 257:

City of St. Petersburg, Florida Sch

- Page 258 and 259:

Independent Auditors' Management Le

- Page 260 and 261:

City of St. Petersburg, Florida App

- Page 262:

City of St. Petersburg, Florida App